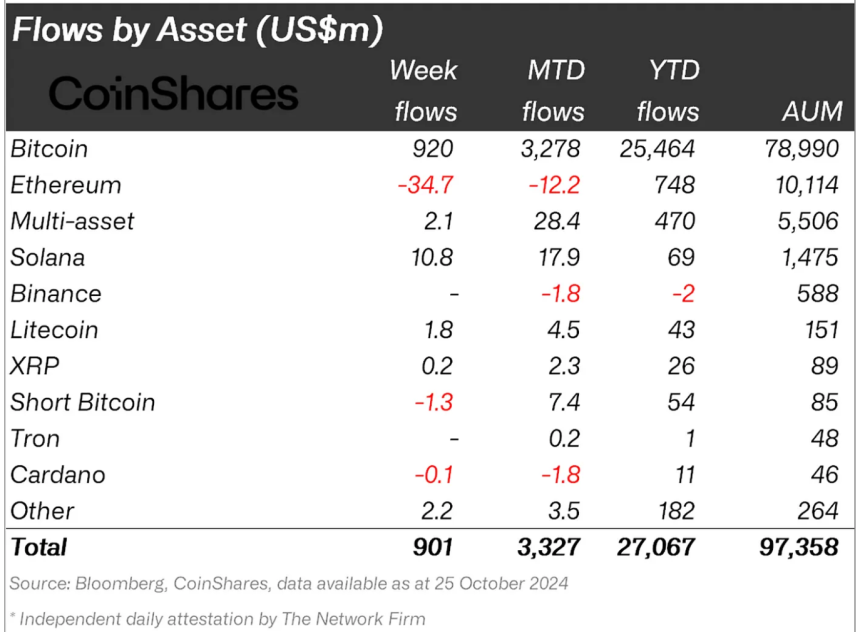

Investment activity in digital assets surged almost throughout October, as crypto investment products, especially that of Bitcoin, experienced substantial inflows, according to the latest data released by CoinShares.

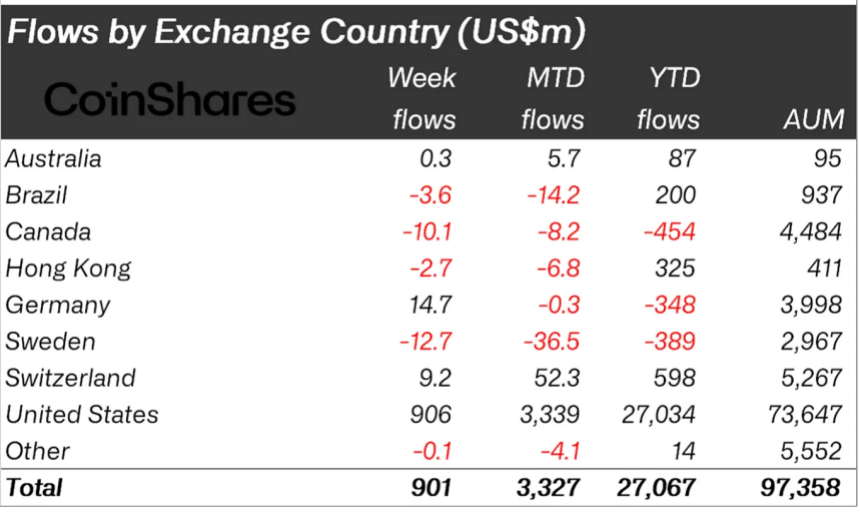

Last week alone, global crypto funds attracted $901 million in net inflows, pushing the total for the month to $3.4 billion.

