Bitcoin has plunged towards the $26,000 level as on-chain data shows the Bitcoin mines have been participating in a selloff.

As pointed out by an analyst in a CryptoQuant post, the miners have been showing signs of selling recently. The relevant indicator here is the “miner to exchange flow,” which keeps track of the total amount of Bitcoin that miners are depositing to exchanges.

Generally, these chain validators only make such transactions when they intend to sell, so the indicator’s value observing a spike can be a sign of a selloff.

The below chart shows the trend in the 7-day moving average (MA) BTC miner to exchange flow over the past couple of weeks:

As displayed in the graph, the 7-day MA Bitcoin miner to exchange flow has seen a huge spike during the past day. The quant has also highlighted the previous instances of high values of the indicator that occurred in the past two weeks.

It would appear that the BTC price has generally registered a drawdown whenever the miners make large deposits to these platforms. With the latest spike in the metric, too, the cryptocurrency has taken a plunge, as its price has now returned back to the $26,000 level, completely erasing the recovery that the Grayscale rally had brought.

It’s never a certainty that the deposits that these holders are making are indeed for selling, but given the timing of the price drawdown, it would appear likely that the miners were looking to sell after all.

In the chart, the analyst has also attached the data for a few more metrics. First, there are the “miner inflow” and “miner outflow” indicators, which, as their name suggests, measure the amount of Bitcoin that the miners are transferring into and out of their wallets, respectively.

From the graph, it’s visible that the BTC miner outflow spiked during the crash, which makes sense as the miners had made some transfers from their wallets toward exchanges.

The miner inflow, however, had also registered high values at the same time, meaning that fresh coins had entered back into the wallets of these chain validators.

This would suggest that some of the miners may have used the opportunity of the crash to expand their holdings. The “miner reserve,” the other metric of interest here, measures the total amount of Bitcoin that this cohort is carrying in its wallets right now and this indicator’s data would confirm that the holdings of the miners have actually gone up during the price drop.

So, while some Bitcoin miners may have contributed to the selling pressure, others have more than made up for it by accumulating more of the cryptocurrency.

As mentioned before, Bitcoin has now seen a complete retrace of the returns from the latest rally, bringing the asset back to the $26,000 level it had previously been consolidating at.

Bitcoin Miner To Exchange Flow Has Spiked During The Past Day

As pointed out by an analyst in a CryptoQuant post, the miners have been showing signs of selling recently. The relevant indicator here is the “miner to exchange flow,” which keeps track of the total amount of Bitcoin that miners are depositing to exchanges.

Generally, these chain validators only make such transactions when they intend to sell, so the indicator’s value observing a spike can be a sign of a selloff.

The below chart shows the trend in the 7-day moving average (MA) BTC miner to exchange flow over the past couple of weeks:

As displayed in the graph, the 7-day MA Bitcoin miner to exchange flow has seen a huge spike during the past day. The quant has also highlighted the previous instances of high values of the indicator that occurred in the past two weeks.

It would appear that the BTC price has generally registered a drawdown whenever the miners make large deposits to these platforms. With the latest spike in the metric, too, the cryptocurrency has taken a plunge, as its price has now returned back to the $26,000 level, completely erasing the recovery that the Grayscale rally had brought.

It’s never a certainty that the deposits that these holders are making are indeed for selling, but given the timing of the price drawdown, it would appear likely that the miners were looking to sell after all.

In the chart, the analyst has also attached the data for a few more metrics. First, there are the “miner inflow” and “miner outflow” indicators, which, as their name suggests, measure the amount of Bitcoin that the miners are transferring into and out of their wallets, respectively.

From the graph, it’s visible that the BTC miner outflow spiked during the crash, which makes sense as the miners had made some transfers from their wallets toward exchanges.

The miner inflow, however, had also registered high values at the same time, meaning that fresh coins had entered back into the wallets of these chain validators.

This would suggest that some of the miners may have used the opportunity of the crash to expand their holdings. The “miner reserve,” the other metric of interest here, measures the total amount of Bitcoin that this cohort is carrying in its wallets right now and this indicator’s data would confirm that the holdings of the miners have actually gone up during the price drop.

So, while some Bitcoin miners may have contributed to the selling pressure, others have more than made up for it by accumulating more of the cryptocurrency.

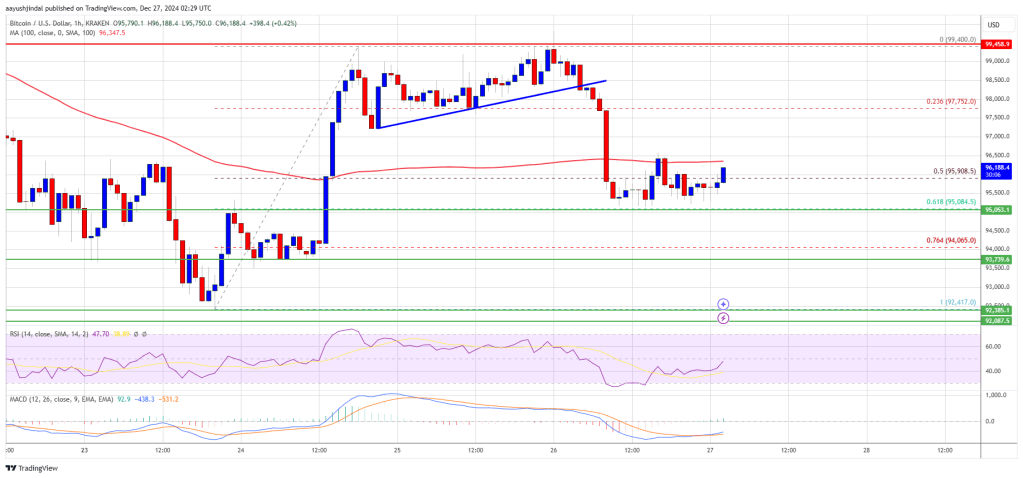

BTC Price

As mentioned before, Bitcoin has now seen a complete retrace of the returns from the latest rally, bringing the asset back to the $26,000 level it had previously been consolidating at.