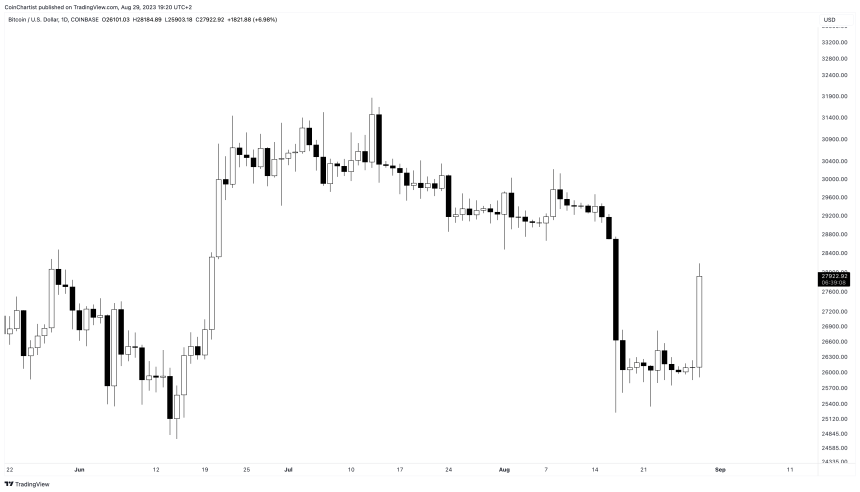

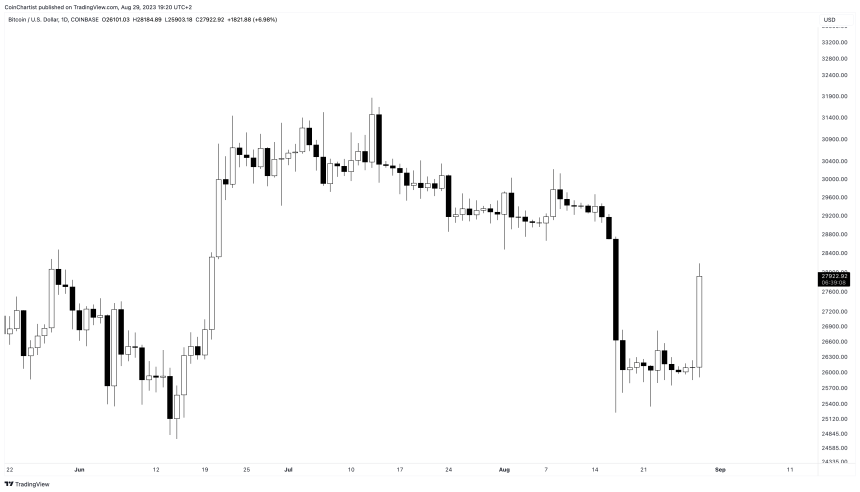

Bitcoin price has thus far made a 7% intraday move following news that a US court ruled in favor of Grayscale against the SEC. At the same time, the stock market is surging.

Could a perfect storm for the top cryptocurrency by market cap be building?

In an asset class as volatile as crypto, prices — and moods — can change in a flash. That’s exactly what we’ve witnessed on a small scale today, moments after news broke that a US court is forcing the SEC to reconsider Grayscale’s Bitcoin ETF.

The news is significant because not only does it increase the chance Grayscale can move ahead with an ETF, but it also improves the likelihood of other ETFs like BlackRock getting the green light.

Green is definitely the color of the day, with BTCUSD climbing back to $28,000 per coin on the heels of the news.

