- The number of Bitcoins in circulation held by long-term holders has hit an ATH of 14.5M BTC.

- On April 26, 2024, the next halving cycle will take place.

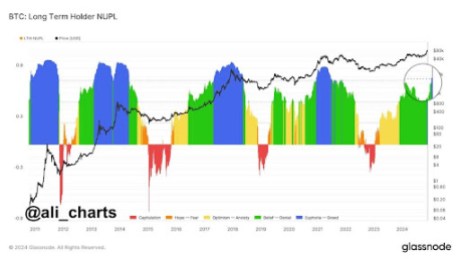

Bitcoin has fallen back below the $30,000 barrier, depressing short-term investors who bought in during the recent Bull Run. Perhaps Bitcoin’s volatility is what attracted investors looking to hold for the long haul. Glassnode reports that the number of Bitcoins in circulation held by long-term holders has hit an all-time high of 14.5 million BTC.

Moreover, on April 26, 2024, the next halving cycle will take place. Even while the halving event will have a negative effect on mining profitability, rising Bitcoin prices will help compensate for this. The amount of money made from each block grows in proportion to the price of Bitcoin.

This, in turn, leads to a rise in the miners’ willingness to spend money on mining gear and energy. As a result, a spike in the value of Bitcoin encourages miners to invest in additional mining hardware and expand their operations.

Identical Historical Pattern

Early in the Asian session, Bitcoin struggled to gain traction higher, as the price remained under pressure below the $30,000 mark despite recently peaking near the $30,060 level.

#Bitcoin 2012 pre and post halving PA forming. With 272 days left before 2024, #bitcoin will make a new yearly high before.

Fundamentally, with the approval of ETF there will be massive upside moves

Why sell cheap to institutions? pic.twitter.com/EhaZcVaJUl

— MikybullCrypto (@MikybullCrypto) July 22, 2023

Bitcoin’s price trend is identical to the one developed in 2012 before and after the first halving event, crypto enthusiast Mikybull Crypto tweeted today. As another fundamental driver that could lead to enormous price increases, he mentioned the introduction of Bitcoin ETFs.

He noted the parallels between the current price chart and the one from 2012 in terms of highs and lows. If Bitcoin follows its historical pattern, its price might witness a significant surge before the next halving in April of 2024. As of right now, investors have a neutral outlook on the market, as measured by the Fear & Greed Index, which is now at 55 out of 100.