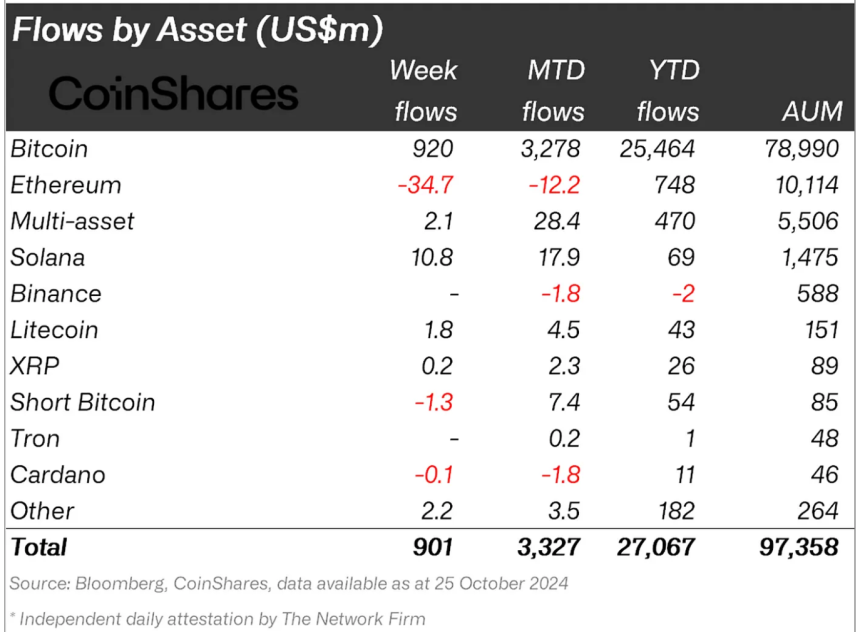

According to CoinShares, out of the total fund flows recorded, Bitcoin-centric investment products captured the lion’s share of inflows, with $920 million in net additions over the past week.

