Bitcoin (BTC) has surpassed the $100,000 threshold for the first time in two weeks, supported by revived momentum after the expected confirmation of Donald Trump’s US election win by Congress this week.

According to Bloomberg data, the market’s leading cryptocurrency climbed over 4% in the 24-hour time frame to hit $102,500 on Monday, recording a weekly rise of 11%—its highest surge since November 24.

BTC’s performance in 2024 encountered a deceleration in late December as investors aimed to secure their gains. Nevertheless, enthusiasm for a pro-crypto government under Trump has rekindled interest, propelling Bitcoin to a record peak of $108,000.

As Congress prepares to assemble to certify Trump’s win, market sentiment appears optimistic. Khushboo Khullar, a venture partner at Lightning Ventures that invests in Bitcoin-related companies, stated, “A super cycle in 2025 is expected due to regulatory changes from the Trump administration.”

A notable surge of investment in Bitcoin exchange-traded funds (ETFs) has also fueled this momentum. On Friday, investors funneled a net $908 million into US Bitcoin ETFs.

This signaled the fifth-highest inflow since they were launched in January 2024, following a historic net outflow of $680 million on December 19.

Another positive indicator for Bitcoin traders is the rebound of the Bitcoin Coinbase Premium, which gauges the price variance between Bitcoin on Coinbase and Binance.

Following its lowest point since Sam Bankman-Fried’s FTX fell in 2022, the premium has recovered, indicating a rising demand for Bitcoin among US investors.

Joe McCann, the CEO of Asymmetric, a crypto hedge fund located in Miami, pointed out that ETF issuers mainly transact with Coinbase, which implies that the demand for ETFs can affect the premium or discount rates.

As the market looks towards 2025, Bloomberg highlights that Bitcoin’s path will significantly rely on Trump’s dedication to his crypto-related pledges, encompassing a national Bitcoin reserve.

Nonetheless, doubts persist about the longevity of the ongoing rally. A recent MLIV Pulse survey revealed that 39% of participants viewed Bitcoin as the investment most prone to becoming a loser in 2025, the highest share of all choices.

