Bitcoin has extended its correction below the $100,000 psychological level into the past 24 hours. At the time of writing, Bitcoin is struggling to hold above the $94,000 mark after recovering briefly from its recent crash to $91,000.

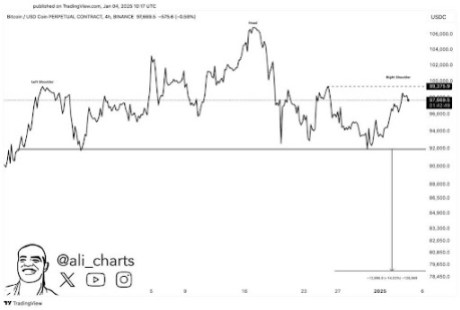

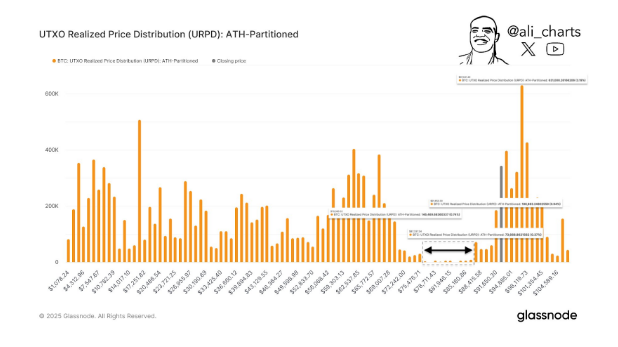

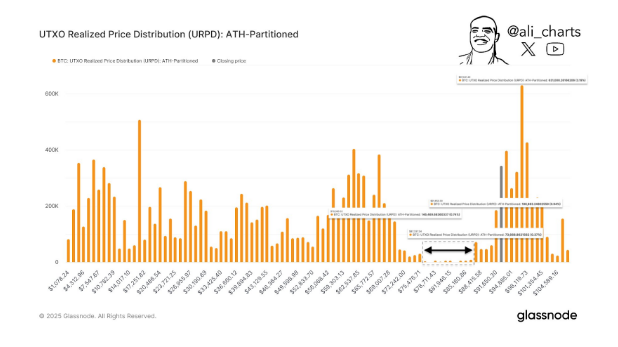

As it stands, Bitcoin’s price outlook has taken a cautious turn, with crypto analyst Ali Martinez highlighting a $12,000 void between $87,000 and $75,000. The analysis, which is based on the Bitcoin UTXO Realized Price Distribution (URPD) ATH-Partitioned, reveals a lack of significant support in this range and raises concerns over a quick crash towards $75,000.

Data from Bitcoin’s UTXO Realized Price Distribution (URPD) ATH-Partitioned metric shows that the range between $87,000 and $75,000 lacks substantial realized price activity. The UTXO is a relatively quiet but important technical indicator that provides insights into the distribution of Bitcoin across different price levels and focuses on UTXOs (Unspent Transaction Outputs).

Therefore, analyzing UTXOs helps identify the price levels at which Bitcoin holders are currently sitting on realized gains or losses.

As noted by Ali Martinez, the range between $87,000 and $75,000 opens up a $12,000 gap that could easily become negative for Bitcoin. This is because this range represents “little to no support,” meaning there is insufficient historical buying activity to stabilize Bitcoin’s price if it enters this zone. As such, this void increases the risk of a sharp correction should Bitcoin fall below the upper boundary.

As it stands, the $12,000 void threat can be only valid if Bitcoin were to break below $87,000. Although Bitcoin has largely held up above $90,000 even during corrections since November, the recent drop to $91,000 opens up the possibility of an eventual drop below $90,000. This concern is amplified by the Crypto Fear and Greed Index shifting to a neutral zone, accompanied by a surge in bearish sentiment across social media.

If Bitcoin were to break below $90,000, this could open up the possibility of a continued decline towards $87,000. This, in turn, would most likely lead to a swift drop to $75,000. This scenario would undoubtedly test the bullish sentiment from investors and Bitcoin’s ability to sustain predictions of a long-term bullish trajectory.

