- Bitcoin ETF options approval boosts institutional inflows and market liquidity.

- Bitcoin dominance surges, setting stage for Layer 1 coin recovery.

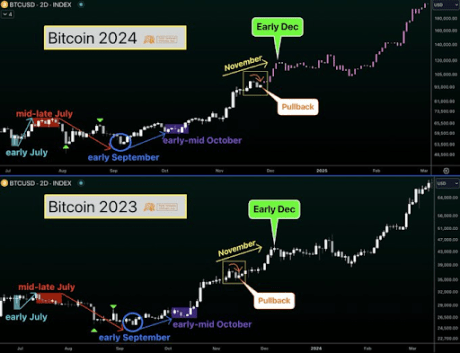

This week marked a significant development in the cryptocurrency market, as Bitcoin (BTC) rallied by 10.48%, reaching a weekly high of $69,000. With BTC now within striking distance of the crucial $70,000 psychological level, market participants are optimistic about its near-term trajectory, particularly as no major macroeconomic data is expected to act as headwinds next week.

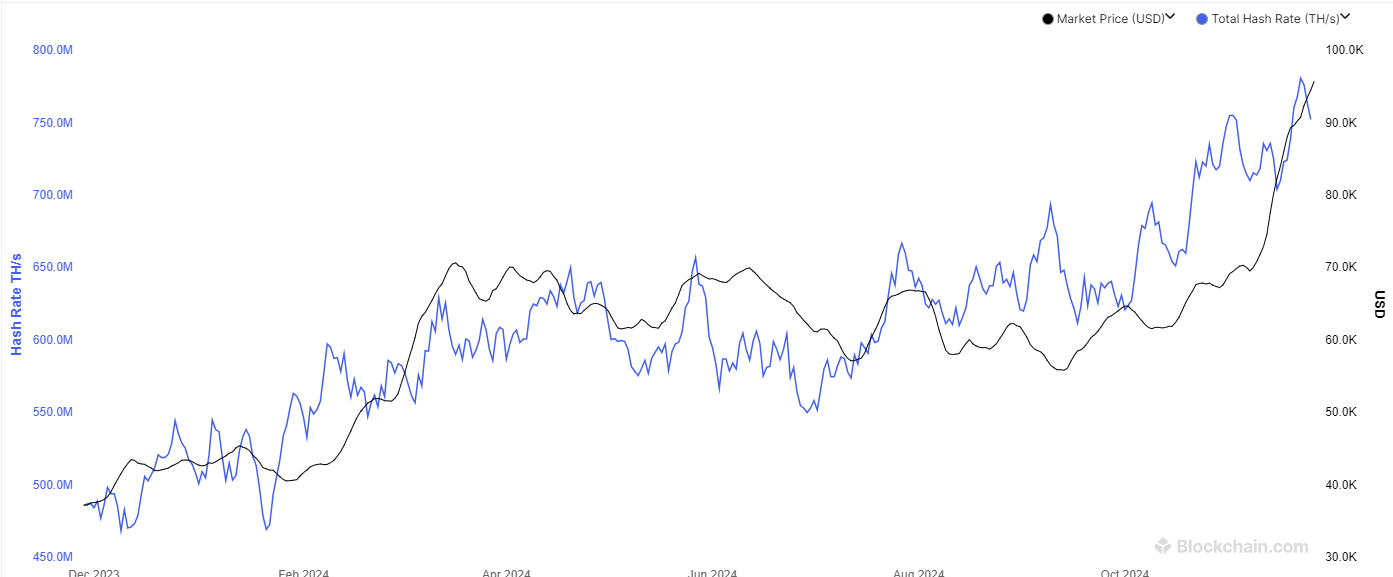

A major catalyst for Bitcoin’s upward momentum was the U.S. Securities and Exchange Commission’s (SEC) approval of Bitcoin ETF options to be listed on the New York Stock Exchange (NYSE). This decision is expected to boost liquidity for the ETF, attracting more sustainable inflows. Throughout the week, BTC ETFs saw impressive inflows, closing Friday with $203.3 million in assets and marking a six-day winning streak. Institutional demand remains robust, as evidenced by these consistent inflows, reports QCP broadcast

Moreover, Bitcoin dominance has surged to a multi-year high of 58%, a level last seen in April 2021. With key resistance at 60% approaching, analysts anticipate a recovery in layer 1 (L1) coins, which have lagged behind Bitcoin’s performance. Analysts view Ethereum (ETH) as overdue for a strong recovery. It is currently 45% below its all-time high, while BTC sits just 7.9% shy of its peak.

Optimistic Days Ahead?

Global macro conditions are also shaping the risk-on environment. Japan’s inflation fell to 2.5%, down from 3.0%. It reducing the likelihood of an interest rate hike by the Bank of Japan (BOJ). The Japanese yen’s weakening trend, combined with U.S. equities nearing all-time highs, continues to fuel risk appetite. It supports the broader crypto market’s bullish outlook.

As part of a trade idea, the firm suggested selling BTC at $72,000 for an additional 2.8% profit if BTC surpasses $70,000 by 25 October. With BTC’s rise and institutional demand growing, the market remains optimistic about further gains as we head into Uptober.

Highlighted News Of The Day

Will Bitcoin Break Past $75K by Month End?