- Uniswap’s decentralized model outpaces Coinbase in spot trading, reflecting market shift.

- Coinbase’s 83% drop vs. Uniswap’s 50% showcases decentralized strength.

In a striking turn of events, Uniswap, the leading decentralized exchange, has emerged as the forerunner in the realm of spot trading volume, outpacing Coinbase, the prominent U.S. crypto exchange, throughout the course of 2023. A recent report by Bitwise’s crypto asset manager, Ryan Rasmussen, reveals a compelling trend that underlines the growing prominence of decentralized protocols.

During the second quarter of this year, Uniswap achieved an impressive feat by processing approximately $110 billion worth of trades, compared to Coinbase’s $90 billion. This follows the trend set in the first quarter, when Uniswap’s quarterly spot volume triumphed over Coinbase with trading activities amounting to around $155 billion. And $145 billion respectively for the two exchanges.

The divergence becomes even more remarkable when examining the aftermath of the bear market that plagued the crypto industry in 2022. Coinbase experienced an 83% drawdown from its Q4 2021 trading volume of nearly $540 billion. In contrast, Uniswap’s volume decreased by a comparatively modest 50% from $235 billion over the same period.

While centralized crypto firms, including exchanges, and venture capital entities, faced substantial losses during the 2022 bear market. Decentralized protocols like Uniswap demonstrated their capacity to operate independently of human intervention, relying on immutable code.

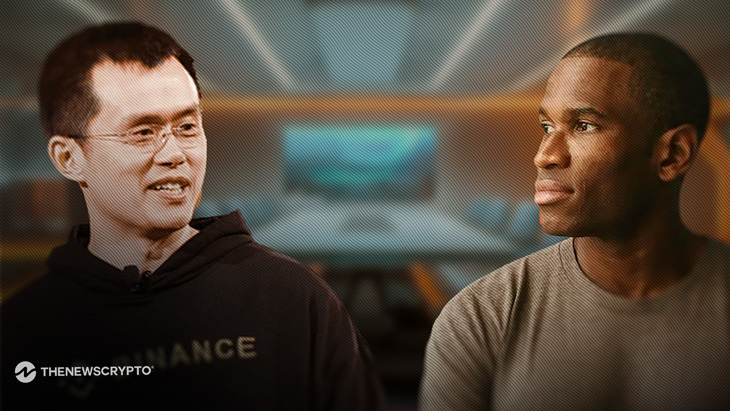

Adding to that, Binance CEO, CZ well-known figure in the crypto space, has lent his support to this narrative. He tweeted, “DeFi is taking over,” further cementing the growing influence of decentralized finance in the industry.

How it Impacted Uniswap (UNI) Price ?

However, amidst this triumph, the native token of Uniswap, UNI, has experienced a 10% decline in value throughout 2023. This decline comes in spite of the exchange’s notable increase in trading volume this year. And currently in 24H, it is down 9%.

Current Price stands at $4.60 with a decline of 3.26% in 24H. Notably, UNI remains significantly below its ATH reached in May 2021, languishing at a level 90% below its peak value.

A look at UNI’s holder composition by time held, as revealed by IntoTheBlock, indicates a distribution where 73% of holders have retained for over a year, 26% for 1 to 12 months, and a mere 2% for less than a month. This pattern suggests a strong foundation of long-term investors who remain committed to the project despite short-term market fluctuations.