In a highly anticipated move, the United States Securities and Exchange Commission (SEC) approved all 11 Bitcoin ETF applications, and the market response has been nothing short of remarkable. The approval has led to significant trading volume and propelled Bitcoin to a new 22-month high.

Within minutes of the Bitcoin ETFs going live, Bitcoin surged over 8% to reach $48,400, representing a new record since the end of the crypto bear market. The early price movement aligns with the predictions made by the majority of experts in the crypto industry.

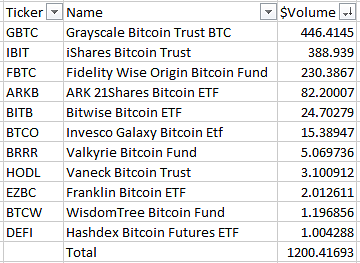

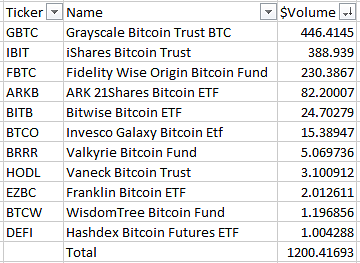

Bloomberg ETF expert James Seyffart reported an astonishing $1.2 billion in trading volume for spot Bitcoin ETFs within 30 minutes of trading. Seyffart captured the excitement with his “Cointucky Derby” analogy, highlighting the performance of different ETFs.

Grayscale’s GBTC Bitcoin Trust took the lead in the “Cointucky Derby,” recording an impressive trading volume of $446 million in the initial minutes. It was closely followed by BlackRock’s Bitcoin Trust, which achieved a trading volume of $388 million within the first half-hour.

Fidelity secured the third spot with a trading volume of $230 million, outperforming Hashdex and Wisdom Tree, which recorded $1 million and $1.1 million in trading volume, respectively.

While the exact breakdown of the trading volume remains uncertain, Seyffart noted that the evening’s data might provide more insights.

However, the Bloomberg ETF expert speculated that a significant portion of the trading volume could be attributed to new flows into the ETFs. Additionally, he suggested that a notable portion of GBTC’s trading volume might be due to outflows.

With the Bitcoin ETF race in full throttle, Bitcoin appears to be on a promising trajectory toward the $50,000 milestone, which could serve as a significant catalyst for Bitcoin bulls and the broader crypto industry.

Currently, having surpassed the $48,000 mark, Bitcoin’s price has reached a level where minimal resistance levels are hindering its ascent to $50,000.

The next notable hurdle lies well above $50,700, followed by potential attempts to reach $53,000. Given the expected spot buys in the Bitcoin market following the approval of Bitcoin ETFs, combined with a considerable separation between major resistance lines, these price levels may be easily breached.

Once beyond the $50,000 threshold, Bitcoin could potentially progress to $51,000, then $53,000, and subsequently $56,000, before ultimately setting its sights on the highly anticipated $60,000 milestone.

This series of price targets may be readily attainable for the largest cryptocurrency in the market, as it navigates through the anticipated market dynamics.

Ultimately, the SEC’s approval of the Bitcoin ETFs has brought renewed optimism to the market, with investors and industry experts closely monitoring the impact of these ETFs on the broader cryptocurrency landscape.

The surge in trading volume and Bitcoin’s impressive price movement signify growing interest from investors seeking regulated and traditional investment avenues in the cryptocurrency market.

Featured image from Shutterstock, chart from TradingView.com

Within minutes of the Bitcoin ETFs going live, Bitcoin surged over 8% to reach $48,400, representing a new record since the end of the crypto bear market. The early price movement aligns with the predictions made by the majority of experts in the crypto industry.

Bitcoin ETF Trading Makes Spectacular Debut

Bloomberg ETF expert James Seyffart reported an astonishing $1.2 billion in trading volume for spot Bitcoin ETFs within 30 minutes of trading. Seyffart captured the excitement with his “Cointucky Derby” analogy, highlighting the performance of different ETFs.

Grayscale’s GBTC Bitcoin Trust took the lead in the “Cointucky Derby,” recording an impressive trading volume of $446 million in the initial minutes. It was closely followed by BlackRock’s Bitcoin Trust, which achieved a trading volume of $388 million within the first half-hour.

Fidelity secured the third spot with a trading volume of $230 million, outperforming Hashdex and Wisdom Tree, which recorded $1 million and $1.1 million in trading volume, respectively.

While the exact breakdown of the trading volume remains uncertain, Seyffart noted that the evening’s data might provide more insights.

However, the Bloomberg ETF expert speculated that a significant portion of the trading volume could be attributed to new flows into the ETFs. Additionally, he suggested that a notable portion of GBTC’s trading volume might be due to outflows.

Is Bitcoin On A Clear Path To $50,000?

With the Bitcoin ETF race in full throttle, Bitcoin appears to be on a promising trajectory toward the $50,000 milestone, which could serve as a significant catalyst for Bitcoin bulls and the broader crypto industry.

Currently, having surpassed the $48,000 mark, Bitcoin’s price has reached a level where minimal resistance levels are hindering its ascent to $50,000.

The next notable hurdle lies well above $50,700, followed by potential attempts to reach $53,000. Given the expected spot buys in the Bitcoin market following the approval of Bitcoin ETFs, combined with a considerable separation between major resistance lines, these price levels may be easily breached.

Once beyond the $50,000 threshold, Bitcoin could potentially progress to $51,000, then $53,000, and subsequently $56,000, before ultimately setting its sights on the highly anticipated $60,000 milestone.

This series of price targets may be readily attainable for the largest cryptocurrency in the market, as it navigates through the anticipated market dynamics.

Ultimately, the SEC’s approval of the Bitcoin ETFs has brought renewed optimism to the market, with investors and industry experts closely monitoring the impact of these ETFs on the broader cryptocurrency landscape.

The surge in trading volume and Bitcoin’s impressive price movement signify growing interest from investors seeking regulated and traditional investment avenues in the cryptocurrency market.

Featured image from Shutterstock, chart from TradingView.com