AVAX, native token of the Avalanche network, made a resounding entrance into the cryptocurrency markets at the onset of the year, establishing itself as a prominent player and outpacing many other altcoins.

The initial enthusiasm surrounding AVAX, however, underwent a notable transformation as the narrative took an unexpected turn. Presently, the token finds itself perched at $36.65, reflecting a marked shift from its earlier bullish trajectory. Over the last seven days, AVAX has encountered a challenging period, sustaining a 15% loss.

The reasons behind this recent downturn could be multifaceted, ranging from market sentiment shifts to external factors influencing broader cryptocurrency trends. Investors and market analysts are closely monitoring the situation to discern the underlying dynamics at play and determine whether this is a temporary correction or indicative of a more sustained trend.

Furthermore, a curious case emerges – the dwindling social volume. Despite AVAX’s resilience, online chatter surrounding the platform has taken a nosedive, raising questions about the sustainability of the coin.

The diminishing social volume might suggest a divergence between market performance and investor sentiment, prompting a closer examination of factors influencing both the cryptocurrency’s value and the perception within the community.

Positively, though, the market capitalization of Avalanche has risen by more than 5% in the past few days, indicating a greater influx of investors.

Not too long after Grayscale’s Digital Large Cap Fund adopted the layer-1 blockchain, Avalanche saw a robust comeback. With billions of cryptocurrency assets under its management, Grayscale is one of the biggest digital asset managers.

The inclusion of AVAX in Grayscale’s fund indicates that institutions will still be interested in Avalanche until 2024 and beyond.

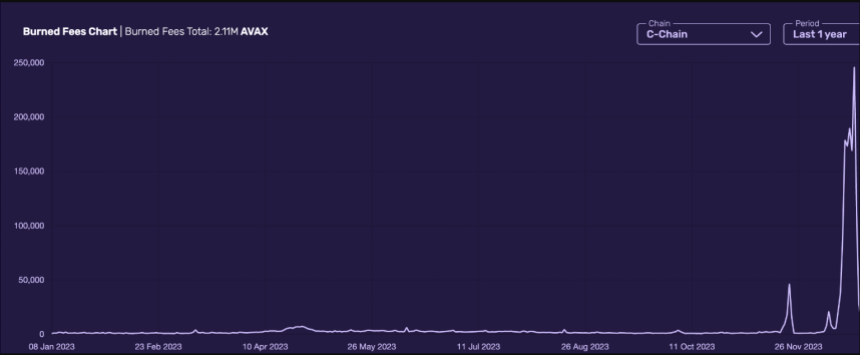

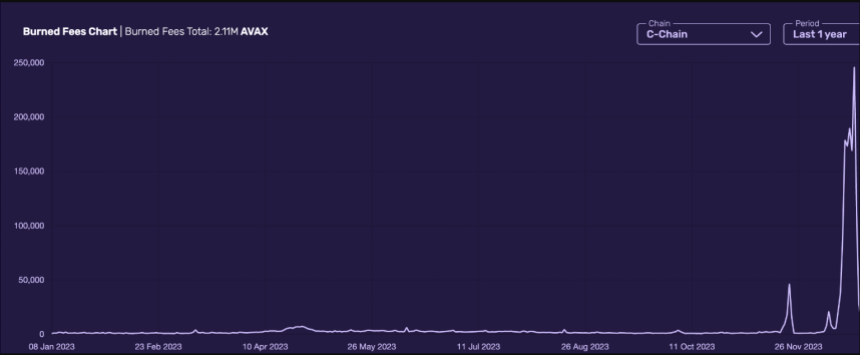

Meanwhile, Avalanche’s circulating supply shrank significantly in the latter half of 2023, fueled by a surge in activity surrounding “inscriptions.”

These data-on-chain creations generate transaction fees, which are then permanently removed from circulation through the network’s burn mechanism.

December alone saw a record 195,000 token burn, a testament to the growing popularity of inscriptions on Avalanche.

Experts attribute this trend to several factors. Inscription-based transactions, initially popular on Bitcoin, are finding new life on Avalanche due to their creative potential and contribution to the burn mechanism.

This creates a positive feedback loop, attracting users and further reducing the circulating supply. Additionally, the rise of inscription activity suggests a growing and engaged Avalanche community, which bodes well for the network’s long-term health.

However, the implications of this trend are nuanced. While token scarcity could lead to increased AVAX value over time, similar to Bitcoin, it also raises concerns about rising transaction fees and potential centralization if large inscription projects control a significant portion of the fee pool.

Featured image from Shutterstock

The initial enthusiasm surrounding AVAX, however, underwent a notable transformation as the narrative took an unexpected turn. Presently, the token finds itself perched at $36.65, reflecting a marked shift from its earlier bullish trajectory. Over the last seven days, AVAX has encountered a challenging period, sustaining a 15% loss.

AVAX Downturn Sparks Concerns, Social Silence

The reasons behind this recent downturn could be multifaceted, ranging from market sentiment shifts to external factors influencing broader cryptocurrency trends. Investors and market analysts are closely monitoring the situation to discern the underlying dynamics at play and determine whether this is a temporary correction or indicative of a more sustained trend.

Furthermore, a curious case emerges – the dwindling social volume. Despite AVAX’s resilience, online chatter surrounding the platform has taken a nosedive, raising questions about the sustainability of the coin.

The diminishing social volume might suggest a divergence between market performance and investor sentiment, prompting a closer examination of factors influencing both the cryptocurrency’s value and the perception within the community.

Positively, though, the market capitalization of Avalanche has risen by more than 5% in the past few days, indicating a greater influx of investors.

Not too long after Grayscale’s Digital Large Cap Fund adopted the layer-1 blockchain, Avalanche saw a robust comeback. With billions of cryptocurrency assets under its management, Grayscale is one of the biggest digital asset managers.

The inclusion of AVAX in Grayscale’s fund indicates that institutions will still be interested in Avalanche until 2024 and beyond.

Meanwhile, Avalanche’s circulating supply shrank significantly in the latter half of 2023, fueled by a surge in activity surrounding “inscriptions.”

Avalanche Surges: Record Token Burns Celebrated

These data-on-chain creations generate transaction fees, which are then permanently removed from circulation through the network’s burn mechanism.

December alone saw a record 195,000 token burn, a testament to the growing popularity of inscriptions on Avalanche.

Experts attribute this trend to several factors. Inscription-based transactions, initially popular on Bitcoin, are finding new life on Avalanche due to their creative potential and contribution to the burn mechanism.

This creates a positive feedback loop, attracting users and further reducing the circulating supply. Additionally, the rise of inscription activity suggests a growing and engaged Avalanche community, which bodes well for the network’s long-term health.

However, the implications of this trend are nuanced. While token scarcity could lead to increased AVAX value over time, similar to Bitcoin, it also raises concerns about rising transaction fees and potential centralization if large inscription projects control a significant portion of the fee pool.

Featured image from Shutterstock