Bitcoin has been on an impressive surge since early September, rising by 31% from local lows around $53,000. However, after testing the $69,500 supply level, the cryptocurrency faces selling pressure. Despite this, Bitcoin remains strong, holding above the previous high of around $66,000, a crucial level determining its next move.

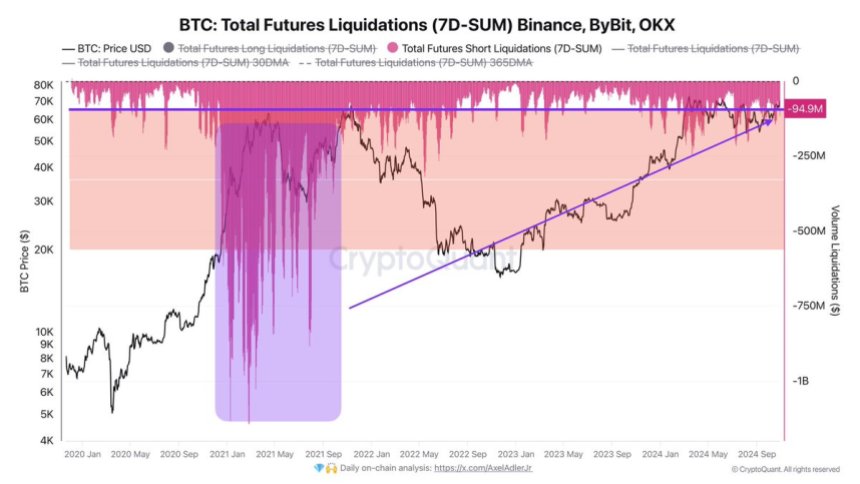

Key data from CryptoQuant reveals that, despite recent bearish attempts, bears are losing control in the futures market. A key indicator has flipped bullish for the first time since July, suggesting that the current selling pressure may not be enough to push Bitcoin lower.

With Bitcoin in a critical phase, holding above the $66,000 level would signal continued strength and maintain the uptrend for the coming weeks. Investors are watching closely, as Bitcoin’s ability to stay above this support could pave the way for new highs and further momentum in the bullish cycle.

Crypto analyst Maartunn shared recent data from CryptoQuant, revealing that Bitcoin taker buyers in the futures market have struggled to gain an advantage over taker sellers throughout the past year. Maartunn highlighted a chart showing that the BTC net taker volume has turned positive for the first time since July, signaling a potential shift in momentum.

The present trend change suggests that bears are beginning to lose control over Bitcoin’s price action, with buyers starting to gain strength.

This data points to an accumulation phase, where Bitcoin’s price has been suppressed by large investors, keeping it from making significant gains or marking new monthly lows. The fact that BTC hasn’t posted new lows despite previous bearish pressure reinforces the view that an accumulation period may end, and a new bullish phase could be on the horizon.

The coming weeks are critical for Bitcoin, particularly with the approaching U.S. presidential election on November 5. Historically, elections introduce volatility and uncertainty into financial markets; this year is no exception.

Broader market trends likely influence Bitcoin’s price action, and traders are watching closely to see how BTC responds to these developments. If Bitcoin maintains its upward momentum, a rally to new highs could follow in the weeks after the election.