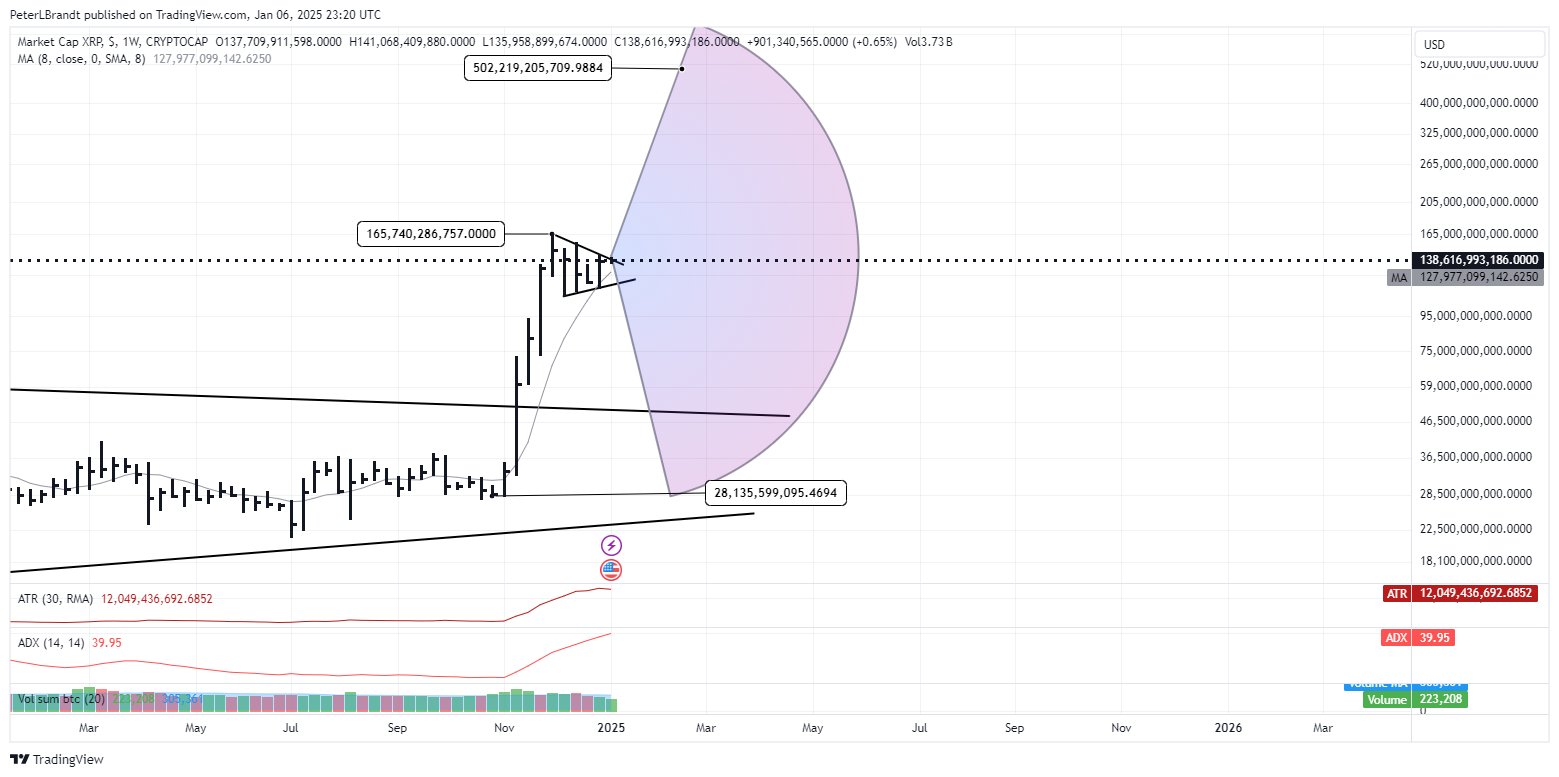

Regarding technical analysis, market expert Morecryptoonl pointed out that Bitcoin has formed a more distinct five-wave pattern, with a bearish outcome that is still feasible if specific support levels are violated.

At present, wave two is required to maintain support, while wave one is technically finished but is anticipated to reach a minimum of $100,800. Crucial support zones have been pinpointed between $93,144 and $96,554, which might be examined after wave one validates its peak.

Concerning Bitcoin ETFs, Glassnode asserts that the purchasing trend continues to be robust, owing to seasonal influences. With Inauguration Day nearing, the market analysis firm expects a higher purchasing activity from traditional finance investors, potentially impacting Bitcoin’s price movements further.

At the time of writing, BTC has slipped back towards the $101,888 level but is still making significant gains on all time frames.

Featured image from DALL-E, chart from TradingView.com

According to Bloomberg data, the market’s leading cryptocurrency climbed over 4% in the 24-hour time frame to hit $102,500 on Monday, recording a weekly rise of 11%—its highest surge since November 24.

Bitcoin Rally Resumes: Surges Past $100,000

BTC’s performance in 2024 encountered a deceleration in late December as investors aimed to secure their gains. Nevertheless, enthusiasm for a pro-crypto government under Trump has rekindled interest, propelling Bitcoin to a record peak of $108,000.

As Congress prepares to assemble to certify Trump’s win, market sentiment appears optimistic. Khushboo Khullar, a venture partner at Lightning Ventures that invests in Bitcoin-related companies, stated, “A super cycle in 2025 is expected due to regulatory changes from the Trump administration.”

A notable surge of investment in Bitcoin exchange-traded funds (ETFs) has also fueled this momentum. On Friday, investors funneled a net $908 million into US Bitcoin ETFs.

This signaled the fifth-highest inflow since they were launched in January 2024, following a historic net outflow of $680 million on December 19.

Another positive indicator for Bitcoin traders is the rebound of the Bitcoin Coinbase Premium, which gauges the price variance between Bitcoin on Coinbase and Binance.

Following its lowest point since Sam Bankman-Fried’s FTX fell in 2022, the premium has recovered, indicating a rising demand for Bitcoin among US investors.

Joe McCann, the CEO of Asymmetric, a crypto hedge fund located in Miami, pointed out that ETF issuers mainly transact with Coinbase, which implies that the demand for ETFs can affect the premium or discount rates.

Key Support Levels Under Scrutiny

As the market looks towards 2025, Bloomberg highlights that Bitcoin’s path will significantly rely on Trump’s dedication to his crypto-related pledges, encompassing a national Bitcoin reserve.

Nonetheless, doubts persist about the longevity of the ongoing rally. A recent MLIV Pulse survey revealed that 39% of participants viewed Bitcoin as the investment most prone to becoming a loser in 2025, the highest share of all choices.

Regarding technical analysis, market expert Morecryptoonl pointed out that Bitcoin has formed a more distinct five-wave pattern, with a bearish outcome that is still feasible if specific support levels are violated.

At present, wave two is required to maintain support, while wave one is technically finished but is anticipated to reach a minimum of $100,800. Crucial support zones have been pinpointed between $93,144 and $96,554, which might be examined after wave one validates its peak.

Concerning Bitcoin ETFs, Glassnode asserts that the purchasing trend continues to be robust, owing to seasonal influences. With Inauguration Day nearing, the market analysis firm expects a higher purchasing activity from traditional finance investors, potentially impacting Bitcoin’s price movements further.

At the time of writing, BTC has slipped back towards the $101,888 level but is still making significant gains on all time frames.

Featured image from DALL-E, chart from TradingView.com