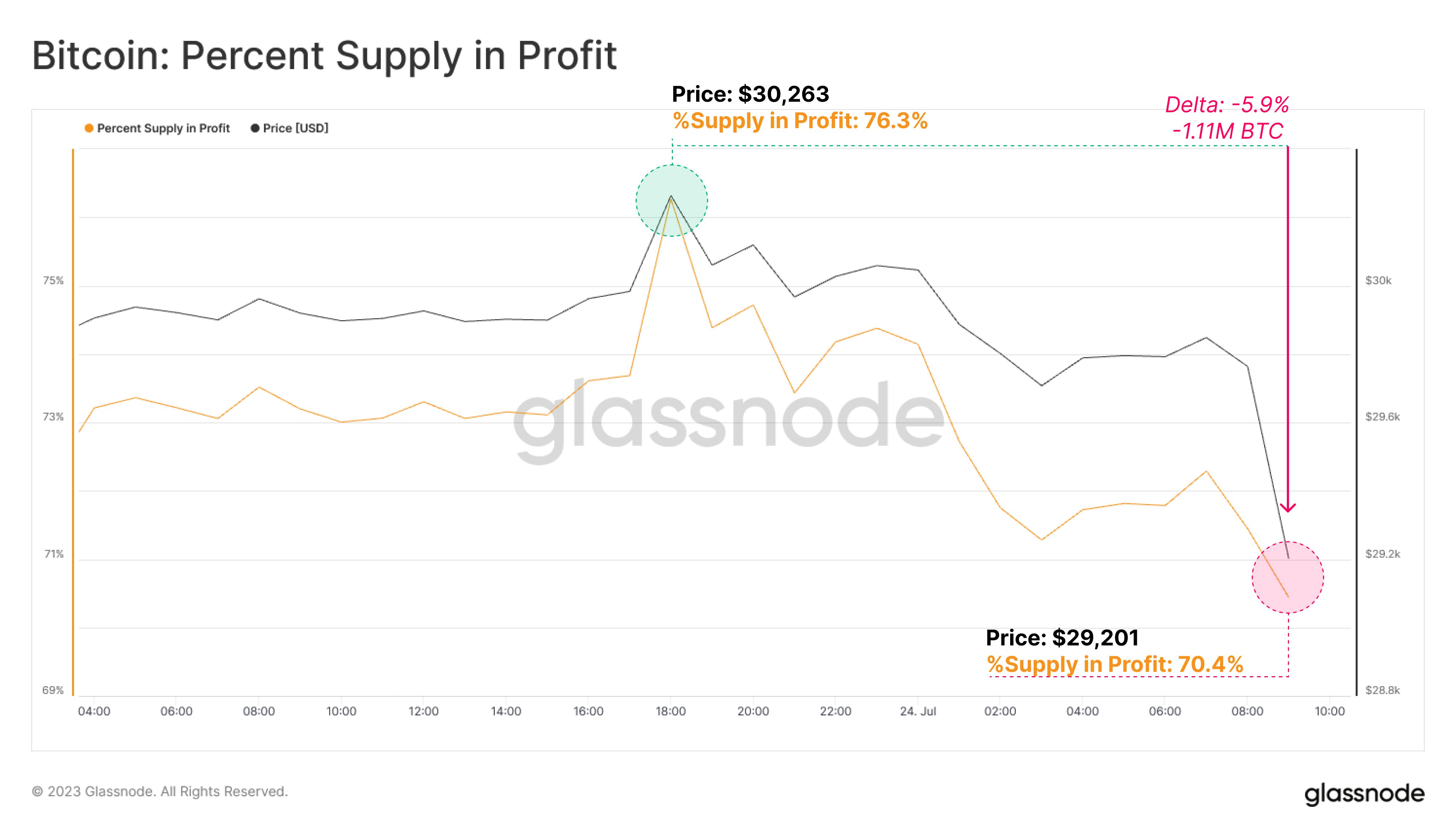

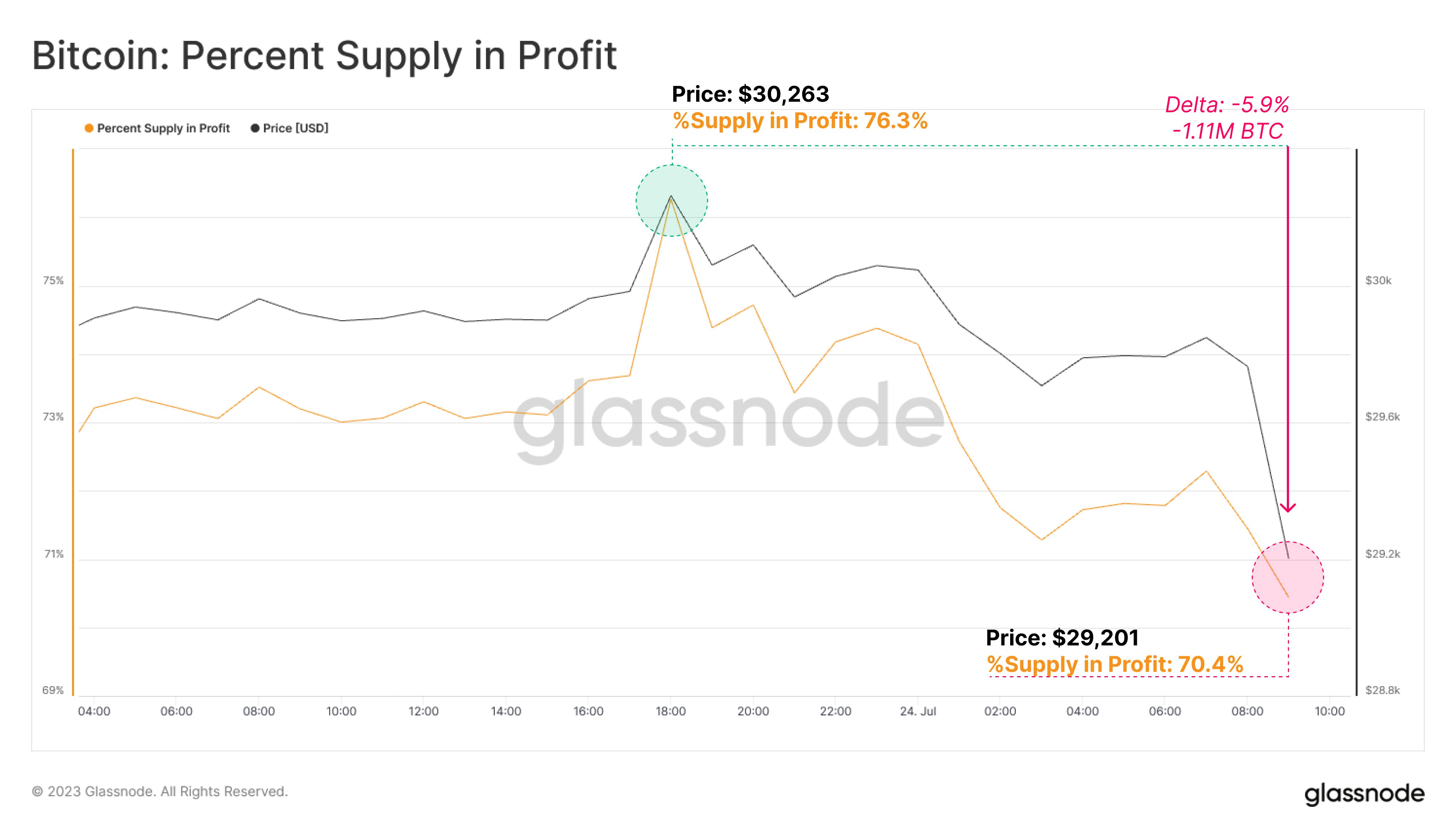

On-chain data shows an additional 5.9% of the total Bitcoin supply has entered into losses as the cryptocurrency’s price has plummeted to $29,200 today.

