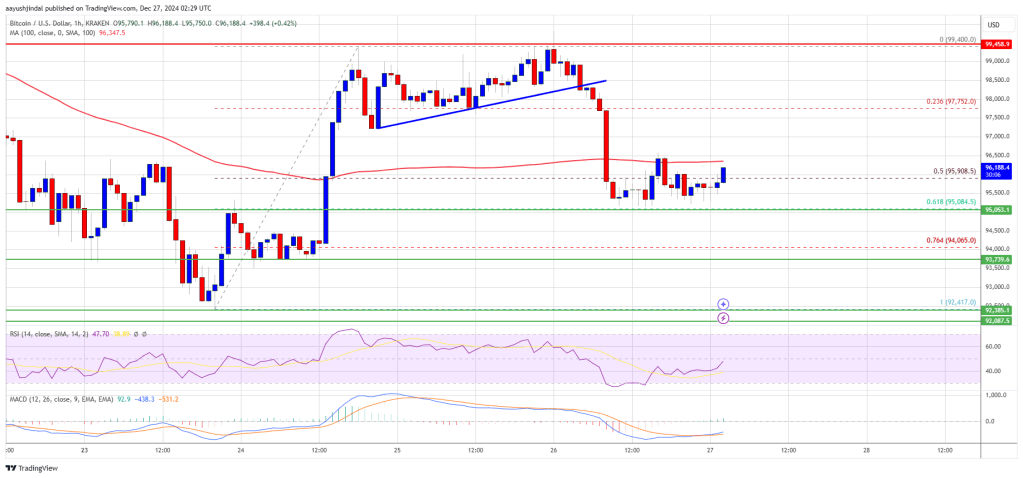

- BTC Futures OI has surged significantly on several other large exchanges in the last day.

- Bitcoin futures open interest (OI) has reached a staggering 437,79K BTC, or $20.43 billion.

