Algorand native token, ALGO, has experienced a dramatic plunge in the wake of the recent crash in the cryptocurrency market. On August 19, the token’s value plummeted by a staggering 18%, hitting a low of $0.082.

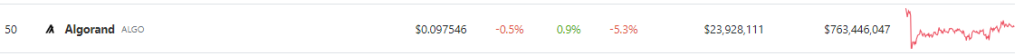

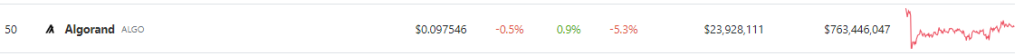

While ALGO subsequently rebounded slightly, currently trading at $0.097 according to CoinGecko, the prevailing sentiment suggests that the selling pressure is something investors must keep an eye on. The 24-hour gains have been a mere 0.9%, and over the span of the past week, ALGO has suffered a 5.3% decline.

Despite the transient recovery in prices, the persistent selling pressure continues to cast a shadow over ALGO’s future prospects. The potential consequence of this is the looming possibility of ALGO establishing a new all-time low in the days to come.

This setback is compounded by a development earlier in the year when the US Securities and Exchange Commission designated ALGO as a security. This action was made as the SEC unleashed regulatory measures against the US-based crypto exchange, Bittrex.

The reclassification of ALGO has set in motion a cascade of ramifications, affecting both the token itself and its holders in terms of financial regulations.

In spite of vigorous resistance from its Foundation, ALGO’s demand has experienced a decline. The overarching reason behind this decline lies in the hesitancy of investors towards assets entangled in regulatory ambiguity. Consequently, the value of the token has witnessed a staggering decline of over 87% since the SEC’s classification.

Over the past three months, ALGO has endured a series of successive all-time lows (ATLs). The downward spiral began on June 10, culminating in the most recent ATL on August 17. The token’s efforts to stage a bullish rebound were quashed by the overwhelming weight of relentless selling pressure.

Critical Support And Prospective Scenarios

Meanwhile, the pivotal $0.09 support level has managed to alleviate some of the selling pressure, although indicators on the trading charts raise concerns about its sustainability.

Should the critical support of $0.09 crumble under the pressure, it opens the gates for short sellers to target the price range of $0.05 to $0.07, potentially setting another unfortunate precedent of a new low for ALGO.

However, if the current support level holds, prospective buyers can anticipate opportunities to secure profits within the range of $0.12 to $0.14.

As ALGO navigates through these tumultuous waters, market observers are keenly watching how it will weather the storm. The complex interplay of regulatory challenges and market sentiment will undoubtedly shape the trajectory of this token in the days ahead.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Just Ride

While ALGO subsequently rebounded slightly, currently trading at $0.097 according to CoinGecko, the prevailing sentiment suggests that the selling pressure is something investors must keep an eye on. The 24-hour gains have been a mere 0.9%, and over the span of the past week, ALGO has suffered a 5.3% decline.

Algorand Challenges Amidst Brief Rebound

Despite the transient recovery in prices, the persistent selling pressure continues to cast a shadow over ALGO’s future prospects. The potential consequence of this is the looming possibility of ALGO establishing a new all-time low in the days to come.

This setback is compounded by a development earlier in the year when the US Securities and Exchange Commission designated ALGO as a security. This action was made as the SEC unleashed regulatory measures against the US-based crypto exchange, Bittrex.

The reclassification of ALGO has set in motion a cascade of ramifications, affecting both the token itself and its holders in terms of financial regulations.

Regulatory Uncertainty And Value Erosion

In spite of vigorous resistance from its Foundation, ALGO’s demand has experienced a decline. The overarching reason behind this decline lies in the hesitancy of investors towards assets entangled in regulatory ambiguity. Consequently, the value of the token has witnessed a staggering decline of over 87% since the SEC’s classification.

Over the past three months, ALGO has endured a series of successive all-time lows (ATLs). The downward spiral began on June 10, culminating in the most recent ATL on August 17. The token’s efforts to stage a bullish rebound were quashed by the overwhelming weight of relentless selling pressure.

Critical Support And Prospective Scenarios

Meanwhile, the pivotal $0.09 support level has managed to alleviate some of the selling pressure, although indicators on the trading charts raise concerns about its sustainability.

Should the critical support of $0.09 crumble under the pressure, it opens the gates for short sellers to target the price range of $0.05 to $0.07, potentially setting another unfortunate precedent of a new low for ALGO.

However, if the current support level holds, prospective buyers can anticipate opportunities to secure profits within the range of $0.12 to $0.14.

As ALGO navigates through these tumultuous waters, market observers are keenly watching how it will weather the storm. The complex interplay of regulatory challenges and market sentiment will undoubtedly shape the trajectory of this token in the days ahead.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Just Ride