Amid the surge in polls in favor of former President and Republican candidate Donald Trump over Vice President Kamala Harris, expectations for a further recovery of the Bitcoin price soared, but the rally seen in late September and the first weeks of October has faded, with experts attributing it to tightening financial conditions that could affect the broader crypto market.

According to a recent Bloomberg report, Bitcoin’s association with Trump is becoming more pronounced as global markets react to his potential return to the White House.

Nonetheless, the financial landscape is shifting, with rising bond yields and a strengthening dollar coinciding with Trump’s lead in prediction markets. Experts anticipate that a Trump victory could usher in a pro-growth economic agenda, thereby tightening monetary policy.

Market analysts, such as Tony Sycamore from IG Australia Pty, emphasize that the current selloff in stocks and a stronger US dollar and rising yields signal tightening financial conditions.

The analyst explains that this environment is generally unfavorable for the Bitcoin price and the broader crypto market, which tends to thrive in more liquid market conditions.

Sycamore went on to say that while the initial monetary conditions were already loose, the speed of the tightening poses a significant threat to the Bitcoin price and other risk assets as the likelihood of Trump securing another term in the Oval Office increases.

Trump’s campaign has openly embraced the cryptocurrency sector, promising to position the US as the “crypto capital of the world.” His approach starkly contrasts Harris’s more cautious stance, which involves supporting a regulatory framework to foster industry growth while ensuring consumer protection.

The recent Bloomberg News/Morning Consult poll reveals that Trump and Harris are statistically tied among likely voters in key swing states, indicating that the upcoming election could hinge on targeted advertising, rallies, and grassroots efforts—all of which could influence market sentiment.

In the crypto market, investors are increasingly betting on a potential victory for former President Donald Trump on Polymarket. Current polls show Trump leading with 62% support compared to 38% for Vice President Kamala Harris as of Thursday, marking the largest margin since the race began.

Should Trump win in the upcoming election, Bloomberg notes that experts predict a potential yield increase, which could negatively impact risk assets, including the Bitcoin price performance.

Caroline Mauron, co-founder of Orbit Markets, points out that while higher yields may pose challenges, the anticipated regulatory easing under a Trump administration could be pivotal in shaping the crypto landscape.

Despite potential economic challenges that could negatively impact BTC’s performance, Mauron concludes that the regulatory shift could support Bitcoin and other digital assets in regaining their footing.

