Bitcoin (BTC) has been no stranger to dramatic price swings in the volatile cryptocurrency world. As September approaches, market analysts closely monitor BTC’s possibility of plunging below the $25,000 mark.

However, history has shown that September’s struggles often pave the way for a resurgence in October, with massive rallies that rekindle investor optimism.

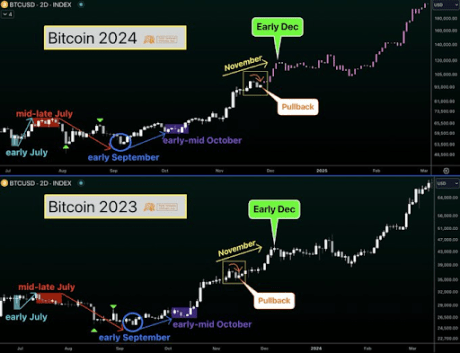

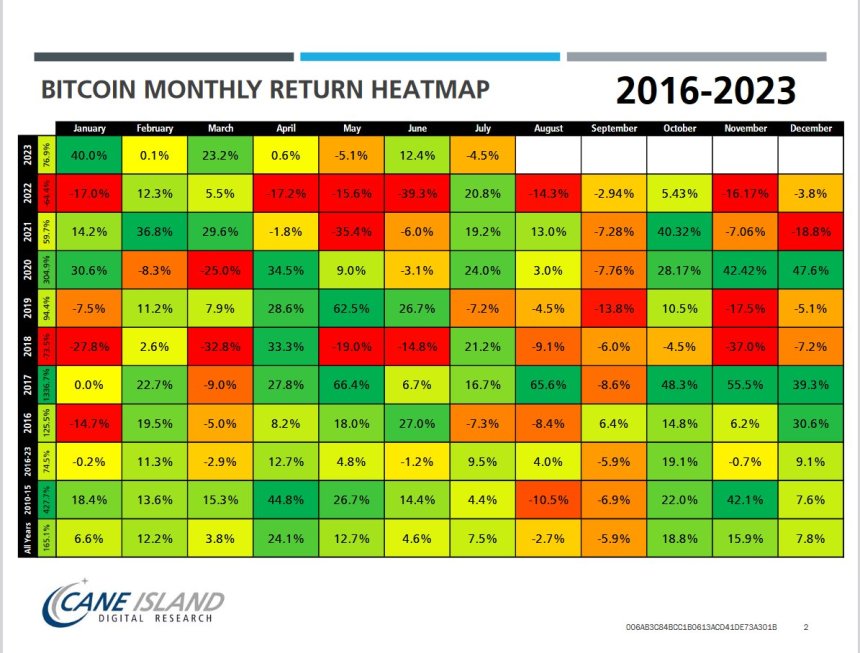

When examining Bitcoin’s historical performance during September, it becomes evident that the month has posed challenges for the world’s most renowned cryptocurrency.

Previous September has witnessed BTC experiencing declines of up to 13%. This downward trend has undoubtedly concerned traders and investors, raising questions about the sustainability of Bitcoin’s bullish momentum.

According to Timothy Peterson, market analyst and investment Manager, based on current market analysis, there is a 50% probability that Bitcoin’s price will dip below the $25,000 threshold before September concludes.

While a potential drop below $25,000 might cause temporary unease among Bitcoin enthusiasts, historical patterns suggest that October could be the month to look forward to.

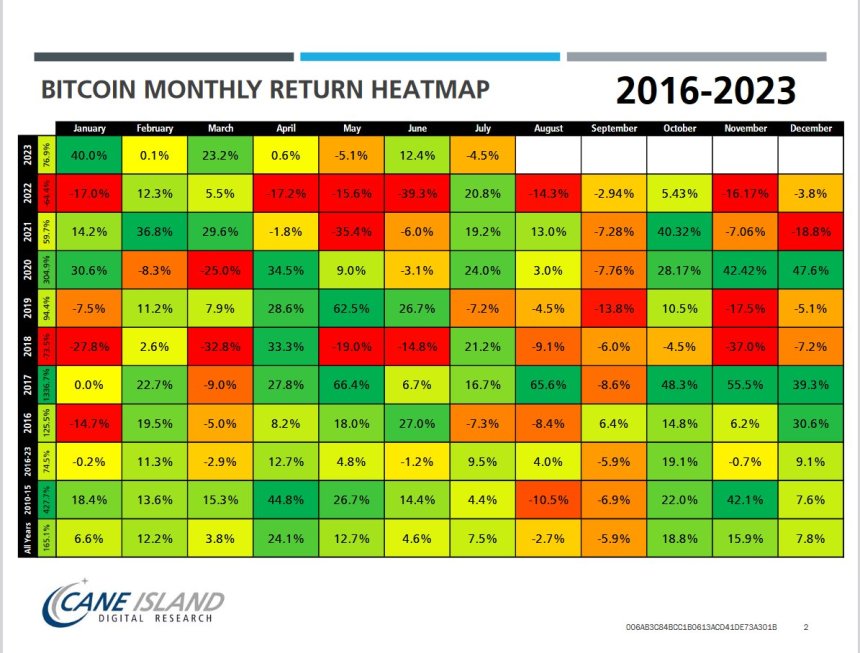

In the past, September’s price declines have often catalyzed significant rallies in the subsequent month. Observing the heatmap above, Peterson identified instances where Bitcoin rebounded with gains as high as 48% following sharp declines in September.

If Bitcoin does indeed experience a dip below $25,000 in September, it may mark the final significant correction before the commencement of a new bull run cycle.

On this note, Peterson believes that such a dip, coupled with the subsequent recovery and October’s potential rally, could set the stage for substantial gains in the coming months.

