XRP, the cryptocurrency associated with the Ripple platform, has experienced a tumultuous ride in recent weeks. The price action of XRP showed that the bears were firmly in control, extinguishing the brief euphoria that followed Ripple’s legal triumph over the United States Securities and Exchange Commission.

At the pinnacle of Ripple’s legal victory, XRP surged above the $0.80 mark, a level unseen since April 2022. However, this jubilation was short-lived. The excitement fizzled out as XRP’s value nosedived, erasing its gains and plunging it back into bearish territory. The abrupt reversal raised questions about the sustainability of the crypto’s upward trajectory.

Investors, once filled with hope, are now left wondering about the future of this once-promising token.

Popular crypto trader Benjamin Cowen pointed out on X that “XRP has retraced the entirety of the move that came after the SEC vs. Ripple case.” This statement underscores the market’s sentiment, suggesting that the legal triumph’s positive impact on XRP’s price was only temporary.

As of now, XRP’s price hovers at $0.480443, according to CoinGecko, with a modest 2.0% gain over the past 24 hours. However, a more concerning statistic is the seven-day dip, which stands at nearly 5%. This decline reflects the current bearish sentiment surrounding the digital asset.

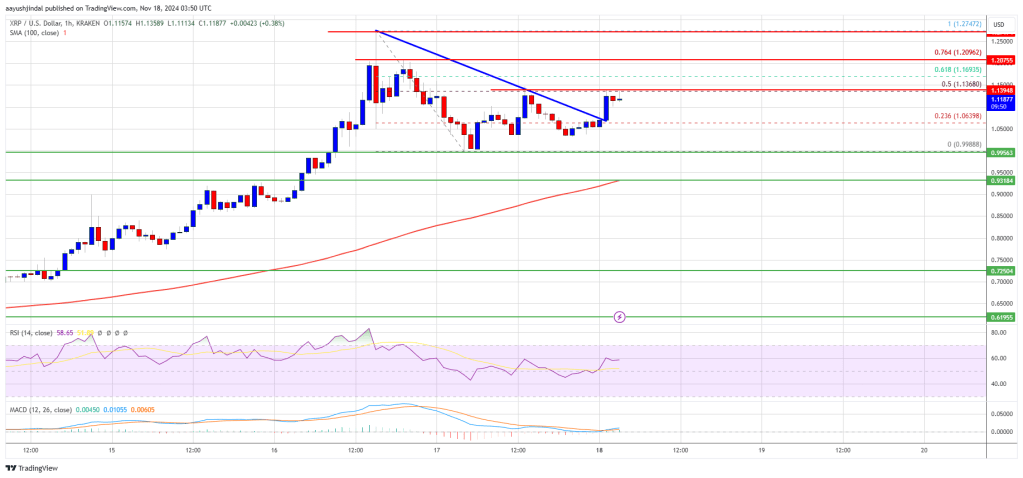

Since early August, the 1-day chart for XRP has displayed a bearish market trend and a downward movement. Since bulls failed to break through last week’s $0.5 resistance, a revisit of that level could be a good opportunity for short sellers.

A closer look at XRP’s on-chain metrics reveals that the selling pressure has been palpable. The On-Balance Volume (OBV), an indicator that tracks buying and selling volumes, has been in a downtrend alongside the price over the past month.

This suggests that sellers have been dominant in the market, while buyers have struggled to exert influence, especially in higher timeframes. This scenario further confirms the bearish grip on XRP.

Another metric worth noting is the mean coin age, which measures the average age of coins being transacted on the network. The metric experienced a sharp decline on August 30 and September 1 but has since started to climb higher.

While this may indicate network-wide accumulation, it does not guarantee an immediate uptrend. Investors must remain cautious and observant in the face of uncertain market conditions.

The recent price action of XRP has cast a shadow on the crypto’s prospects. Despite the initial excitement surrounding Ripple’s legal victory, the bears have reclaimed control, driving XRP’s value downward. With key metrics reflecting selling pressure and uncertainty in the market, XRP’s future remains uncertain, leaving investors to ponder their next moves in this volatile landscape.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from The Change Management Blog

At the pinnacle of Ripple’s legal victory, XRP surged above the $0.80 mark, a level unseen since April 2022. However, this jubilation was short-lived. The excitement fizzled out as XRP’s value nosedived, erasing its gains and plunging it back into bearish territory. The abrupt reversal raised questions about the sustainability of the crypto’s upward trajectory.

Investors, once filled with hope, are now left wondering about the future of this once-promising token.

XRP Market Insights Paint A Grim Picture

Popular crypto trader Benjamin Cowen pointed out on X that “XRP has retraced the entirety of the move that came after the SEC vs. Ripple case.” This statement underscores the market’s sentiment, suggesting that the legal triumph’s positive impact on XRP’s price was only temporary.

$XRP has retraced the entirety of the move that came after the SEC vs. Ripple case.

Narratives do not drive the market, liquidity does. pic.twitter.com/8295jFRdHB

— Benjamin Cowen (@intocryptoverse) September 11, 2023

As of now, XRP’s price hovers at $0.480443, according to CoinGecko, with a modest 2.0% gain over the past 24 hours. However, a more concerning statistic is the seven-day dip, which stands at nearly 5%. This decline reflects the current bearish sentiment surrounding the digital asset.

Since early August, the 1-day chart for XRP has displayed a bearish market trend and a downward movement. Since bulls failed to break through last week’s $0.5 resistance, a revisit of that level could be a good opportunity for short sellers.

Selling Pressure Evident

A closer look at XRP’s on-chain metrics reveals that the selling pressure has been palpable. The On-Balance Volume (OBV), an indicator that tracks buying and selling volumes, has been in a downtrend alongside the price over the past month.

This suggests that sellers have been dominant in the market, while buyers have struggled to exert influence, especially in higher timeframes. This scenario further confirms the bearish grip on XRP.

Another metric worth noting is the mean coin age, which measures the average age of coins being transacted on the network. The metric experienced a sharp decline on August 30 and September 1 but has since started to climb higher.

While this may indicate network-wide accumulation, it does not guarantee an immediate uptrend. Investors must remain cautious and observant in the face of uncertain market conditions.

The recent price action of XRP has cast a shadow on the crypto’s prospects. Despite the initial excitement surrounding Ripple’s legal victory, the bears have reclaimed control, driving XRP’s value downward. With key metrics reflecting selling pressure and uncertainty in the market, XRP’s future remains uncertain, leaving investors to ponder their next moves in this volatile landscape.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from The Change Management Blog