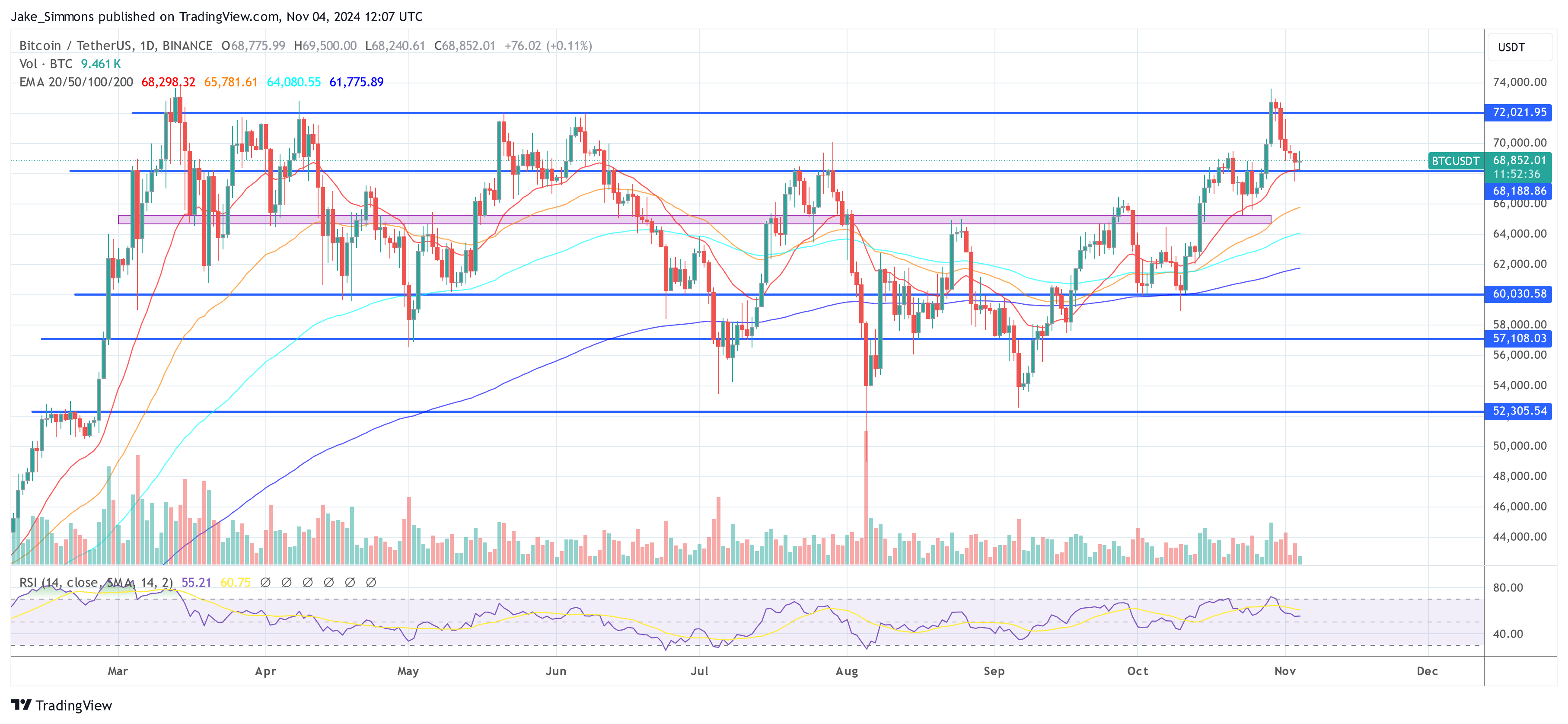

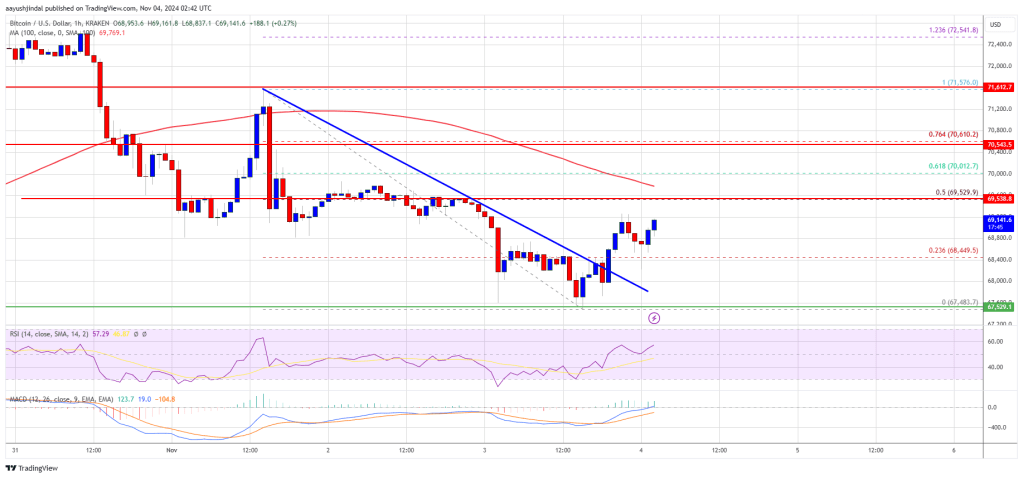

At the time of writing, Bitcoin is trading at $67,670, up 2.4% over the past 24 hours.

Featured image from DALL-E, chart from TradingView.com

How Trump’s Campaign And Rising Yields Impact Bitcoin Price

According to a recent Bloomberg report, Bitcoin’s association with Trump is becoming more pronounced as global markets react to his potential return to the White House.

Nonetheless, the financial landscape is shifting, with rising bond yields and a strengthening dollar coinciding with Trump’s lead in prediction markets. Experts anticipate that a Trump victory could usher in a pro-growth economic agenda, thereby tightening monetary policy.

Market analysts, such as Tony Sycamore from IG Australia Pty, emphasize that the current selloff in stocks and a stronger US dollar and rising yields signal tightening financial conditions.

The analyst explains that this environment is generally unfavorable for the Bitcoin price and the broader crypto market, which tends to thrive in more liquid market conditions.

Sycamore went on to say that while the initial monetary conditions were already loose, the speed of the tightening poses a significant threat to the Bitcoin price and other risk assets as the likelihood of Trump securing another term in the Oval Office increases.

Regulatory Easing Under Trump’s Return?

Trump’s campaign has openly embraced the cryptocurrency sector, promising to position the US as the “crypto capital of the world.” His approach starkly contrasts Harris’s more cautious stance, which involves supporting a regulatory framework to foster industry growth while ensuring consumer protection.

The recent Bloomberg News/Morning Consult poll reveals that Trump and Harris are statistically tied among likely voters in key swing states, indicating that the upcoming election could hinge on targeted advertising, rallies, and grassroots efforts—all of which could influence market sentiment.

In the crypto market, investors are increasingly betting on a potential victory for former President Donald Trump on Polymarket. Current polls show Trump leading with 62% support compared to 38% for Vice President Kamala Harris as of Thursday, marking the largest margin since the race began.

Should Trump win in the upcoming election, Bloomberg notes that experts predict a potential yield increase, which could negatively impact risk assets, including the Bitcoin price performance.

Caroline Mauron, co-founder of Orbit Markets, points out that while higher yields may pose challenges, the anticipated regulatory easing under a Trump administration could be pivotal in shaping the crypto landscape.

Despite potential economic challenges that could negatively impact BTC’s performance, Mauron concludes that the regulatory shift could support Bitcoin and other digital assets in regaining their footing.

At the time of writing, Bitcoin is trading at $67,670, up 2.4% over the past 24 hours.

Featured image from DALL-E, chart from TradingView.com