The Bitcoin market appears to have taken an intriguing turn as the asset’s reserves on centralized exchanges have hit the lowest levels since November 2018.

This development, highlighted by a CryptoQuant analyst known as G a a h, points out a notable change in BTC’s investor behavior within the crypto space and also suggests quite an interesting trend for Bitcoin.

According to the analyst, Bitcoin reserves on exchanges have diminished significantly throughout 2024, reflecting a shift towards long-term holding strategies among market participants.

This trend suggests that investors increasingly transfer their assets to private wallets, reducing the supply available for immediate sale and contributing to buying pressure in a market already constrained by supply.

According to G a a h, this behavior indicates a broader sentiment shift, with market participants displaying increased confidence in Bitcoin as a store of value amidst “economic uncertainty and rising inflation.”

By moving Bitcoin away from exchanges, investors reduce the likelihood of sudden sell-offs, which can lead to increased price stability. However, the reduced supply on exchanges may also lead to heightened volatility, especially if demand continues to grow or remains consistent.

The CryptoQuant analyst noted:

Following an all-time high (ATH) of $93,477 on Wednesday, November 13, BTC has faced quite a noticeable correction, now down by 4% from this peak. So far, the asset has been unable to continue its upward momentum and appears to be seeing more sell-offs.

When writing, Bitcoin trades below $90,000 with a current trading price of $89,779, down by 1.4% in the past day. This price decline resulted in roughly $49 billion subtracted from its market capitalization valuation on Wednesday.

For context, as of today, BTC’s market cap sits at $1.775 trillion, a nearly 5% decrease from the $1.835 trillion valuation two days ago. Bitcoin’s daily trading volume dropped from over $100 billion earlier this week to below $85 billion.

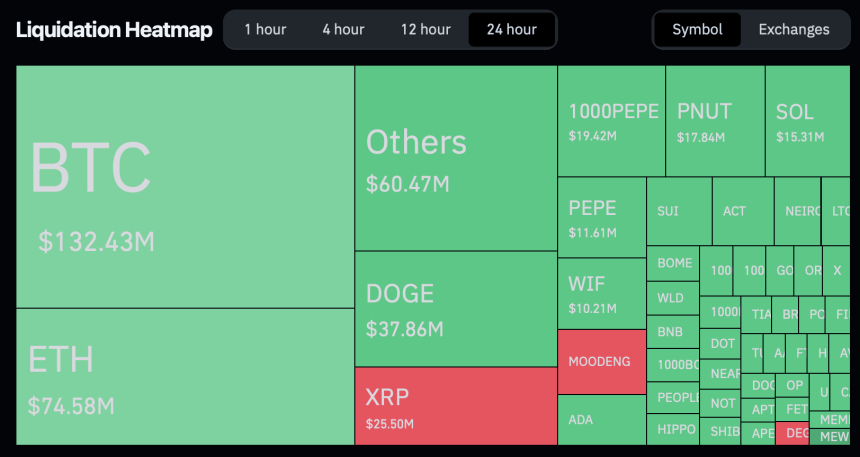

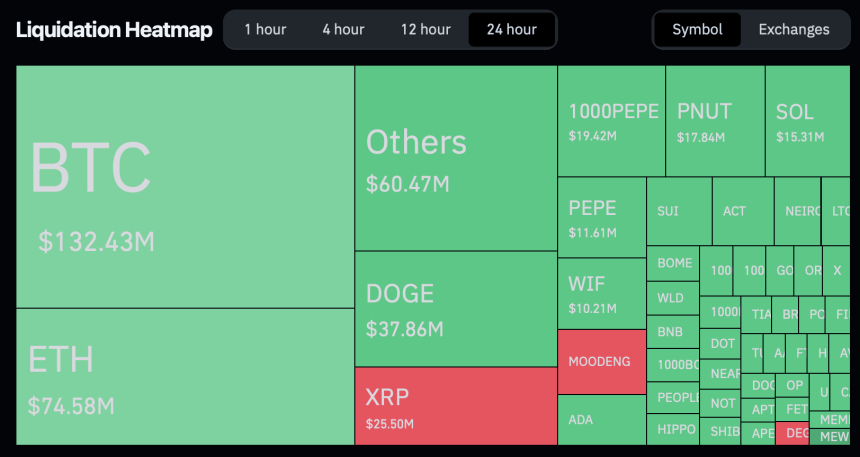

Besides the implications on its market cap and trading volume, BTC’s decline has significantly impacted a handful of traders. According to data from Coinglass, in the past 24 hours alone, roughly 170,215 traders have been liquidated, bringing the total liquidations in the crypto market to $510.13 million.

Out of these total liquidations, Bitcoin accounts for $132.43 million, with the majority of the liquidations coming from long positions—those who bet that the upward momentum would continue.

Featured image created with DALL-E, Chart from TradingView

This development, highlighted by a CryptoQuant analyst known as G a a h, points out a notable change in BTC’s investor behavior within the crypto space and also suggests quite an interesting trend for Bitcoin.

Bitcoin Reserves On Exchanges Reach Five-Year Low

According to the analyst, Bitcoin reserves on exchanges have diminished significantly throughout 2024, reflecting a shift towards long-term holding strategies among market participants.

This trend suggests that investors increasingly transfer their assets to private wallets, reducing the supply available for immediate sale and contributing to buying pressure in a market already constrained by supply.

According to G a a h, this behavior indicates a broader sentiment shift, with market participants displaying increased confidence in Bitcoin as a store of value amidst “economic uncertainty and rising inflation.”

By moving Bitcoin away from exchanges, investors reduce the likelihood of sudden sell-offs, which can lead to increased price stability. However, the reduced supply on exchanges may also lead to heightened volatility, especially if demand continues to grow or remains consistent.

The CryptoQuant analyst noted:

With that said, this scenario signals a potentially more volatile but more resilient Bitcoin market, with less selling pressure and a growing dominance of long-term holders, which could open up space for new price peaks.

BTC’s Upward Momentum Cools Off

Following an all-time high (ATH) of $93,477 on Wednesday, November 13, BTC has faced quite a noticeable correction, now down by 4% from this peak. So far, the asset has been unable to continue its upward momentum and appears to be seeing more sell-offs.

When writing, Bitcoin trades below $90,000 with a current trading price of $89,779, down by 1.4% in the past day. This price decline resulted in roughly $49 billion subtracted from its market capitalization valuation on Wednesday.

For context, as of today, BTC’s market cap sits at $1.775 trillion, a nearly 5% decrease from the $1.835 trillion valuation two days ago. Bitcoin’s daily trading volume dropped from over $100 billion earlier this week to below $85 billion.

Besides the implications on its market cap and trading volume, BTC’s decline has significantly impacted a handful of traders. According to data from Coinglass, in the past 24 hours alone, roughly 170,215 traders have been liquidated, bringing the total liquidations in the crypto market to $510.13 million.

Out of these total liquidations, Bitcoin accounts for $132.43 million, with the majority of the liquidations coming from long positions—those who bet that the upward momentum would continue.

Featured image created with DALL-E, Chart from TradingView