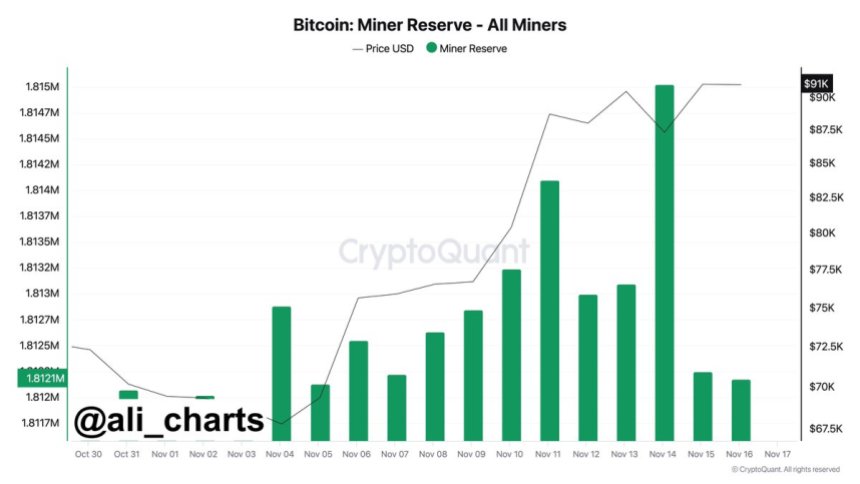

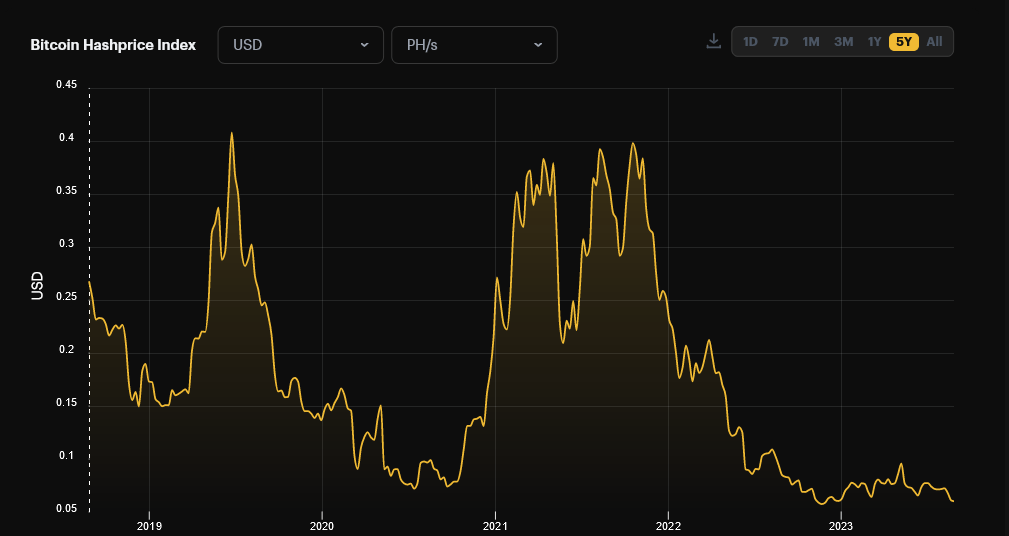

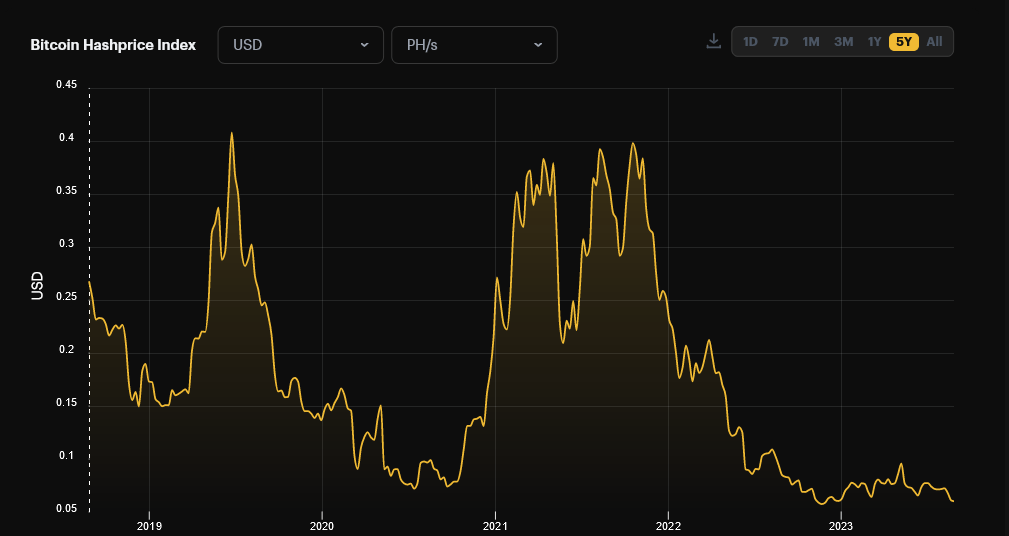

Bitcoin miners are churning less in revenue, looking at trackers on August 28. According to Hashrate Index data, a platform that tracks the correlation between hash rate and revenue accrued by miners over time, income generated from Bitcoin mining operations is at near record lows.

At $0.059 per Tera Hash (TH) daily, the trend doesn’t look exciting for Bitcoin miners as it is cents away from $0.056, a level recorded in late November 2022.

At the depth of last year’s crypto winter when prices fell, cracking below $16,000, hash price, which measures the potential revenue expected from deploying 1 Tera Hash of hash rate to the Bitcoin network per day, crumbled to the lowest point in three years.

