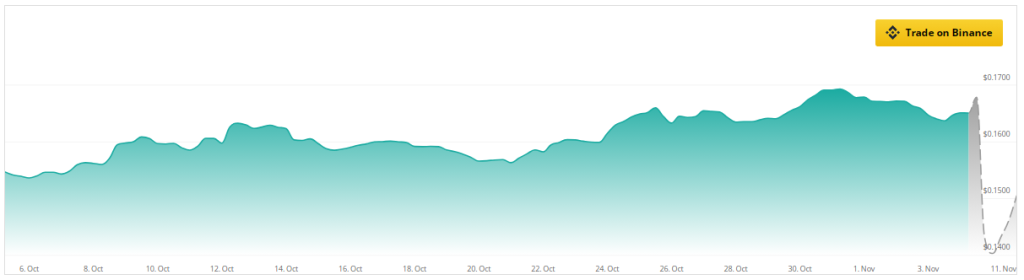

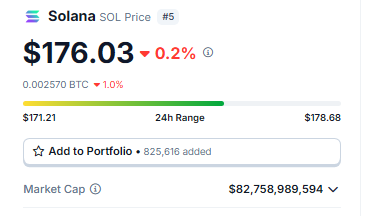

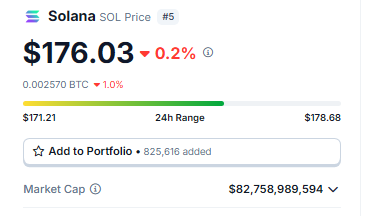

The Solana native coin is generating news as it goes against the trend, lately surpassing $176 in a move that has piqued the crypto world’s interest. This gain is especially surprising given the sour mood around the crypto just weeks ago, with several analysts predicting the altcoin would suffer.

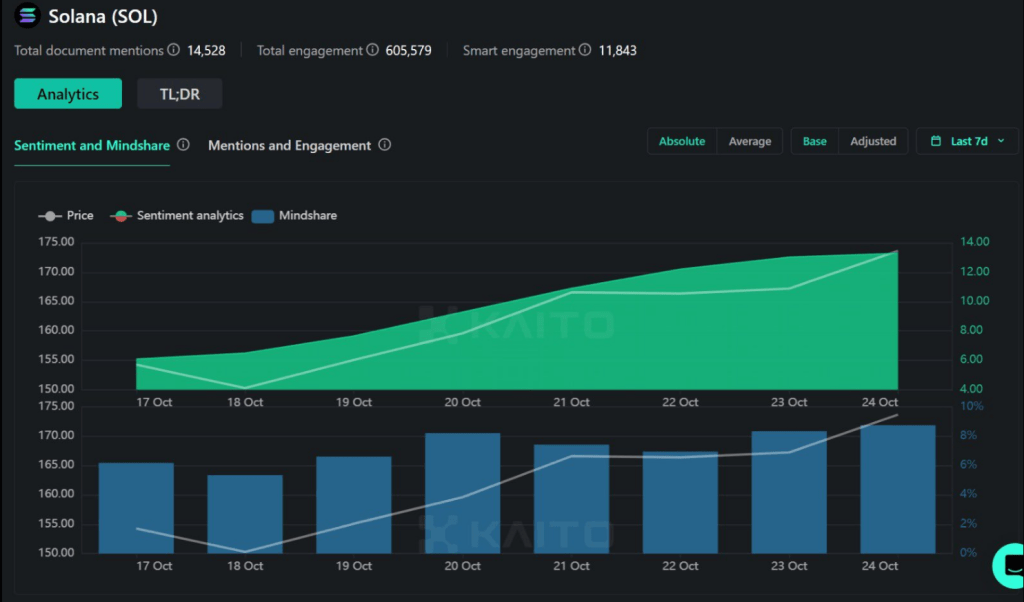

But Solana has defied the odds, increasing both in price and in market confidence. According to analyst Miles Deutscher, the gain coincides with a broader increase in positive sentiment for Solana, encouraging industry-wide discussions about its potential.

Technical signs indicate an even brighter future for the fifth-largest altcoin. According to experts, Solana’s present trajectory, which is supported by a bullish pennant pattern, indicates that SOL might reach as high as $260 if it breaks past resistance.