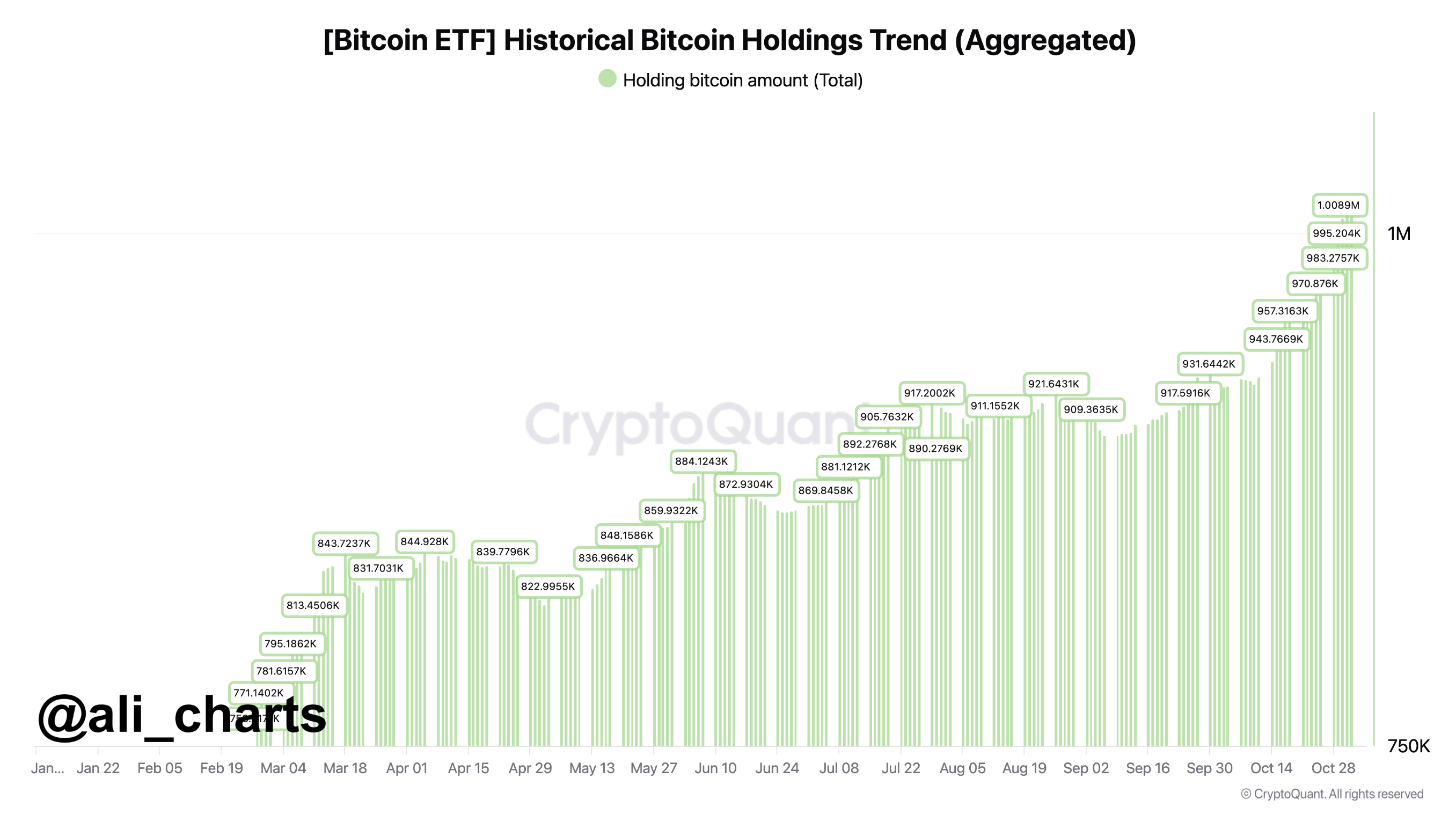

US spot Bitcoin exchange-traded funds (ETFs) recorded $997.6 million in net inflows, led largely by BlackRock’s iShares Bitcoin Trust (IBIT).

Bitcoin’s dominance was notable, with blockchain equities and Solana-based products also seeing inflows of $12.2 million and $10.8 million, respectively.

However, other Bitcoin-based products, including those outside US markets, faced some net outflows. While Bitcoin maintained strong inflows, Ethereum-based funds recorded net outflows of $34.7 million last week, signaling a decrease in investor interest.

CoinShares reported that Ethereum’s price ratio to Bitcoin had fallen to its lowest point since April 2021, which could be contributing to this outflow trend.

The data suggests that while Ethereum has seen gains in the past, investors are now focusing more on Bitcoin, possibly anticipating future regulatory clarity and further mainstream adoption with developments like spot ETFs.

Geographically, US-based crypto funds attracted a substantial $906 million in net inflows last week. In contrast, other regions saw mixed results, with funds based in Sweden, Canada, Brazil, and Hong Kong collectively experiencing $29.1 million in net outflows.

This difference highlights the United States’ growing role in shaping the global crypto investment market, especially as American firms like BlackRock and Fidelity expand their crypto offerings.

According to CoinShares’ Head of Research, James Butterfill reveals that the we political climate likely influences the recent Bitcoin price movements and increase in inflows. He noted that Republican gains in the polls correlate with increased interest in Bitcoin investments.

This suggests that market participants may see a shift in political power as favourable to digital assets, potentially driving anticipation of regulatory reforms or even greater crypto acceptance.

CoinShares report shows that the October influx represents roughly 12% of assets under management (AUM) in digital asset funds and marks the fourth-largest month for inflows on record. This brings the year-to-date total to $27 billion, almost tripling the previous high of $10.5 billion set in 2021.

