- Bitcoin dropped to $92,000 after a profit taking pullback and global uncertainty from Trump’s tariffs.

- Trump’s crypto friendly policies are increasing investors with $7 billion invested in U.S. Bitcoin ETFs.

- VanEck predicts Bitcoin could hit $180,000 in 18 months.

Bitcoin’s Recent Pullback Despite Trump’s Winning

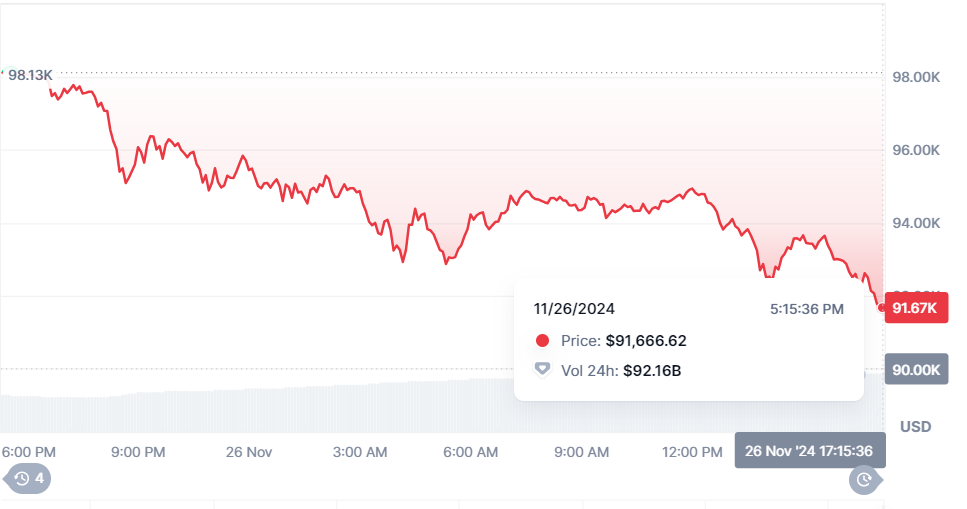

Bitcoin recently saw its longest losing streak since Donald Trump’s election victory, dropping 6% over three days and stabilizing around $92,000. There was huge expectation around it to cross $100000 but it failed, with profit-taking and global market uncertainty by Trump’s recent tariff proposals on China, Canada, and Mexico. Despite this, the broader crypto market remains up $1 trillion since Election Day.

Trump’s pledges to establish a national Bitcoin reserve and regulations, has created belief in the crypto space. Analysts like TD Cowen’s Jaret Seiberg suggest his upcoming influence over the SEC could ease crypto regulations, increasing market growth. Meanwhile, $7 billion flowed into U.S. Bitcoin ETFs after Trump’s victory, though some outflows have occurred during the recent market correction.

Donald Trump collaborating with tech visionary Elon Musk to ensure all future Bitcoin mining takes place in the U.S. These initiatives have created a wave of excitement, with Bitcoin’s price surging by $25,000 after Trump’s election win and reaching $98,500, just shy of the $100,000 milestone.

VanEck’s $180,000 Bitcoin Prediction

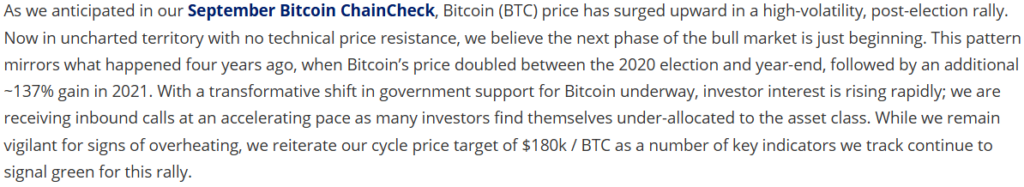

VanEck predicts Bitcoin could reach $180,000 within the next 18 months, signalling the start of a potentially historic bull run.

VanEck’s $180,000 Bitcoin prediction, Analysts Nathan Frankovitz and Matthew Sigel highlight that Bitcoin is just beginning its next bull market. They believe that increasing participation from institutions, favourable regulations, and Bitcoin’s strengthened market dominance, currently at 59%, drive its growth.

Bitcoin’s transformation from a niche asset to a globally recognized financial tool has made it more liquid and appealing to investors, further supporting VanEck’s long-term bullish outlook.

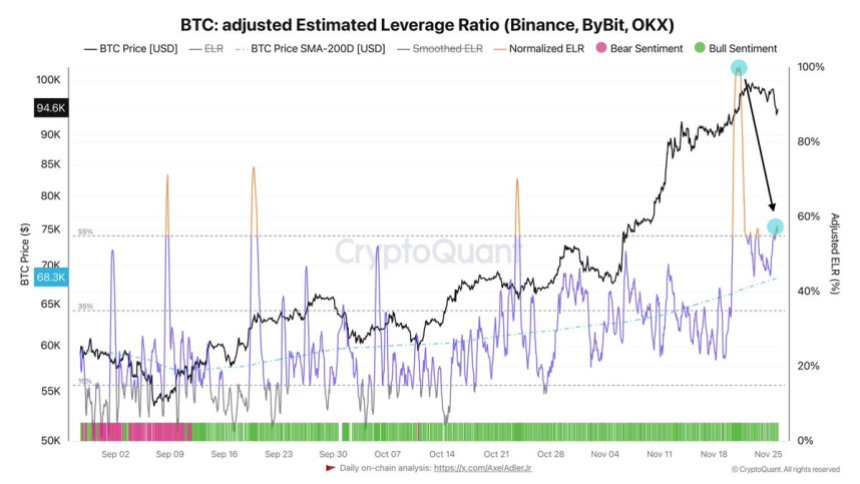

Despite nearing the $100,000 mark, Bitcoin recently experienced a three-day pullback, dropping 6% to stabilize at $94,000. This marked its longest losing streak since Trump’s victory. Analysts say the correction happened because traders took profits after the price rally, along with concerns over Trump’s potential tariffs on China and Canada. While this caused market uncertainty, experts see the dip as a normal adjustment, not a sign of a trend reversal.

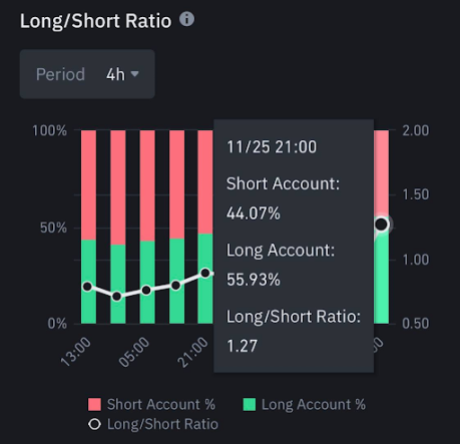

The temporary setback has not dampened optimism. VanEck’s report indicates that Bitcoin’s market fundamentals remain strong. Elevated funding rates for perpetual futures contracts suggest continued momentum in the near term.

At the same time, Trump’s influence over regulatory bodies like the SEC could pave the way for crypto-friendly reforms, including approving Bitcoin ETFs—these developments, coupled with advancing market maturity, position Bitcoin for long-term growth.

The future for Bitcoin looks promising. With Trump’s pro-crypto vision, Elon Musk’s collaboration, and VanEck’s bullish projection. While short-term corrections are part of the journey, the combination of political support, institutional backing, and favourable regulations indicates that Bitcoin’s rise is far from over.

Highlighted Crypto News Today

Why Is the Global Crypto Market Down Today?