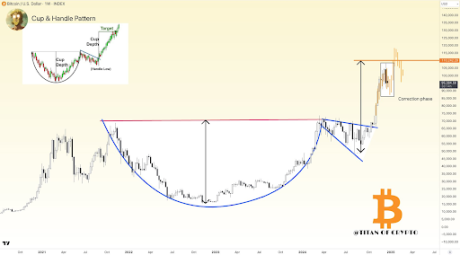

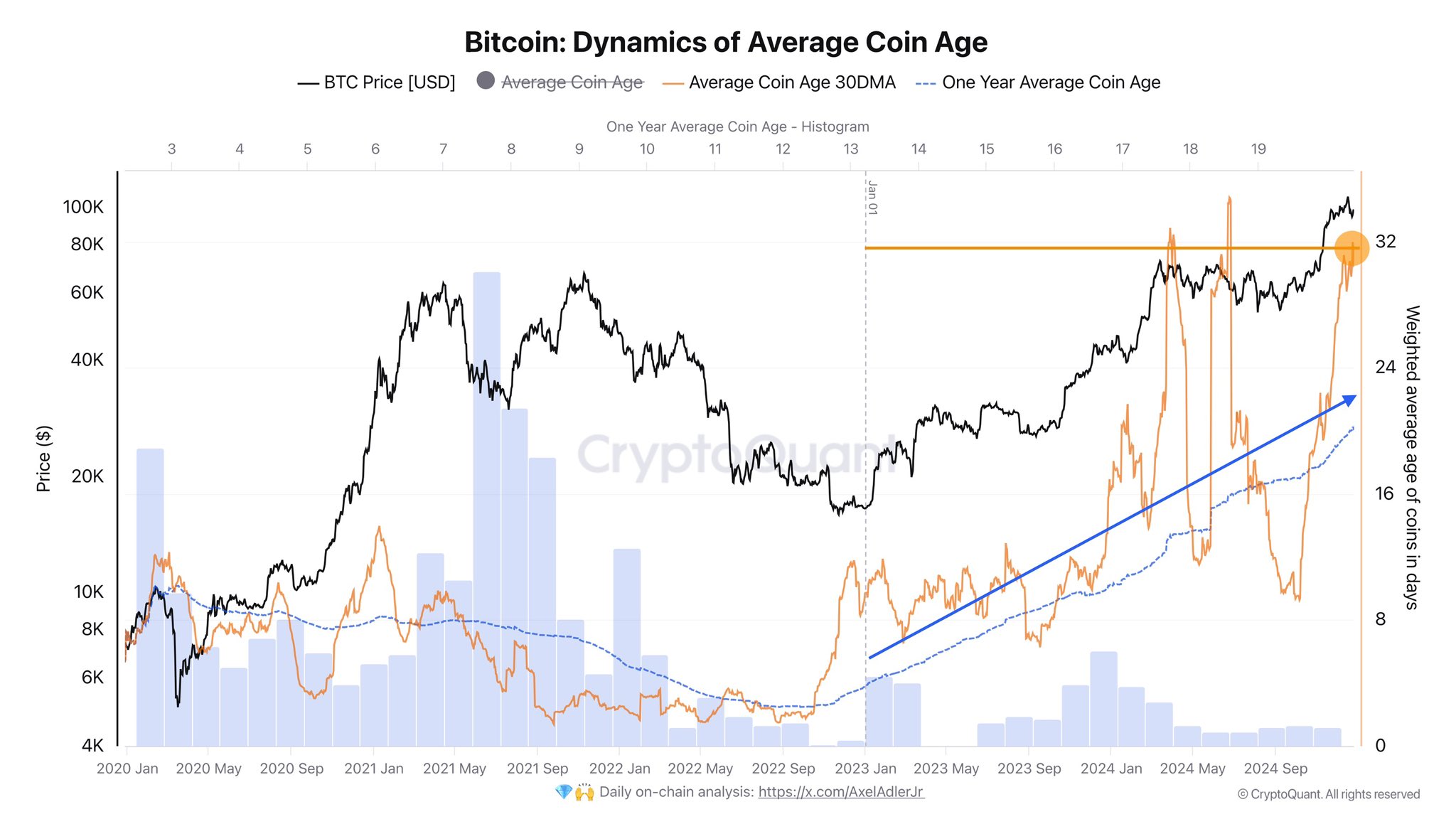

The overall Open Interest (OI) in Bitcoin Futures has surged to unprecedented levels, paving the way for what might be a crypto market revolution. Total Bitcoin futures contracts on the CME have reached an all-time high, according to Coinshares Head of Research James Butterfill, who recently released a critical graphic on twitter.

Also, according to the most recent numbers, BTC Futures OI has surged significantly on several other large exchanges in the last day.

Bitcoin futures open interest (OI) has reached a staggering 437,79K BTC, or $20.43 billion, according to data from Coinglass, indicating that the cryptocurrency market is seeing a tremendous surge. This spike, which occurred on Tuesday, January 9, marks a 10.31% gain in the last 24 hours.

Investors are keeping a careful watch on market dynamics as they await the SEC’s possible approval of a Spot Bitcoin ETF this week. A sign of the market’s optimistic mood is the growth in total Bitcoin futures OI, according to James Butterfill, Head of Research at Coinshares.

An impressive 15.45% increase, to $132.90K BTC, or $6.19 billion, was seen on the CME Group market alone in the last 24 hours. Moreover, Binance, another prominent cryptocurrency exchange, had a 9.91% increase in Bitcoin Open Interest, bringing the total to 97.34K, or $4.55 billion.

Highly Anticipated Approval

Bitcoin has had an extraordinary climb since April 2022, when it soared beyond $47,000 today. Speculation that the SEC may approve the first spot Bitcoin ETF is likely a major factor in this upsurge.

Bloomberg Intelligence analysts have pegged the likelihood of approval this week at an amazing 95%, which has heightened market euphoria. The U.S. Securities and Exchange Commission’s decision is likely to change the crypto landscape, therefore investors and traders are bracing for high volatility this week.

Highlighted Crypto News Today:

CFTC Committee Report Calls for Regulatory Collaboration in DeFi