While BTC supporters are optimistic, expecting prices to recover in the second half of 2023, miners must contend with lower revenue. How this impacts their operations is yet to be seen because miners depend on income generated from deploying hash rate to cater for operational expenses and sometimes pay shareholders.

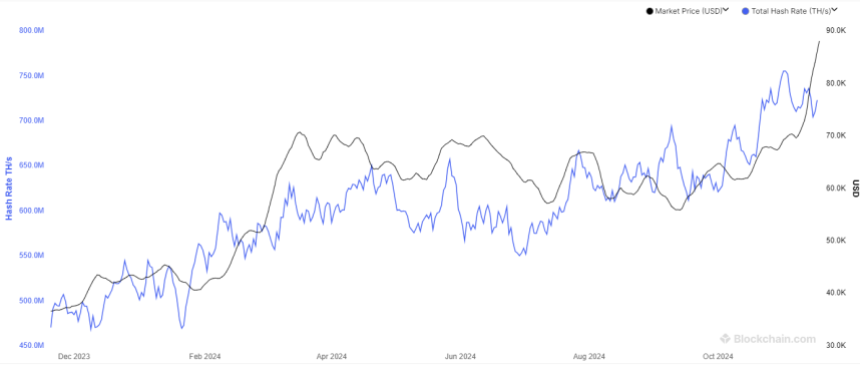

On May 8, the hash price rose to $0.095, the highest level in 2023, but has since contracted, dropping by over 40%. As the hash price falls, it could mean miners are having a hard time competing. The trend, as it is visible, comes when the hash rate has been rising to record levels as more miners power up their mining rigs.

