After reaching a new all-time high of $99,600 last Friday, the Bitcoin price has retraced to the $94,000 mark for the first time in nearly a week. This pullback comes amid growing speculation about a possible correction following a massive three-week uptrend that saw the leading crypto surge by 40% after Donald Trump’s election on November 5.

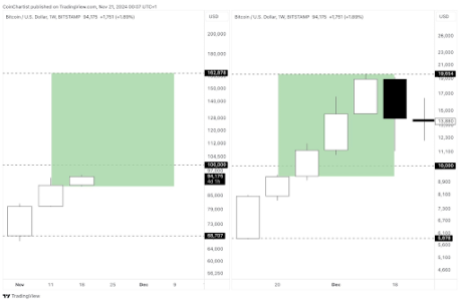

Market expert and technical analyst Rekt Capital recently voiced concerns on social media platform X (formerly Twitter), drawing parallels with historical price cycles. He highlighted that in the 2013 cycle, the Bitcoin price experienced six weeks of rising prices leading into what is known as “Price Discovery,” followed by its first major correction in Week 7.

Similarly, in the 2017 cycle, a seven-week rally culminated in a significant retracement of 34% in Week 8. In the 2020/2021 cycle, Bitcoin rallied for six weeks before facing its first meaningful pullback of 16%.Currently, Rekt Capital notes that Bitcoin is in the fourth week of its current uptrend.

Based on these historical patterns, it suggests that the cryptocurrency may be poised for a retest of lower support levels within the next two to four weeks, aligning with the previous trends, where the average declines have been substantial.

Considering the data from past corrections, the Bitcoin price could experience a 25% pullback, potentially bringing the price down to around $70,500—a level not seen since the election day.

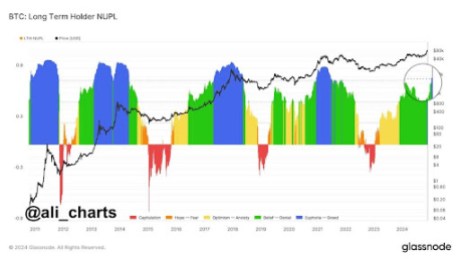

Contributing to the current pullback, data from on-chain market intelligence firm Glassnode reveals that long-term holders (LTHs) have significantly increased their selling activity, with a notable selling pressure recorded at -366,000 BTC per month—the highest level seen since April 2024.

The analysis indicates that among long-term holders, the 6 to 12-month cohort is leading the charge, averaging 25,600 BTC sold per day. This group of investors has capitalized on the recent Bitcoin price surge, having acquired their coins at an average cost basis approximately 71% lower than the current market price, which hovers around $57,900.

The increase in selling pressure among this group also reflects a potential shift in market movement in the coming days. With Bitcoin hitting new all-time highs just below $100,000, some investors may choose to take profits rather than ride out potential volatility.

At the time of writing, the largest cryptocurrency on the market is trading at $94,000, recording a retracement of nearly 5% on the 24-hour time frame.

For the time being, however, the Bitcoin price continues to post gains in all other time frames, with the year-to-date being the most notable with a 150% surge in that time period.

Featured image from DALL-E, chart from TradingView.com

Bitcoin Price May Drop To $70,500

Market expert and technical analyst Rekt Capital recently voiced concerns on social media platform X (formerly Twitter), drawing parallels with historical price cycles. He highlighted that in the 2013 cycle, the Bitcoin price experienced six weeks of rising prices leading into what is known as “Price Discovery,” followed by its first major correction in Week 7.

Similarly, in the 2017 cycle, a seven-week rally culminated in a significant retracement of 34% in Week 8. In the 2020/2021 cycle, Bitcoin rallied for six weeks before facing its first meaningful pullback of 16%.Currently, Rekt Capital notes that Bitcoin is in the fourth week of its current uptrend.

Based on these historical patterns, it suggests that the cryptocurrency may be poised for a retest of lower support levels within the next two to four weeks, aligning with the previous trends, where the average declines have been substantial.

Considering the data from past corrections, the Bitcoin price could experience a 25% pullback, potentially bringing the price down to around $70,500—a level not seen since the election day.

Who’s Selling Bitcoin?

Contributing to the current pullback, data from on-chain market intelligence firm Glassnode reveals that long-term holders (LTHs) have significantly increased their selling activity, with a notable selling pressure recorded at -366,000 BTC per month—the highest level seen since April 2024.

The analysis indicates that among long-term holders, the 6 to 12-month cohort is leading the charge, averaging 25,600 BTC sold per day. This group of investors has capitalized on the recent Bitcoin price surge, having acquired their coins at an average cost basis approximately 71% lower than the current market price, which hovers around $57,900.

The increase in selling pressure among this group also reflects a potential shift in market movement in the coming days. With Bitcoin hitting new all-time highs just below $100,000, some investors may choose to take profits rather than ride out potential volatility.

At the time of writing, the largest cryptocurrency on the market is trading at $94,000, recording a retracement of nearly 5% on the 24-hour time frame.

For the time being, however, the Bitcoin price continues to post gains in all other time frames, with the year-to-date being the most notable with a 150% surge in that time period.

Featured image from DALL-E, chart from TradingView.com