- Bitcoin dipped 14% in the past 30 days.

- BTC price declined all the way till $$25,060, breaking the key support level of $25,510.

In the ever-volatile world of cryptocurrency, Bitcoin, the largest market capitalization holder, has found itself facing relentless bearish pressure, sending shockwaves throughout the market. BTC price declined all the way till $$25,060, breaking the key support level of $25,510. This has resulted in a 14% decline over the past 30 days.

Adding to the uncertainty, Bitcoin made headlines with news of a user paying a staggering transaction fee of 19 Bitcoin (BTC), equivalent to $509,563. This came to light through Whale Alert, an analytics provider that tracks large cryptocurrency transactions. This fee is way higher than the average transaction cost and has led to rampant speculation regarding the circumstances.

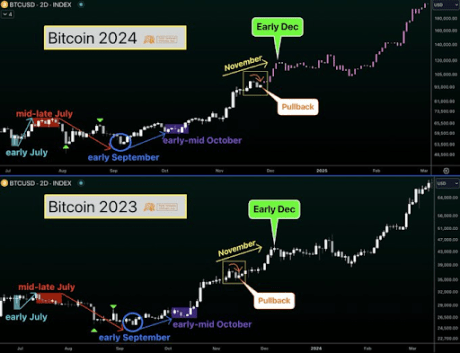

The impending Bitcoin halving and the long-awaited SEC approval of Bitcoin ETFs hold the promise of reshaping the cryptocurrency landscape. On the other hand, traders and investors draw parallels with Bitcoin’s historical dips in 2015-16 and 2019-20, during which the cryptocurrency orchestrated impressive comebacks.

Meanwhile, data from IntoTheBlock, a crypto data analytics platform, reveals that 69% of Bitcoin are held for over a year, while 25% is held for 1-12 months, and the remaining 7% is held for one month.

Where is Bitcoin Heading?

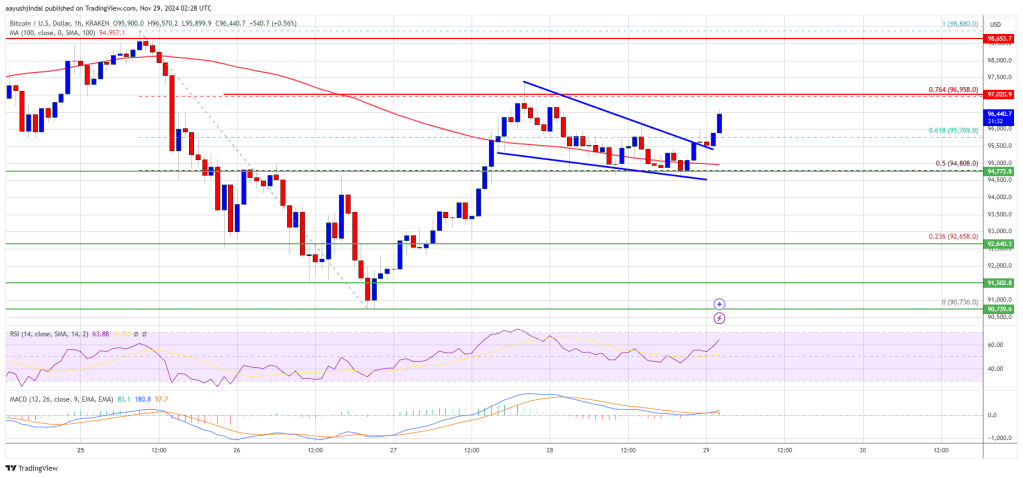

A close examination of Bitcoin’s recent price movements reveals an underlying bearish trend on the daily chart. The 50-day exponential moving average (EMA) currently stands at $27,232, underscoring the prevailing bearish sentiment. The daily relative strength index (RSI) at 36 suggests that Bitcoin is edging into oversold territory.

Source: CoinMarketCap

Buyers now find themselves at a crucial juncture, needing to propel and sustain Bitcoin’s price above $26,833 to initiate a relief rally towards the 50-day simple moving average (SMA) at $28,048. Such a move could signal that Bitcoin might remain within the broad range of $24,800 to $31,000. The price recently broke the key support level of $25,510 and is currently trading at $25,174.

Moreover, the bears are eyeing a breach of the support zone between $24,800 to $24,000. Should they succeed, the selling pressure could intensify, potentially driving the BTC price down to $20,000.