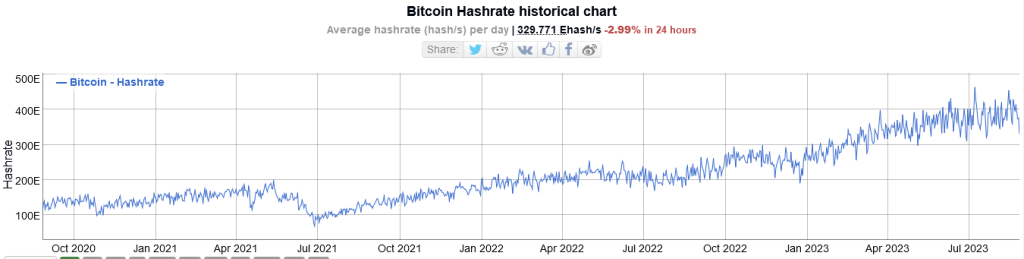

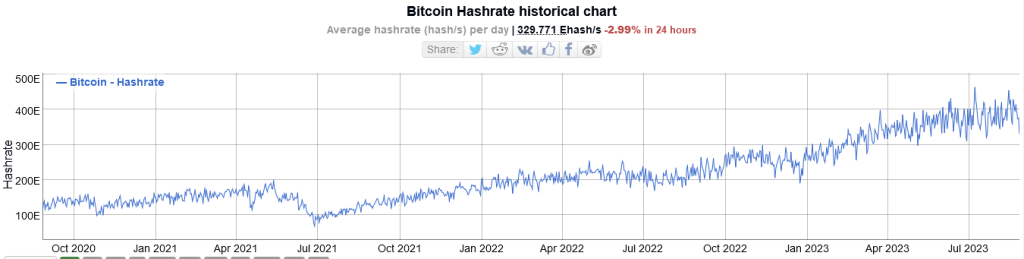

Throughout 2023, the total Bitcoin hash rate, a metric measuring the computing power channeled to the network, rose from 269 EH/s in early January 2023 to 465 EH/s in early July 2023. The hash rate has since dropped around 329 EH/s, a level that’s still higher than 2022 highs.

With a rising hash rate, the Bitcoin network automatically adjusted the mining difficulty to the highest level last week. Trackers show the network’s difficulty is now at 55.62 T, following a 6% increment.

For the better part of the year, difficulty levels have been rising amid an increase in hash rate. As prices recovered in January and the hash rate rose, the network increased difficulty levels by 10%, the highest spike this year.

Hash rate will likely continue rising in the months ahead. Tether Energy, an affiliate of Tether Holdings, issues USDT, plans to connect their rigs in Latin America. Their launch translates to more competition for existing miners, including Riot Blockchain.

Bitcoin Miner Revenue Declining

At $0.059 per Tera Hash (TH) daily, the trend doesn’t look exciting for Bitcoin miners as it is cents away from $0.056, a level recorded in late November 2022.

At the depth of last year’s crypto winter when prices fell, cracking below $16,000, hash price, which measures the potential revenue expected from deploying 1 Tera Hash of hash rate to the Bitcoin network per day, crumbled to the lowest point in three years.

While BTC supporters are optimistic, expecting prices to recover in the second half of 2023, miners must contend with lower revenue. How this impacts their operations is yet to be seen because miners depend on income generated from deploying hash rate to cater for operational expenses and sometimes pay shareholders.

On May 8, the hash price rose to $0.095, the highest level in 2023, but has since contracted, dropping by over 40%. As the hash price falls, it could mean miners are having a hard time competing. The trend, as it is visible, comes when the hash rate has been rising to record levels as more miners power up their mining rigs.

Throughout 2023, the total Bitcoin hash rate, a metric measuring the computing power channeled to the network, rose from 269 EH/s in early January 2023 to 465 EH/s in early July 2023. The hash rate has since dropped around 329 EH/s, a level that’s still higher than 2022 highs.

More Rigs, Higher Hash Rate

With a rising hash rate, the Bitcoin network automatically adjusted the mining difficulty to the highest level last week. Trackers show the network’s difficulty is now at 55.62 T, following a 6% increment.

For the better part of the year, difficulty levels have been rising amid an increase in hash rate. As prices recovered in January and the hash rate rose, the network increased difficulty levels by 10%, the highest spike this year.

Hash rate will likely continue rising in the months ahead. Tether Energy, an affiliate of Tether Holdings, issues USDT, plans to connect their rigs in Latin America. Their launch translates to more competition for existing miners, including Riot Blockchain.