A quant has explained how a pattern in the Bitcoin open interest that held during the past month now appears to be broken.

As explained by an analyst in a CryptoQuant post, the BTC price had earlier been rising along with increases in the open interest. The “open interest” here refers to an indicator that measures the total amount of Bitcoin futures contracts that are currently open on all derivative exchanges.

When the value of this metric goes up, it means that users are opening up more positions on the futures market right now. As leverage generally increases when this happens, the price of the asset may become more volatile following this trend.

On the other hand, the value of the indicator decreasing suggests the users are either closing up their contracts of their own volition or are being liquidated by their platforms currently. Such a trend may lead to the cryptocurrency’s price becoming more stable.

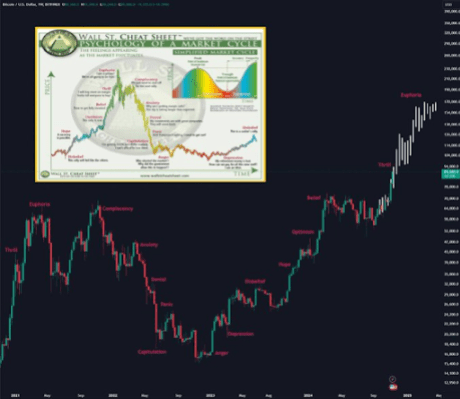

Now, here is a chart that shows the trend in the Bitcoin open interest over the past few weeks:

As displayed in the above graph, the Bitcoin open interest has been steadily rising during the past few days. This suggests that investors have been slowly opening up more contracts on derivative exchanges.

During the last month or so, whenever the open interest had risen, the price of the cryptocurrency had also registered an increase. The quant notes that this would imply that the bulls had been dominating the futures market in this period, as the open interest going up alongside the price implies that the increase in contracts had been coming from long contract holders.

This pattern had held up until the surge BTC had observed a few days back. This sharp increase in the price had ended up only being temporary, and as the price had plunged down, the longs had seen liquidation.

As the longs had previously dominated the Bitcoin market, this decrease in the open interest was quite sharp, as is visible in the chart. The indicator didn’t take too long to rebound, however, as it initially sharply rose and then fell back to a trend of gradual growth. which has continued until today.

But as the price has in fact been going down in this same period, it would appear that the increase in the open interest is now being driven by the shorts. This would imply that a shift in the market may have occurred, as the open interest pattern that had previously held up now seems to be invalid.

“Have the bears returned once again? In any case, it is advisable to exercise caution in the current area,” warns the quant.

At the time of writing, Bitcoin is trading around $30,000, down 2% in the last week.

Bitcoin Open Interest Is Now Moving Against The Price

As explained by an analyst in a CryptoQuant post, the BTC price had earlier been rising along with increases in the open interest. The “open interest” here refers to an indicator that measures the total amount of Bitcoin futures contracts that are currently open on all derivative exchanges.

When the value of this metric goes up, it means that users are opening up more positions on the futures market right now. As leverage generally increases when this happens, the price of the asset may become more volatile following this trend.

On the other hand, the value of the indicator decreasing suggests the users are either closing up their contracts of their own volition or are being liquidated by their platforms currently. Such a trend may lead to the cryptocurrency’s price becoming more stable.

Now, here is a chart that shows the trend in the Bitcoin open interest over the past few weeks:

As displayed in the above graph, the Bitcoin open interest has been steadily rising during the past few days. This suggests that investors have been slowly opening up more contracts on derivative exchanges.

During the last month or so, whenever the open interest had risen, the price of the cryptocurrency had also registered an increase. The quant notes that this would imply that the bulls had been dominating the futures market in this period, as the open interest going up alongside the price implies that the increase in contracts had been coming from long contract holders.

This pattern had held up until the surge BTC had observed a few days back. This sharp increase in the price had ended up only being temporary, and as the price had plunged down, the longs had seen liquidation.

As the longs had previously dominated the Bitcoin market, this decrease in the open interest was quite sharp, as is visible in the chart. The indicator didn’t take too long to rebound, however, as it initially sharply rose and then fell back to a trend of gradual growth. which has continued until today.

But as the price has in fact been going down in this same period, it would appear that the increase in the open interest is now being driven by the shorts. This would imply that a shift in the market may have occurred, as the open interest pattern that had previously held up now seems to be invalid.

“Have the bears returned once again? In any case, it is advisable to exercise caution in the current area,” warns the quant.

BTC Price

At the time of writing, Bitcoin is trading around $30,000, down 2% in the last week.