On-chain data shows the Bitcoin Puell Multiple is about to undergo a crossover that has historically been very bullish for BTC’s price.

As pointed out by an analyst in a CryptoQuant Quicktake post, the Bitcoin Puell Multiple has been approaching its 365-day moving average (MA) recently. The “Puell Multiple” here refers to a popular on-chain indicator that tells us about how the revenue of the Bitcoin miners compares against its yearly average.

BTC miners earn their income through two sources, the transaction fees and the block subsidy, but in the context of the Puell Multiple, only the latter is relevant. Block subsidy is the reward miners receive as compensation for adding blocks to the network.

When the indicator’s value is greater than 1, it means the miners are currently making a higher revenue than the average for the past year. On the other hand, it being under the threshold suggests the miners are earning less than usual.

Now, here is a chart that shows the trend in the Bitcoin Puell Multiple, as well as its 365-day MA, over the last few years:

As displayed in the above graph, the Bitcoin Puell Multiple had plunged under the 1 mark earlier in the year, but recently, its value has seen a sharp rise back towards the mark.

The reason behind the earlier plummet was the occurrence of the fourth BTC Halving. “Halvings” are events coded into the blockchain that automatically shave off the asset’s block subsidy in half every four years.

As the Puell Multiple keeps track of the block subsidy, it naturally makes sense that the Halving would drastically affect the ratio’s value. Outside of the Halvings, the block subsidy remains constant in BTC value and is more or less given out at a constant rate.

However, the ratio’s value can still change at times other than Halvings because it measures the USD value of the miner revenue. The rewards that miners get are in BTC and so, their value is also tied to the USD rate of the asset.

With the cryptocurrency observing a sharp rally recently, the miner revenue seems to be back to the same as the 365-day MA. The 1 mark isn’t the only important level the Puell Multiple has risen to; it is now near its 365-day MA.

In the chart, the quant highlighted what happened the last three times the metric broke above this line. It would appear that the asset went on to rally at least 76% each time.

It remains to be seen whether the Puell Multiple could break above this line, potentially giving a bullish signal for Bitcoin, or if the retest would fail.

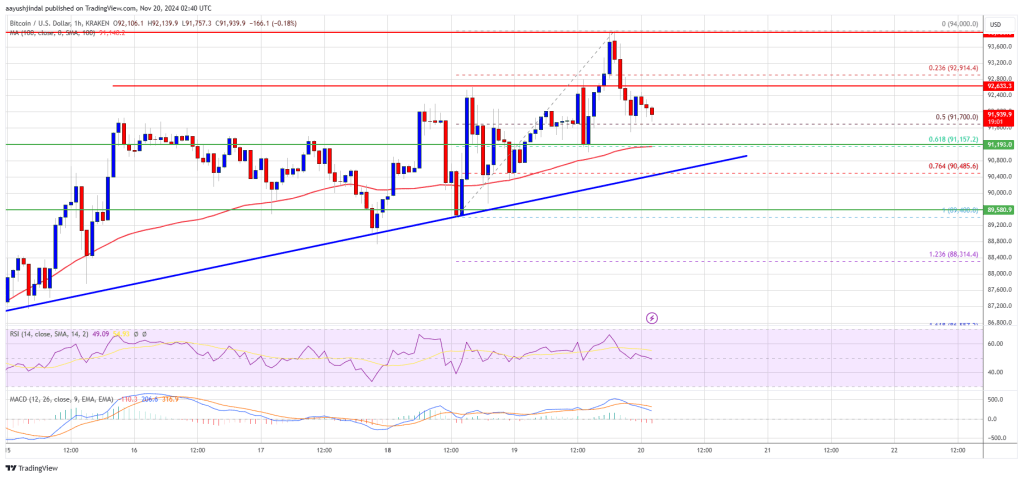

Bitcoin has recently witnessed a cooldown in bullish momentum as its price has fallen to a sideways movement. At present, BTC is trading at around $91,900.

Bitcoin Puell Multiple Could Cross Its 365-Day MA In Near Future

As pointed out by an analyst in a CryptoQuant Quicktake post, the Bitcoin Puell Multiple has been approaching its 365-day moving average (MA) recently. The “Puell Multiple” here refers to a popular on-chain indicator that tells us about how the revenue of the Bitcoin miners compares against its yearly average.

BTC miners earn their income through two sources, the transaction fees and the block subsidy, but in the context of the Puell Multiple, only the latter is relevant. Block subsidy is the reward miners receive as compensation for adding blocks to the network.

When the indicator’s value is greater than 1, it means the miners are currently making a higher revenue than the average for the past year. On the other hand, it being under the threshold suggests the miners are earning less than usual.

Now, here is a chart that shows the trend in the Bitcoin Puell Multiple, as well as its 365-day MA, over the last few years:

As displayed in the above graph, the Bitcoin Puell Multiple had plunged under the 1 mark earlier in the year, but recently, its value has seen a sharp rise back towards the mark.

The reason behind the earlier plummet was the occurrence of the fourth BTC Halving. “Halvings” are events coded into the blockchain that automatically shave off the asset’s block subsidy in half every four years.

As the Puell Multiple keeps track of the block subsidy, it naturally makes sense that the Halving would drastically affect the ratio’s value. Outside of the Halvings, the block subsidy remains constant in BTC value and is more or less given out at a constant rate.

However, the ratio’s value can still change at times other than Halvings because it measures the USD value of the miner revenue. The rewards that miners get are in BTC and so, their value is also tied to the USD rate of the asset.

With the cryptocurrency observing a sharp rally recently, the miner revenue seems to be back to the same as the 365-day MA. The 1 mark isn’t the only important level the Puell Multiple has risen to; it is now near its 365-day MA.

In the chart, the quant highlighted what happened the last three times the metric broke above this line. It would appear that the asset went on to rally at least 76% each time.

It remains to be seen whether the Puell Multiple could break above this line, potentially giving a bullish signal for Bitcoin, or if the retest would fail.

BTC Price

Bitcoin has recently witnessed a cooldown in bullish momentum as its price has fallen to a sideways movement. At present, BTC is trading at around $91,900.