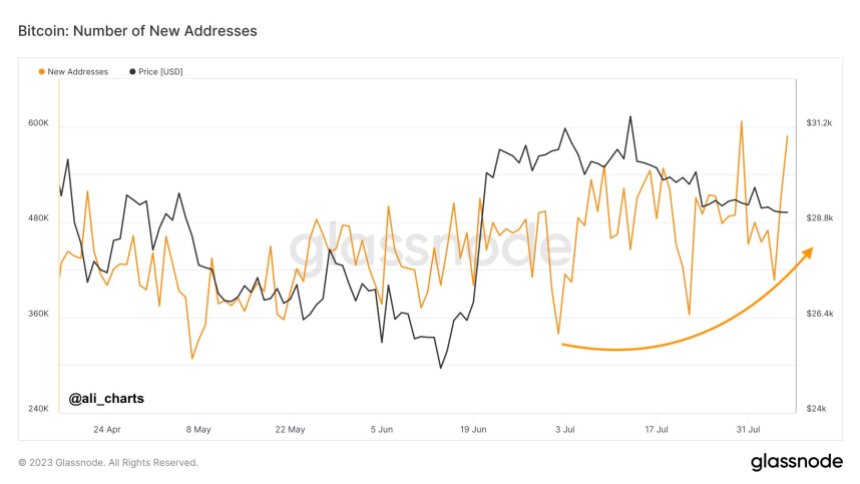

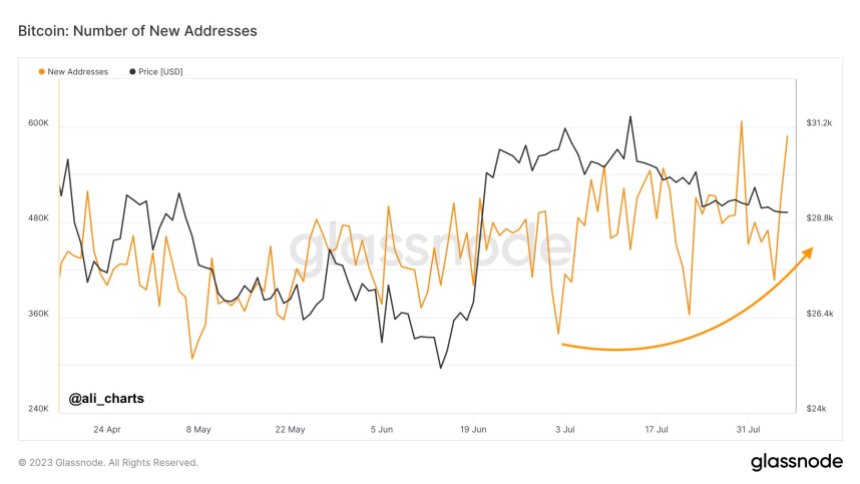

As BTC experienced a drop from $32,000 to $29,000, trader Ali Martinez highlighted a significant trend; the number of new Bitcoin addresses continued to rise steadily.

This intriguing divergence between price and network growth provides insights into BTC’s potentially stable long-term uptrend.

While Bitcoin’s price exhibited a downward trajectory, the number of newly created Bitcoin addresses has consistently grown.

This divergence is noteworthy, suggesting that despite short-term price fluctuations, the network’s expansion remains robust. It signifies a growing interest in Bitcoin adoption and usage, which, in turn, supports the notion of a stable and sustainable long-term uptrend.

Conversely, Bitcoin remains trapped within a price range of $29,200 and $28,900, a pattern that has persisted since the start of August. As of the time of writing, BTC is trading at $28,960, reflecting a 0.5% decrease in the last 24 hours.

Featured image from iStock, chart from TradingView.com

However, history has shown that September’s struggles often pave the way for a resurgence in October, with massive rallies that rekindle investor optimism.

Potential For BTC To Drop Below $25,000 Before A Promising October

When examining Bitcoin’s historical performance during September, it becomes evident that the month has posed challenges for the world’s most renowned cryptocurrency.

Previous September has witnessed BTC experiencing declines of up to 13%. This downward trend has undoubtedly concerned traders and investors, raising questions about the sustainability of Bitcoin’s bullish momentum.

According to Timothy Peterson, market analyst and investment Manager, based on current market analysis, there is a 50% probability that Bitcoin’s price will dip below the $25,000 threshold before September concludes.

While a potential drop below $25,000 might cause temporary unease among Bitcoin enthusiasts, historical patterns suggest that October could be the month to look forward to.

In the past, September’s price declines have often catalyzed significant rallies in the subsequent month. Observing the heatmap above, Peterson identified instances where Bitcoin rebounded with gains as high as 48% following sharp declines in September.

If Bitcoin does indeed experience a dip below $25,000 in September, it may mark the final significant correction before the commencement of a new bull run cycle.

On this note, Peterson believes that such a dip, coupled with the subsequent recovery and October’s potential rally, could set the stage for substantial gains in the coming months.

Bitcoin Bullish Divergence

As BTC experienced a drop from $32,000 to $29,000, trader Ali Martinez highlighted a significant trend; the number of new Bitcoin addresses continued to rise steadily.

This intriguing divergence between price and network growth provides insights into BTC’s potentially stable long-term uptrend.

While Bitcoin’s price exhibited a downward trajectory, the number of newly created Bitcoin addresses has consistently grown.

This divergence is noteworthy, suggesting that despite short-term price fluctuations, the network’s expansion remains robust. It signifies a growing interest in Bitcoin adoption and usage, which, in turn, supports the notion of a stable and sustainable long-term uptrend.

Conversely, Bitcoin remains trapped within a price range of $29,200 and $28,900, a pattern that has persisted since the start of August. As of the time of writing, BTC is trading at $28,960, reflecting a 0.5% decrease in the last 24 hours.

Featured image from iStock, chart from TradingView.com