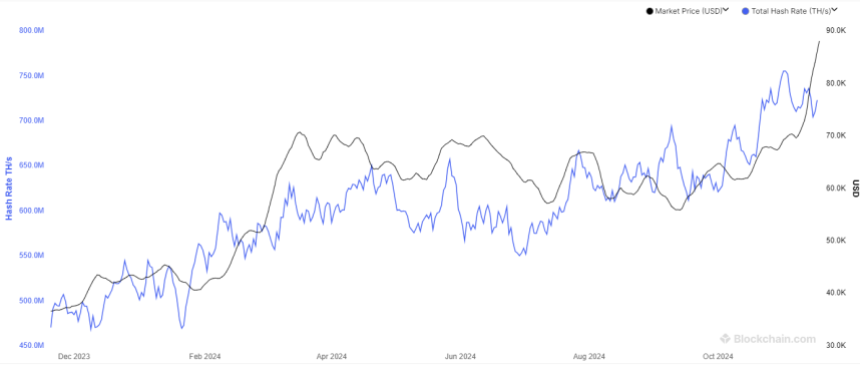

- On August 18, the Bitcoin network’s hash rate reached a new all-time high of 414 EH/s.

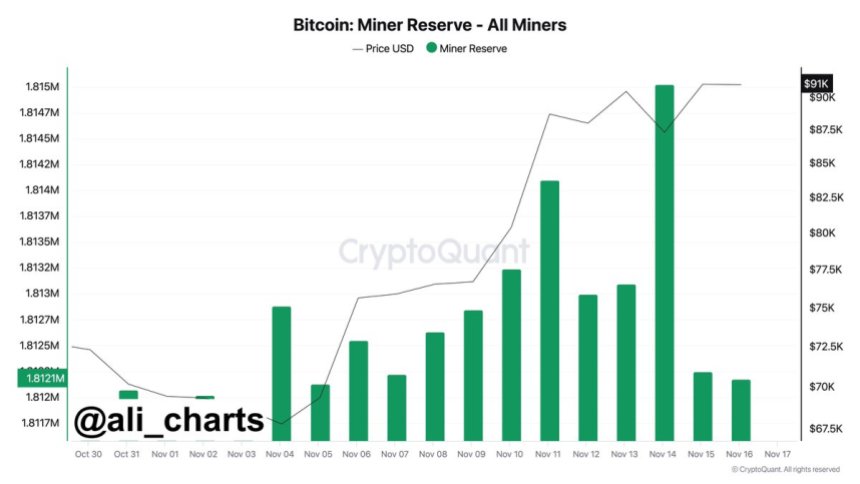

- BTC miners have been using money from stock sales in the Q2 to survive.

The “hash price” of Bitcoin mining, which is the amount of money miner’s make per terahashes per second, has fallen to levels not seen since the FTX crash of November 2022, despite the fact that the hash rate has hit all-time highs. On August 18, the Bitcoin network’s hash rate reached a new all-time high of 414 EH/s, a milestone reached during the last week.

At its peak, the network hash rate was 54% higher than it was at the start of 2023, and 80% higher than it was a year ago, as reported by Blockchain.com.

Surviving the Market Downturn

In spite of the network’s apparent security, Bitcoin miners are in a bind since their income has plummeted to levels last seen when BTC reached a market cycle low of roughly $16,500 in November last year.

The income of $0.060 per terahash per second per day is less than 50% of what it was in the beginning of May. As revenue and hashrate continue to decline, market analysts have suggested that mining profitability requires higher prices in order to maintain current hashrates.

It has been revealed that Bitcoin miners have been using money from stock sales in the Q2 to survive the market downturn. The twelve largest publicly listed miners together raised approximately $440 million in the second quarter via stock sales, Bloomberg reported on August 24. According to CMC, the price of Bitcoin at the time of writing is $25,914 and is down 0.46% market. The price has been struggling for quite some time now.

Highlighted Crypto News Today:

Pepe Coin Scandal Shakes the Market: But PEPE is Still Trending