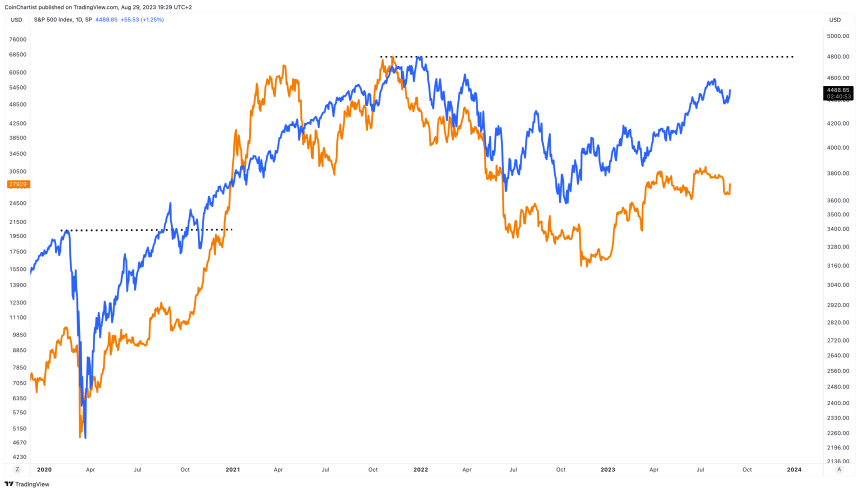

It isn’t just crypto getting a major boost today. US stock indexes are also soaring today. The S&P 500 is up over 1.2%, the tech-heavy Nasdaq over 1.88%, and the Dow Jones Industrial Average at 0.63%. The latest bounce in stocks puts traditional markets within striking distance of a new all-time high.

This is important because if Bitcoin price is already turning bullish in the wake of the Grayscale news, then a simultaneous stock market all-time high could cause crypto to go ballistic.

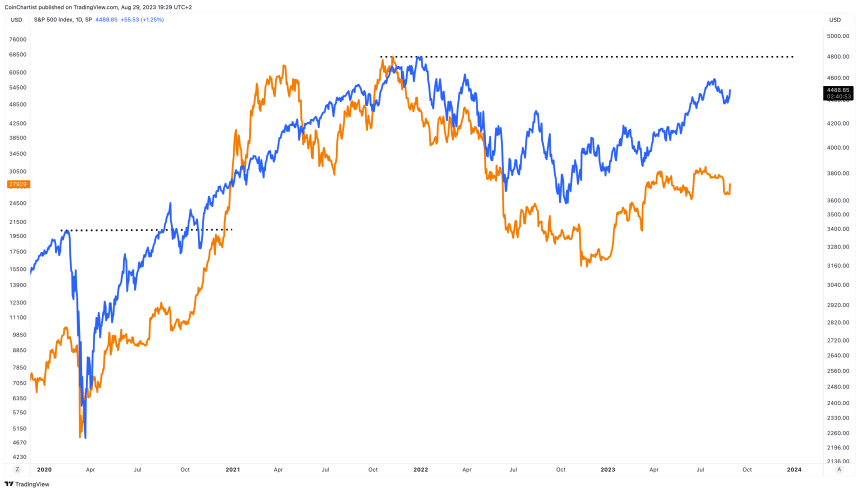

Cryptocurrencies have a ton of catching up to do relative to the stock market. Furthermore, back in 2020, after the S&P 500 made a new all-time high, Bitcoin price followed in the weeks to come and set a record of its own. Is this what we can expect if the stock market sets new record highs, and a slew of ETFs are approved?

Could a perfect storm for the top cryptocurrency by market cap be building?

Back At $28,000: Grayscale Court Ruling Causes BTC To Bounce

In an asset class as volatile as crypto, prices — and moods — can change in a flash. That’s exactly what we’ve witnessed on a small scale today, moments after news broke that a US court is forcing the SEC to reconsider Grayscale’s Bitcoin ETF.

The news is significant because not only does it increase the chance Grayscale can move ahead with an ETF, but it also improves the likelihood of other ETFs like BlackRock getting the green light.

Green is definitely the color of the day, with BTCUSD climbing back to $28,000 per coin on the heels of the news.

Bitcoin Price Could Benefit From A New Stock Market High

It isn’t just crypto getting a major boost today. US stock indexes are also soaring today. The S&P 500 is up over 1.2%, the tech-heavy Nasdaq over 1.88%, and the Dow Jones Industrial Average at 0.63%. The latest bounce in stocks puts traditional markets within striking distance of a new all-time high.

This is important because if Bitcoin price is already turning bullish in the wake of the Grayscale news, then a simultaneous stock market all-time high could cause crypto to go ballistic.

Cryptocurrencies have a ton of catching up to do relative to the stock market. Furthermore, back in 2020, after the S&P 500 made a new all-time high, Bitcoin price followed in the weeks to come and set a record of its own. Is this what we can expect if the stock market sets new record highs, and a slew of ETFs are approved?