On-chain data shows Bitcoin is currently not satisfying a condition that has historically occurred alongside major bottoms in the price.

In a new post on X, James V. Straten, a research and data analyst, has pointed out how BTC isn’t fulfilling the bottom condition for the supply in profit and loss metrics.

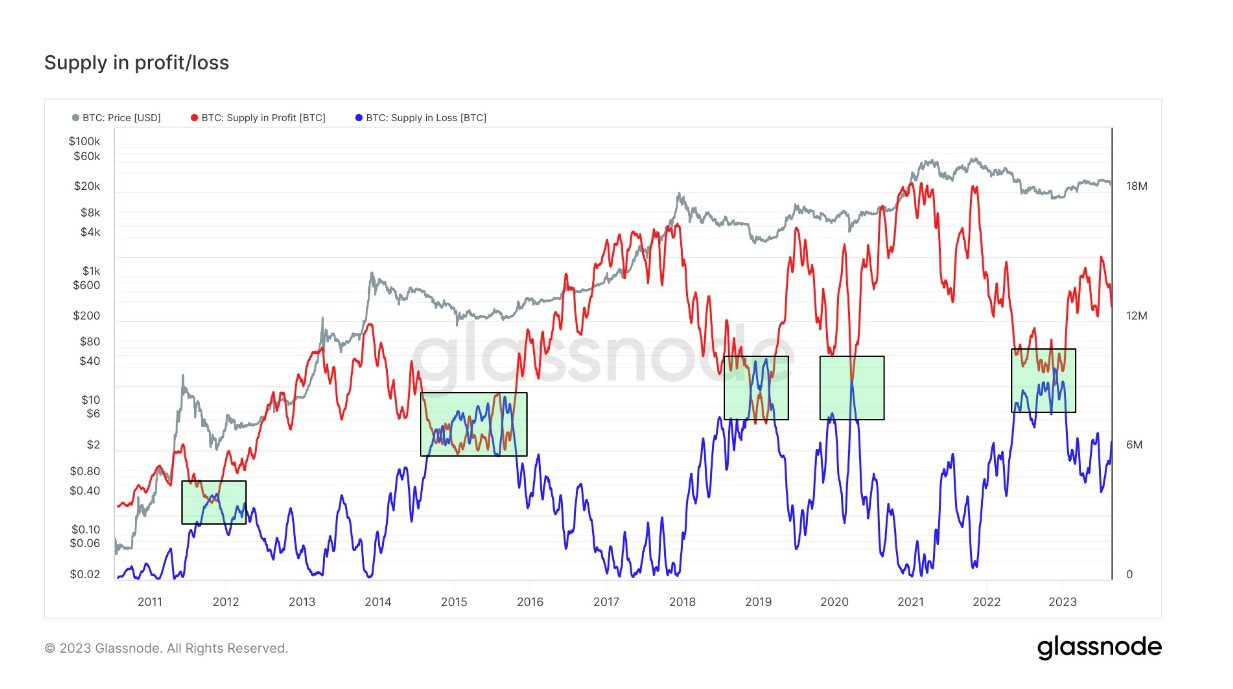

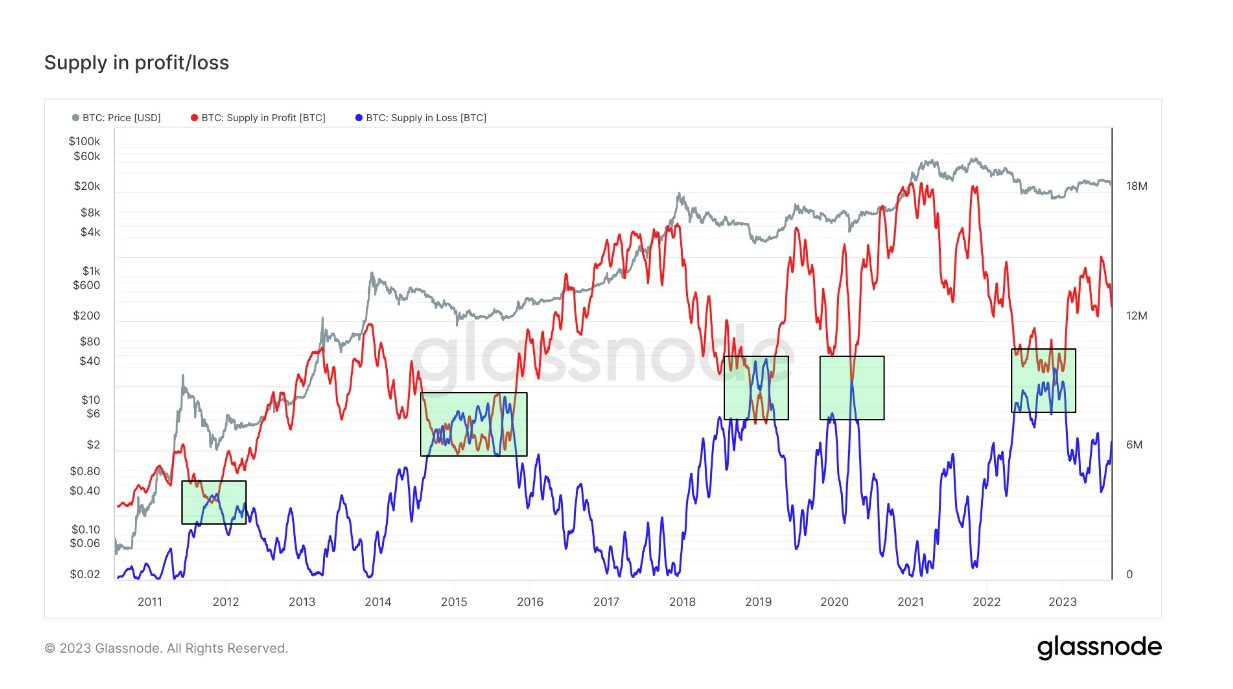

The “supply in profit” here naturally refers to the total amount of Bitcoin supply currently carrying an unrealized profit. Similarly, the “supply in loss” keeps track of the number of underwater coins.

These indicators work by going through the on-chain history of each coin in circulation to see what price it was last transferred at. If this previous price for any coin was less than the current BTC spot price, then that particular coin is being held at a profit, and the supply in profit adds to its value. On the other hand, the coins with a higher cost basis are counted by the supply in loss.

Now, here is a chart that shows the trend in both these Bitcoin metrics over the entire history of the cryptocurrency:

In the graph, the analyst has highlighted a specific pattern that these two indicators have shown during historical bottoms in the cryptocurrency’s price. It would appear that the supply in profit dips below the supply in loss during these periods of lows, implying that most of the market enters into a state of loss.

Generally, investors in profit are more likely to sell, so whenever the supply in profit is at very high values, tops become more probable for Bitcoin. Similarly, a large number of investors instead of being in loss should mean there wouldn’t be too many sellers left.

This is potentially why bottoms have historically formed when the supply in loss exceeds the supply in profit. The chart shows that the Bitcoin Supply in Profit is currently quite a distance over the supply in loss, suggesting that a decent number of coins still carry gains.

To be more precise, there is a difference of six million coins between the two supplies at the moment. The current market is nowhere near fulfilling the historical bottom criteria.

However, the bottoms that the pattern has generally coincided with have been the cyclical lows, observed during the worst phase of the bear markets. In the current cycle, this bottom was marked after the FTX crash in November 2022.

The only exception to this rule was in March 2020, when Bitcoin crashed due to the onset of the COVID-19 virus. This crash was an unexpected event, which may explain why it doesn’t fit in with the other bottoms.

As the market at its current stage is likely already past the bear-market bottom, this supply in profit and loss pattern shouldn’t hold too much bearing on whether BTC has hit a local bottom after the recent crash.

If the November 2022 low wasn’t the true bear-market bottom, BTC might have more pain in store, as a significant swing in market profitability will be required before the real bottom is found.

