Bitcoin has plunged below the $29,000 level during the past day. According to on-chain data, here’s the next level that could act as major support.

As pointed out by an analyst in a CryptoQuant post, the realized price of the short-term holders at $28,000 could be an essential level for the asset. The “realized price” here refers to the cost basis (that is, the buying price) of the average investor in the Bitcoin market.

Whenever the price of the asset dips below this level, it means that more than 50% of the investors are now underwater. Similarly, a break above the point implies that the overall market has entered into a state of profits.

In the context of the current discussion, the realized price of the entire market isn’t of relevance, but rather of a specific segment of it: the “short-term holders” (STHs).

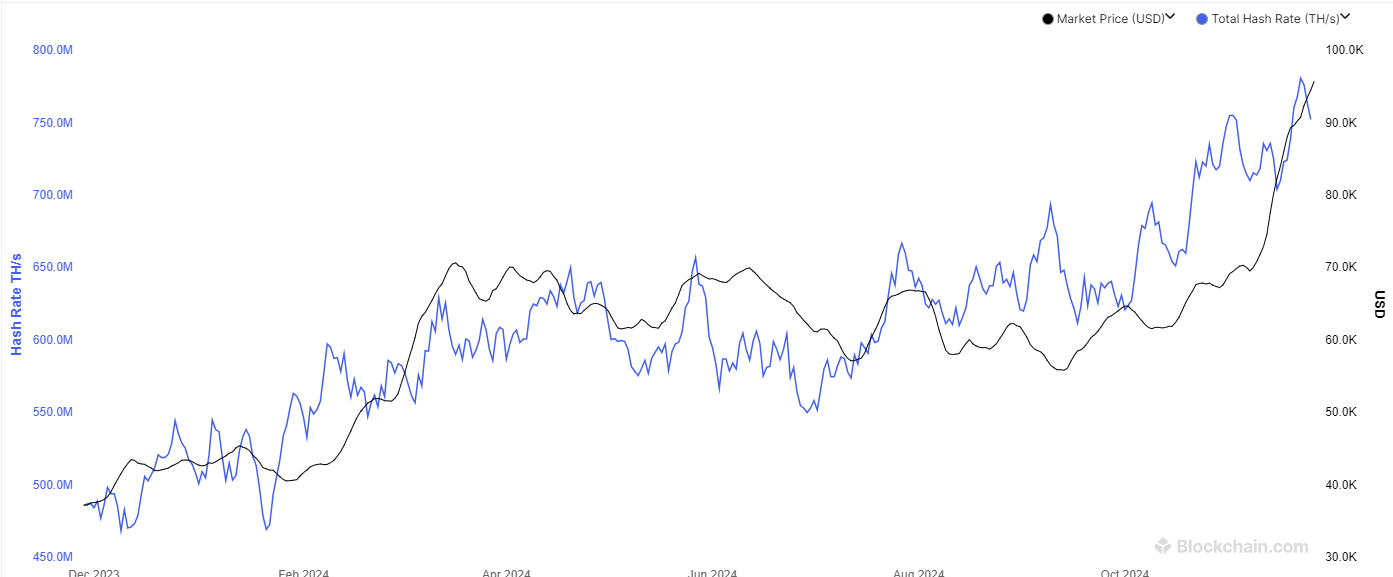

This investor group typically only includes holders who bought their BTC within the last six months. Here is a chart that shows the trend in the average cost basis for this Bitcoin cohort over the history of the cryptocurrency:

Historically, the Bitcoin STH realized price has had some interesting interactions with the spot price of the asset. First is the interactions during bullish periods, which the quant has highlighted in the above graph.

It would appear that during these rallies, the price has usually remained above the level. But not just that, the STH realized price has actually actively provided support to it in such periods.

In the rally during the past year, too, a similar trend has been seen, as both during the March and June price drawdowns, the cryptocurrency rebounded when it made a retest of this line.

Psychologically, investors view their cost basis as a profitable buying opportunity during bullish periods, as they believe that the price will only go up from here. So, whenever the asset returns to its cost basis in such periods, they are likely to accumulate again.

This extraordinary buying pressure at the level of the STHs could perhaps explain why Bitcoin finds support here. In a similar way, the level acts as resistance during bearish periods, as investors start looking at their acquisition price as the ideal exit opportunity.

From the chart, it’s visible that the Bitcoin spot price is approaching the STH realized price once again right now. This level, which is valued at $28,000 currently, could possibly be where Bitcoin can turn around its recent trend of decline.

The analyst warns, however, “if the realized price of short-term holders fails to hold, the bull market may be over.”

At the time of writing, Bitcoin is trading around $28,900, down 1% in the last week.

Bitcoin Short-Term Holder Realized Price May Be The Next Support Level

As pointed out by an analyst in a CryptoQuant post, the realized price of the short-term holders at $28,000 could be an essential level for the asset. The “realized price” here refers to the cost basis (that is, the buying price) of the average investor in the Bitcoin market.

Whenever the price of the asset dips below this level, it means that more than 50% of the investors are now underwater. Similarly, a break above the point implies that the overall market has entered into a state of profits.

In the context of the current discussion, the realized price of the entire market isn’t of relevance, but rather of a specific segment of it: the “short-term holders” (STHs).

This investor group typically only includes holders who bought their BTC within the last six months. Here is a chart that shows the trend in the average cost basis for this Bitcoin cohort over the history of the cryptocurrency:

Historically, the Bitcoin STH realized price has had some interesting interactions with the spot price of the asset. First is the interactions during bullish periods, which the quant has highlighted in the above graph.

It would appear that during these rallies, the price has usually remained above the level. But not just that, the STH realized price has actually actively provided support to it in such periods.

In the rally during the past year, too, a similar trend has been seen, as both during the March and June price drawdowns, the cryptocurrency rebounded when it made a retest of this line.

Psychologically, investors view their cost basis as a profitable buying opportunity during bullish periods, as they believe that the price will only go up from here. So, whenever the asset returns to its cost basis in such periods, they are likely to accumulate again.

This extraordinary buying pressure at the level of the STHs could perhaps explain why Bitcoin finds support here. In a similar way, the level acts as resistance during bearish periods, as investors start looking at their acquisition price as the ideal exit opportunity.

From the chart, it’s visible that the Bitcoin spot price is approaching the STH realized price once again right now. This level, which is valued at $28,000 currently, could possibly be where Bitcoin can turn around its recent trend of decline.

The analyst warns, however, “if the realized price of short-term holders fails to hold, the bull market may be over.”

BTC Price

At the time of writing, Bitcoin is trading around $28,900, down 1% in the last week.