According to data from the on-chain analytics firm Glassnode, 1.11 million BTC has gone underwater with the latest asset value drop. The relevant indicator here is the “percent supply in profit,” which tells us about the percentage of the total Bitcoin supply currently carrying some profit.

Related Reading: Bitcoin Cash Price Could Restart Rally To $300 If It Breaks This Resistance

This metric works by going through the on-chain history of each coin in circulation to see what price it was previously moved at on the network. If this last transfer price for any coin were less than the current spot price of the asset, then that particular coin would be holding an unrealized gain currently.

The percent supply in profit adds up all such coins and calculates what part of the total supply they make up for. A counterpart indicator called the “percent supply in loss” keeps track of the opposite type of tokens, and its value can be simply found by subtracting the supply in profit from 100.

Now, here is a chart that shows the trend in the Bitcoin percent supply in profit over the past day or so:

As displayed in the above graph, the Bitcoin percent supply in profit had been floating around 76.3% when the cryptocurrency price was above $30,200 yesterday.

With the plunge to $29,200 over the past day, though, the metric has also taken a sharp hit, as only 70.4% of the total circulating supply is holding some unrealized profit now.

Historically, whenever the profit in supply has crossed the 75% mark, declines in the price have become more probable. This is because investors become more likely to sell the more profits they hold.

The latest tumble in the asset may have come because of this, as the investors who had been sitting on profits may have buckled and sold their coins to harvest their gains. As the metric has cooled down well below the 75% mark now, it’s possible that this may be it for the correction.

Before the plunge to $29,200, Bitcoin had been consolidating above $30,000 since many weeks ago. As buying and selling took place in this sideways trend, many investors slowly gained their cost basis at or above this level.

Due to this reason, the drop below this level has resulted in a significant part of the supply going into loss. More specifically, around 1.11 million BTC (equivalent to 5.9% of the total supply) has entered into the red.

At the time of writing, Bitcoin is trading around $29,100, down 4% in the last week.

Bitcoin Supply In Profit Has Declined To 70.4% After Today’s Price Plunge

According to data from the on-chain analytics firm Glassnode, 1.11 million BTC has gone underwater with the latest asset value drop. The relevant indicator here is the “percent supply in profit,” which tells us about the percentage of the total Bitcoin supply currently carrying some profit.

Related Reading: Bitcoin Cash Price Could Restart Rally To $300 If It Breaks This Resistance

This metric works by going through the on-chain history of each coin in circulation to see what price it was previously moved at on the network. If this last transfer price for any coin were less than the current spot price of the asset, then that particular coin would be holding an unrealized gain currently.

The percent supply in profit adds up all such coins and calculates what part of the total supply they make up for. A counterpart indicator called the “percent supply in loss” keeps track of the opposite type of tokens, and its value can be simply found by subtracting the supply in profit from 100.

Now, here is a chart that shows the trend in the Bitcoin percent supply in profit over the past day or so:

As displayed in the above graph, the Bitcoin percent supply in profit had been floating around 76.3% when the cryptocurrency price was above $30,200 yesterday.

With the plunge to $29,200 over the past day, though, the metric has also taken a sharp hit, as only 70.4% of the total circulating supply is holding some unrealized profit now.

Historically, whenever the profit in supply has crossed the 75% mark, declines in the price have become more probable. This is because investors become more likely to sell the more profits they hold.

The latest tumble in the asset may have come because of this, as the investors who had been sitting on profits may have buckled and sold their coins to harvest their gains. As the metric has cooled down well below the 75% mark now, it’s possible that this may be it for the correction.

Before the plunge to $29,200, Bitcoin had been consolidating above $30,000 since many weeks ago. As buying and selling took place in this sideways trend, many investors slowly gained their cost basis at or above this level.

Due to this reason, the drop below this level has resulted in a significant part of the supply going into loss. More specifically, around 1.11 million BTC (equivalent to 5.9% of the total supply) has entered into the red.

BTC Price

At the time of writing, Bitcoin is trading around $29,100, down 4% in the last week.