When writing, Bitcoin is trading around $26,300, down 7% in the last seven days.

Bitcoin Supply In Profit Is Still Greater Than Supply In Loss

In a new post on X, James V. Straten, a research and data analyst, has pointed out how BTC isn’t fulfilling the bottom condition for the supply in profit and loss metrics.

The “supply in profit” here naturally refers to the total amount of Bitcoin supply currently carrying an unrealized profit. Similarly, the “supply in loss” keeps track of the number of underwater coins.

These indicators work by going through the on-chain history of each coin in circulation to see what price it was last transferred at. If this previous price for any coin was less than the current BTC spot price, then that particular coin is being held at a profit, and the supply in profit adds to its value. On the other hand, the coins with a higher cost basis are counted by the supply in loss.

Now, here is a chart that shows the trend in both these Bitcoin metrics over the entire history of the cryptocurrency:

In the graph, the analyst has highlighted a specific pattern that these two indicators have shown during historical bottoms in the cryptocurrency’s price. It would appear that the supply in profit dips below the supply in loss during these periods of lows, implying that most of the market enters into a state of loss.

Generally, investors in profit are more likely to sell, so whenever the supply in profit is at very high values, tops become more probable for Bitcoin. Similarly, a large number of investors instead of being in loss should mean there wouldn’t be too many sellers left.

This is potentially why bottoms have historically formed when the supply in loss exceeds the supply in profit. The chart shows that the Bitcoin Supply in Profit is currently quite a distance over the supply in loss, suggesting that a decent number of coins still carry gains.

To be more precise, there is a difference of six million coins between the two supplies at the moment. The current market is nowhere near fulfilling the historical bottom criteria.

However, the bottoms that the pattern has generally coincided with have been the cyclical lows, observed during the worst phase of the bear markets. In the current cycle, this bottom was marked after the FTX crash in November 2022.

The only exception to this rule was in March 2020, when Bitcoin crashed due to the onset of the COVID-19 virus. This crash was an unexpected event, which may explain why it doesn’t fit in with the other bottoms.

As the market at its current stage is likely already past the bear-market bottom, this supply in profit and loss pattern shouldn’t hold too much bearing on whether BTC has hit a local bottom after the recent crash.

If the November 2022 low wasn’t the true bear-market bottom, BTC might have more pain in store, as a significant swing in market profitability will be required before the real bottom is found.

BTC Price

When writing, Bitcoin is trading around $26,300, down 7% in the last seven days.