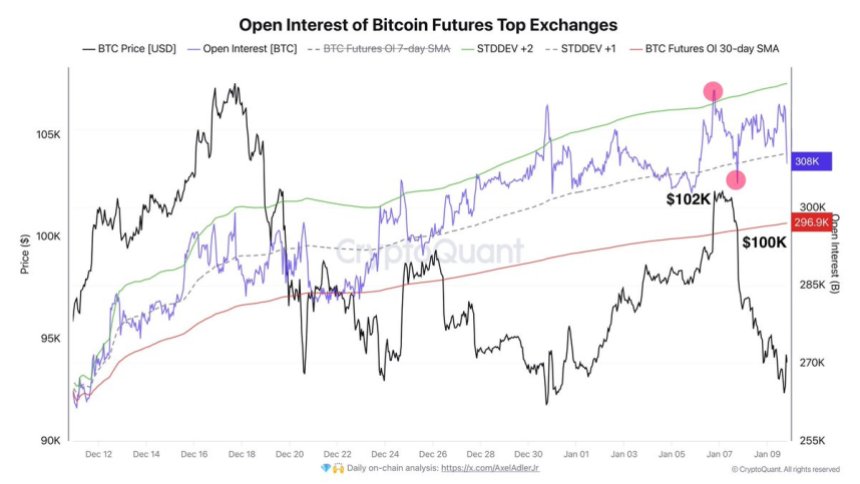

On the other hand, you could easily argue that the ongoing consolidation opens up the opportunity to accumulate more BTC. According to an analyst on CryptoQuant, the short-term SOPR indicator is currently below 1, meaning many short-term investors are selling Bitcoin at a loss. However, history shows this phenomenon often precedes a major upward trend, making it a good time for accumulation.

At the time of writing, Bitcoin is trading at $94,350.

Featured image from Getty Images, chart from TradingView

As it stands, Bitcoin’s price outlook has taken a cautious turn, with crypto analyst Ali Martinez highlighting a $12,000 void between $87,000 and $75,000. The analysis, which is based on the Bitcoin UTXO Realized Price Distribution (URPD) ATH-Partitioned, reveals a lack of significant support in this range and raises concerns over a quick crash towards $75,000.

$12,000 Void Shows Lack Of Support Between $87,000 And $75,000

Data from Bitcoin’s UTXO Realized Price Distribution (URPD) ATH-Partitioned metric shows that the range between $87,000 and $75,000 lacks substantial realized price activity. The UTXO is a relatively quiet but important technical indicator that provides insights into the distribution of Bitcoin across different price levels and focuses on UTXOs (Unspent Transaction Outputs).

Therefore, analyzing UTXOs helps identify the price levels at which Bitcoin holders are currently sitting on realized gains or losses.

As noted by Ali Martinez, the range between $87,000 and $75,000 opens up a $12,000 gap that could easily become negative for Bitcoin. This is because this range represents “little to no support,” meaning there is insufficient historical buying activity to stabilize Bitcoin’s price if it enters this zone. As such, this void increases the risk of a sharp correction should Bitcoin fall below the upper boundary.

Market Implications Of The $12,000 Void

As it stands, the $12,000 void threat can be only valid if Bitcoin were to break below $87,000. Although Bitcoin has largely held up above $90,000 even during corrections since November, the recent drop to $91,000 opens up the possibility of an eventual drop below $90,000. This concern is amplified by the Crypto Fear and Greed Index shifting to a neutral zone, accompanied by a surge in bearish sentiment across social media.

If Bitcoin were to break below $90,000, this could open up the possibility of a continued decline towards $87,000. This, in turn, would most likely lead to a swift drop to $75,000. This scenario would undoubtedly test the bullish sentiment from investors and Bitcoin’s ability to sustain predictions of a long-term bullish trajectory.

On the other hand, you could easily argue that the ongoing consolidation opens up the opportunity to accumulate more BTC. According to an analyst on CryptoQuant, the short-term SOPR indicator is currently below 1, meaning many short-term investors are selling Bitcoin at a loss. However, history shows this phenomenon often precedes a major upward trend, making it a good time for accumulation.

At the time of writing, Bitcoin is trading at $94,350.

Featured image from Getty Images, chart from TradingView