- Glassnode’s tweet reveals insights on Bitcoin’s price correction and the supply dynamics during the dip to $25,000.

- A pattern emerges when comparing supply levels in recent and previous cycles, highlighting the repetitive nature of Bitcoin’s market cycles.

- The $30,000 price level acts as a critical mid-point in the recent cycle, with approximately 75% of the total supply in profit and 25% in a loss.

In a recent tweet by Glassnode, an on-chain analytics platform, intriguing insights were shared about the recent correction in Bitcoin’s price. The data highlighted the magnitude of supply acquired during the dip to $25,000, shedding light on the dynamics between supply in profit and supply in loss.

Furthermore, a peculiar pattern emerged when comparing these levels to previous cycles, adding an intriguing layer to the analysis. This article delves into the details presented in the tweet, examining the repetitive nature of Bitcoin’s market cycles and the significance of certain price levels.

Assessing the magnitude of supply acquired during the recent correction to $25k, the volume of supply which jumped from 'in-loss' to 'in-profit' status was around 2.47M BTC, equivalent to 12.7% of the total supply.

Conversely, the supply held 'in-loss' has declined to just 4.79M… pic.twitter.com/DEM2RbisFh

— glassnode (@glassnode) July 13, 2023

Supply in Profit and Supply in Loss

According to Glassnode’s tweet, during the recent correction, approximately 2.47 million BTC, equivalent to 12.7% of the total supply, transitioned from being in a loss to being in a profit.

Conversely, the supply held ‘in loss’ decreased to a mere 4.79 million Bitcoin. This decline brought the supply in loss to levels similar to those observed in July 2021 ($30,000), July 2020 ($9,200), April 2016 ($6,500), and March 2016 ($425). The reduction in the supply held in loss indicates that a significant portion of Bitcoin holders regained a profitable position during the recent price recovery.

The first midpoint was observed during the 2013-2016 cycle at the $425 level, while the second occurred in the 2018-2019 cycle at approximately $6,500. Notably, these levels coincide with the points where a comparable volume of supply was held in a loss.

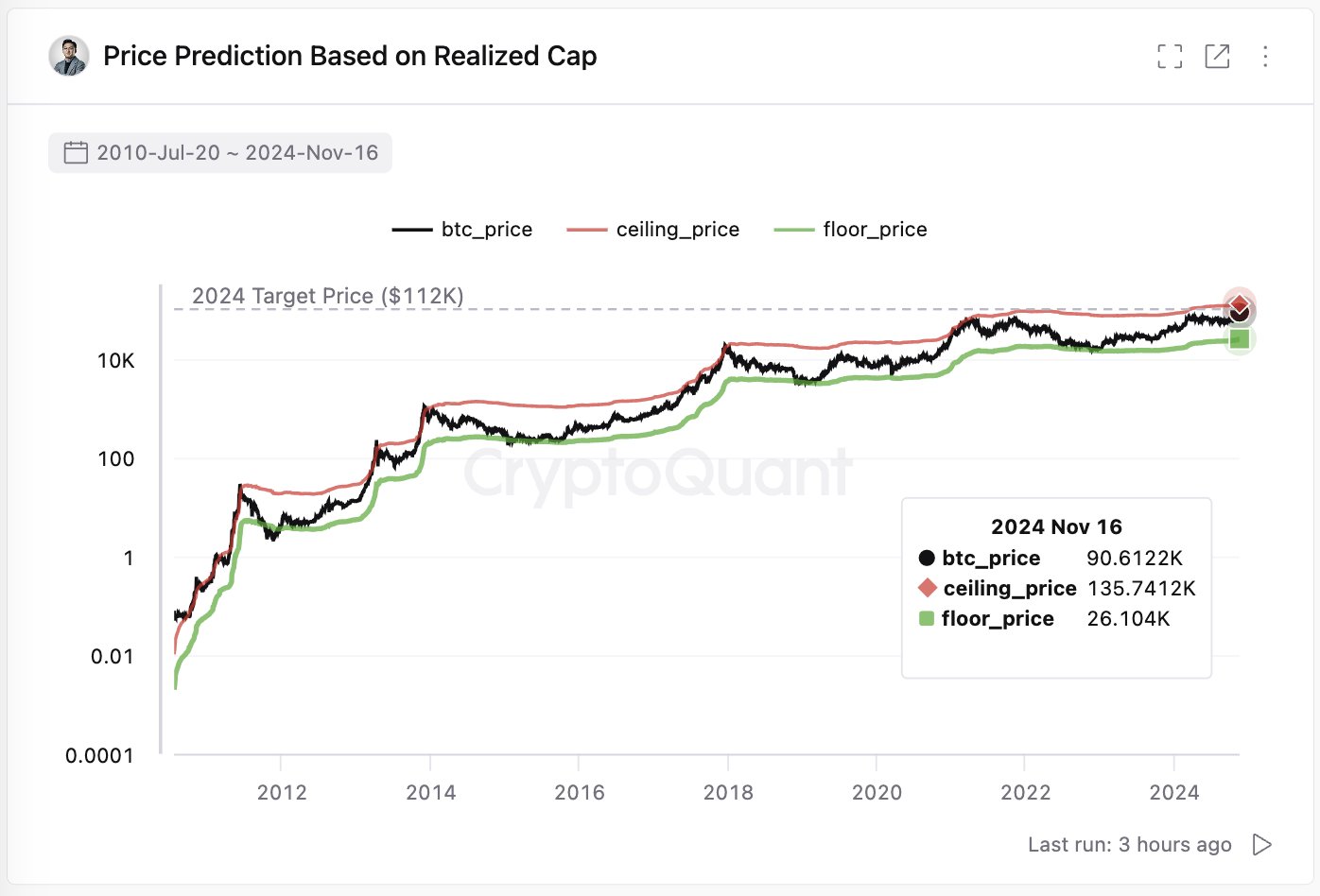

The $30,000 ‘Mid-Point’ and Market Dynamics: In the most recent cycle, the $30,000 price level acted as a crucial mid-point, being tested multiple times from both above and below.

Glassnode’s analysis reveals that as the market consolidates below this level, approximately 75% of the total supply is currently in profit, while the remaining 25% is held in a loss. Interestingly, this distribution mirrors the balance reached when Bitcoin price approached mid-points in both 2016 and 2019.

While historical patterns cannot guarantee future outcomes, they offer valuable context for investors and analysts seeking to navigate the ever-evolving cryptocurrency landscape.