Bitcoin (BTC) soared by over 5% on Tuesday to trade above $26,000 for the first time this week. A major contributor to this price rise was an increase in positive sentiment around the token as a result of Franklin Templeton, a $1.45 trillion asset manager, filing for a spot bitcoin ETF with the US Securities and Exchange Commission (SEC)

However, as the market euphoria dies down, the premier cryptocurrency has experienced some market recorrection, with many investors now speculating on the token’s next movement. On this note, popular crypto analyst Ali Martinez has discovered a buy signal for BTC investors. However, there are certain conditions to be met.

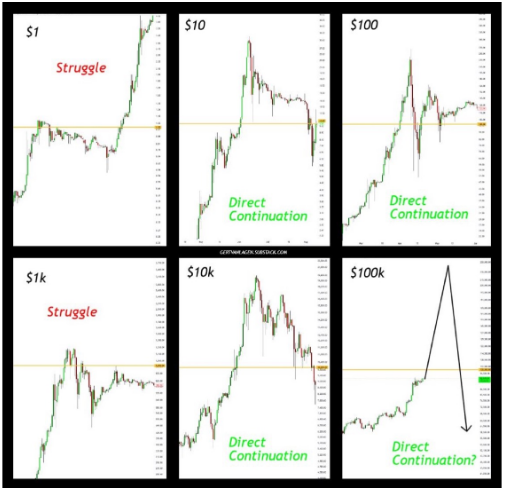

According to an X post on Tuesday, Ali Martinez states that the TD sequential indicator has produced a buy signal on Bitcoin’s weekly chart. Therefore, BTC could be set for a price rally after losing about 10.85% of its market value in the last 30 days.

For context, the Tom Denmark (TD) sequential indicator is a technical analysis tool used to identify the exact time of trend exhaustion and price reversal. However, Martinez notes there is a clause to his latest prediction.

In order to confirm the buy signal generated by the TD sequential indicator, Bitcoin must close this week trading above $25,600. Upon fulfilling this condition, the analyst predicts that BTC could trade as high as $28,350-$31,800 in the coming weeks.

In other news, many BTC investors and crypto investors are likely on high alert, waiting for the United States to publish its monthly CPI data report, which is slated for release on Wednesday.

The Consumer Price Index, which measures the percentage change in the price of a basket of goods and services, is a popular indicator of inflation.

Related Reading: Bitcoin Price Signals Another Bearish Formation and Could Revisit $25K

If the upcoming CPI report presents a rise in inflation for the month of August, it may prompt the US Federal Reserve to hike interest rates, which is popularly known to induce a dip in the demand for risk assets such as Bitcoin and other cryptocurrencies.

At the time of writing, Bitcoin is trading at $26,136.30 with price gains of 1.64% in the last seven days, respectively. Meanwhile, the token’s daily trading volume declined 24.19% and is now valued at $14.83 billion.

However, as the market euphoria dies down, the premier cryptocurrency has experienced some market recorrection, with many investors now speculating on the token’s next movement. On this note, popular crypto analyst Ali Martinez has discovered a buy signal for BTC investors. However, there are certain conditions to be met.

$28,350 or $31,800, How High Can Bitcoin Go?

According to an X post on Tuesday, Ali Martinez states that the TD sequential indicator has produced a buy signal on Bitcoin’s weekly chart. Therefore, BTC could be set for a price rally after losing about 10.85% of its market value in the last 30 days.

#Bitcoin | As we navigate a week with key financial events, it’s crucial to highlight that the TD Sequential indicator has signaled a ‘buy’ on the $BTC weekly chart.

For this to be validated, #BTC needs to close above the week above $25,600. If confirmed, targets could be… pic.twitter.com/0S06I5AndB

— Ali (@ali_charts) September 12, 2023

For context, the Tom Denmark (TD) sequential indicator is a technical analysis tool used to identify the exact time of trend exhaustion and price reversal. However, Martinez notes there is a clause to his latest prediction.

In order to confirm the buy signal generated by the TD sequential indicator, Bitcoin must close this week trading above $25,600. Upon fulfilling this condition, the analyst predicts that BTC could trade as high as $28,350-$31,800 in the coming weeks.

CPI Report Incoming: What Could This Mean For BTC Market?

In other news, many BTC investors and crypto investors are likely on high alert, waiting for the United States to publish its monthly CPI data report, which is slated for release on Wednesday.

The Consumer Price Index, which measures the percentage change in the price of a basket of goods and services, is a popular indicator of inflation.

Related Reading: Bitcoin Price Signals Another Bearish Formation and Could Revisit $25K

If the upcoming CPI report presents a rise in inflation for the month of August, it may prompt the US Federal Reserve to hike interest rates, which is popularly known to induce a dip in the demand for risk assets such as Bitcoin and other cryptocurrencies.

At the time of writing, Bitcoin is trading at $26,136.30 with price gains of 1.64% in the last seven days, respectively. Meanwhile, the token’s daily trading volume declined 24.19% and is now valued at $14.83 billion.