- Bitcoin registered a $68,789 range on November 10, 2021.

- BTC’s price could soar to a staggering $138,000, mirroring the remarkable 346% return.

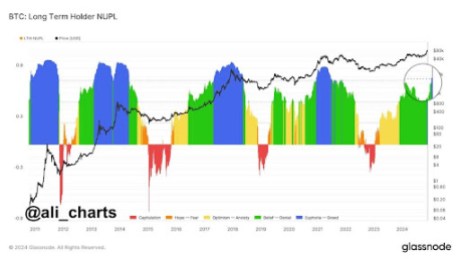

Bitcoin (BTC), the largest cryptocurrency’s consolidation at the $30,000 mark, has brought a strong pattern. According to the data from Glassnode, approximately 75% of the total Bitcoin supply is held in profit, while the remaining 25% is held in loss. Remarkably, this balance mirrors the equilibrium point observed during previous milestones in 2016 and 2019.

The intriguing balance arises from the fact that this 75:25 balance of supply held in profit vs loss appears to be the equilibrium point for Bitcoin. Throughout its trading history, 50% of all trading days have seen a higher Profit-to-Loss balance, while the remaining 50% have witnessed a lower one.

Bitcoin (BTC) Track (Source: Glassnode)

Also, it is important to note that the current market consolidation has caused the Bitcoin price to stick at $30,000. However, it does serve as a point of reference for market observers, hinting at potential patterns that have historically played out during Bitcoin’s price cycles. At the continuation of the 2019 cycle, Bitcoin registered a $68,789 range on November 10, 2021.

Will Bitcoin (BTC) Price Surge Further?

In a major development for the cryptocurrency market, there is growing speculation that a Bitcoin Exchange-Traded Fund (ETF) may receive approval at a relatively low entry point of $30,000. If this were to happen, market analysts are predicting that Bitcoin’s price could soar to a staggering $138,000, mirroring the remarkable 346% return that gold experienced after the approval of its first ETF back in 2004.

Chart of Gold after ETF approval

So if #Bitcoin ETF gets approved at

$30,000, copying gold’s 346% return

after its first ETF approval in 2004

BTC price at a return of 346% would

be at $138,000 pic.twitter.com/ubBAIXsg2v

— Ash Crypto (@Ashcryptoreal) July 12, 2023

The potential approval of a Bitcoin ETF has been a highly anticipated event in the cryptocurrency community, as it could open the doors for institutional investors and traditional financial institutions to enter the Bitcoin market more easily.

At the time of writing, Bitcoin (BTC) traded at $30,700 with a 24 hour trading volume of over $11.59 billion. Further, Bitcoin continues its impressive bullish run, gaining over 1.5% in a single day and showing an impressive 87% surge since the beginning of the year. With a current market share of 50%, BTC’s market cap now stands at over $595 billion, contributing to the overall global cryptocurrency market cap of $1.19 trillion.

Bitcoin (BTC) Price Chart (Source: Tradingview)

Technical indicators also support the bullish sentiment surrounding Bitcoin. The 50-day moving average (MA) for BTC is signaling an uptrend, reinforcing the positive outlook for the leading cryptocurrency.