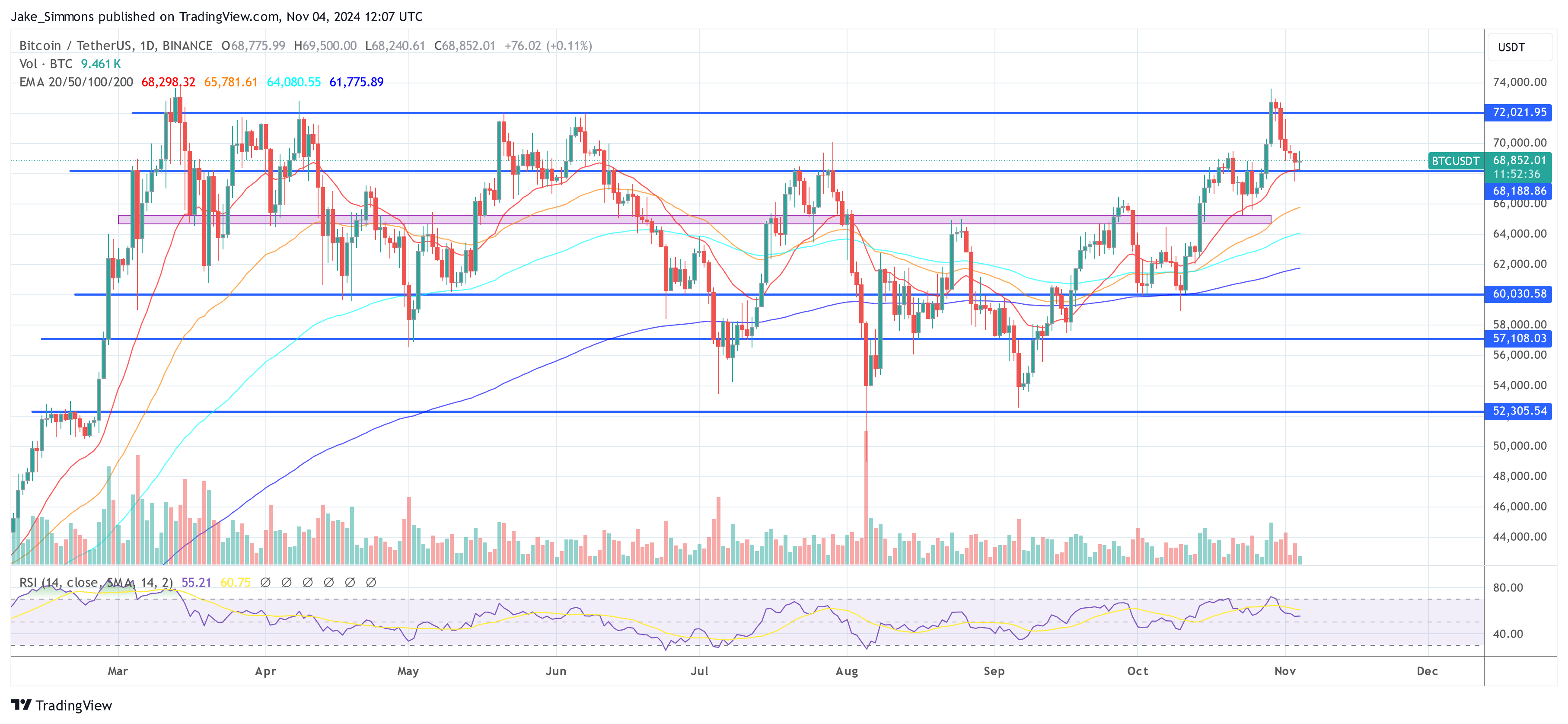

Bitcoin is currently trading at $66,400 after a healthy retrace from its recent high of $69,500. The price now finds support at $66,000, which acted as a key resistance in late September and has since flipped into a crucial demand zone for BTC. This support is essential for the bulls to maintain control, as holding above $66,000 signals strength and keeps the momentum alive for another attempt at breaking the $70,000 mark.

If Bitcoin can hold steady above this support level, the next logical target would be to challenge the $70,000 resistance, which has proven difficult to breach. A successful push past this level would likely trigger further upside, potentially driving BTC into new price discovery.

However, if the price exceeds $66,000, a retrace to lower demand levels could occur. In this case, the daily 200 moving average at $63,300 is the next key area where Bitcoin could find support before resuming its upward trend. The coming days will be crucial in determining whether BTC can maintain its bullish trajectory or if a deeper pullback is on the horizon.

Featured image from Dall-E, chart from TradingView

Key data from CryptoQuant reveals that, despite recent bearish attempts, bears are losing control in the futures market. A key indicator has flipped bullish for the first time since July, suggesting that the current selling pressure may not be enough to push Bitcoin lower.

With Bitcoin in a critical phase, holding above the $66,000 level would signal continued strength and maintain the uptrend for the coming weeks. Investors are watching closely, as Bitcoin’s ability to stay above this support could pave the way for new highs and further momentum in the bullish cycle.

Bitcoin Taker Buyers Starting To Breathe

Crypto analyst Maartunn shared recent data from CryptoQuant, revealing that Bitcoin taker buyers in the futures market have struggled to gain an advantage over taker sellers throughout the past year. Maartunn highlighted a chart showing that the BTC net taker volume has turned positive for the first time since July, signaling a potential shift in momentum.

The present trend change suggests that bears are beginning to lose control over Bitcoin’s price action, with buyers starting to gain strength.

This data points to an accumulation phase, where Bitcoin’s price has been suppressed by large investors, keeping it from making significant gains or marking new monthly lows. The fact that BTC hasn’t posted new lows despite previous bearish pressure reinforces the view that an accumulation period may end, and a new bullish phase could be on the horizon.

The coming weeks are critical for Bitcoin, particularly with the approaching U.S. presidential election on November 5. Historically, elections introduce volatility and uncertainty into financial markets; this year is no exception.

Broader market trends likely influence Bitcoin’s price action, and traders are watching closely to see how BTC responds to these developments. If Bitcoin maintains its upward momentum, a rally to new highs could follow in the weeks after the election.

BTC Testing Crucial Support

Bitcoin is currently trading at $66,400 after a healthy retrace from its recent high of $69,500. The price now finds support at $66,000, which acted as a key resistance in late September and has since flipped into a crucial demand zone for BTC. This support is essential for the bulls to maintain control, as holding above $66,000 signals strength and keeps the momentum alive for another attempt at breaking the $70,000 mark.

If Bitcoin can hold steady above this support level, the next logical target would be to challenge the $70,000 resistance, which has proven difficult to breach. A successful push past this level would likely trigger further upside, potentially driving BTC into new price discovery.

However, if the price exceeds $66,000, a retrace to lower demand levels could occur. In this case, the daily 200 moving average at $63,300 is the next key area where Bitcoin could find support before resuming its upward trend. The coming days will be crucial in determining whether BTC can maintain its bullish trajectory or if a deeper pullback is on the horizon.

Featured image from Dall-E, chart from TradingView