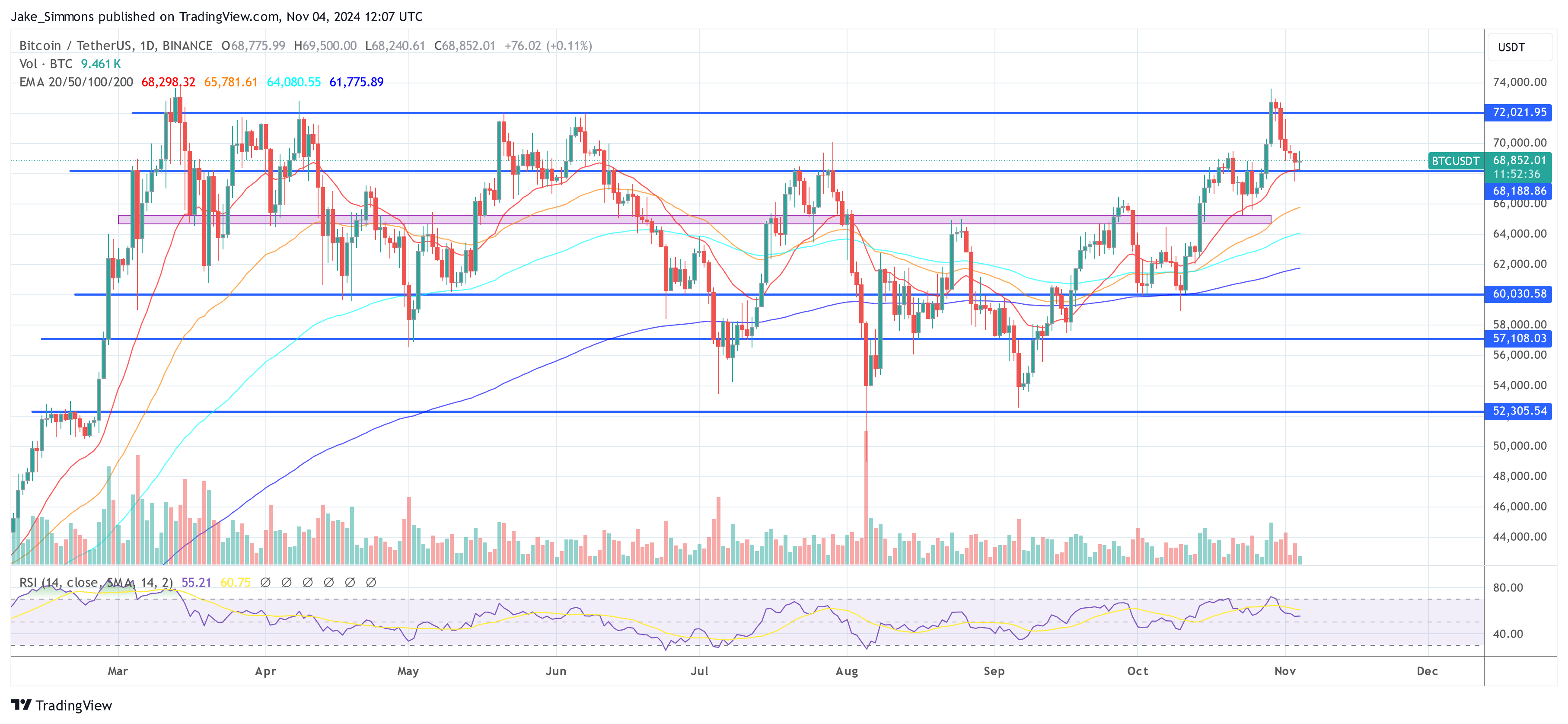

Featured imahge created with DALL-E, Chart from TradingView

Last week alone, global crypto funds attracted $901 million in net inflows, pushing the total for the month to $3.4 billion.

Bitcoin Dominates Inflows As Ethereum Sees Outflows

According to CoinShares, out of the total fund flows recorded, Bitcoin-centric investment products captured the lion’s share of inflows, with $920 million in net additions over the past week.

US spot Bitcoin exchange-traded funds (ETFs) recorded $997.6 million in net inflows, led largely by BlackRock’s iShares Bitcoin Trust (IBIT).

Bitcoin’s dominance was notable, with blockchain equities and Solana-based products also seeing inflows of $12.2 million and $10.8 million, respectively.

However, other Bitcoin-based products, including those outside US markets, faced some net outflows. While Bitcoin maintained strong inflows, Ethereum-based funds recorded net outflows of $34.7 million last week, signaling a decrease in investor interest.

CoinShares reported that Ethereum’s price ratio to Bitcoin had fallen to its lowest point since April 2021, which could be contributing to this outflow trend.

The data suggests that while Ethereum has seen gains in the past, investors are now focusing more on Bitcoin, possibly anticipating future regulatory clarity and further mainstream adoption with developments like spot ETFs.

Regional Trends And Behind The Boom

Geographically, US-based crypto funds attracted a substantial $906 million in net inflows last week. In contrast, other regions saw mixed results, with funds based in Sweden, Canada, Brazil, and Hong Kong collectively experiencing $29.1 million in net outflows.

This difference highlights the United States’ growing role in shaping the global crypto investment market, especially as American firms like BlackRock and Fidelity expand their crypto offerings.

According to CoinShares’ Head of Research, James Butterfill reveals that the we political climate likely influences the recent Bitcoin price movements and increase in inflows. He noted that Republican gains in the polls correlate with increased interest in Bitcoin investments.

This suggests that market participants may see a shift in political power as favourable to digital assets, potentially driving anticipation of regulatory reforms or even greater crypto acceptance.

CoinShares report shows that the October influx represents roughly 12% of assets under management (AUM) in digital asset funds and marks the fourth-largest month for inflows on record. This brings the year-to-date total to $27 billion, almost tripling the previous high of $10.5 billion set in 2021.

Featured imahge created with DALL-E, Chart from TradingView