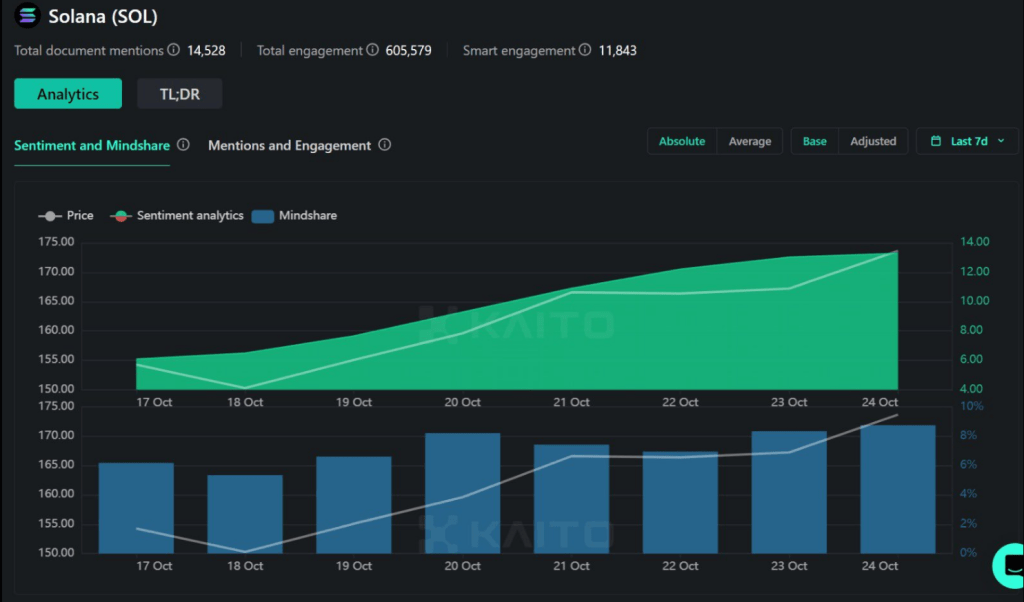

As Solana’s price rose, observers saw a dramatic surge in positive sentiment about the asset. According to data, the number of discussions surrounding Solana has contributed to the upsurge observed in the slant.

Mindshare (a measure of the percentage of crypto discussions a coin commands) has remained high. For Deutscher, the increasing attentiveness on Solana is a sign that there is even more room for growth, contrary to the prevailing tendency in the market.

Although some investors are wary, experts say the technical terrain is still favorable. If the item breaks over its barrier, the optimistic pennant formation in SOL’s price action usually denotes more gains. Depending on if Solana can break out from its present level, its token’s price might be positioned for a notable climb toward $260.

The Ethereum-Solana Rivalry

The Ethereum-Solana Rivalry

Surprisingly, Solana’s comeback happens at the same time that Ethereum co-founder Anatoly Yakovenko shows his accolade on Ethereum. Solana and Ethereum are competitors, but Yakovenko recently praised Ethereum’s core technology and said he liked its design and goal.

This is of interest to people as they are generally two competing networks that try to outdo each other in offering superior decentralized apps and smart contracts functionality.

Ethereum has long been the preferred protocol among developers, but Solana, dubbed a “Ethereum-killer,” has quickly gained favor because to its speed and lower transaction fees. Yakovenko’s recognition demonstrates a developing sector in which competitors can acknowledge each other’s contributions to blockchain innovation.

Future Perspectives And Market Sentiment

Meanwhile, Deutscher feels Solana’s price might double or possibly quadruple, particularly if Bitcoin rises to new highs, say $100,000. SOL’s continued performance despite recent falls suggests that it may have strong community and long-term holders. For the time being, SOL is a coin to keep an eye on, and with increased sentiment and a technical boost, it appears to be on track to continue challenging expectations.

Featured image from Pintu, chart from TradingView

But Solana has defied the odds, increasing both in price and in market confidence. According to analyst Miles Deutscher, the gain coincides with a broader increase in positive sentiment for Solana, encouraging industry-wide discussions about its potential.

Solana sentiment and mindshare keeps going through the roof.

But the run is far from over.

I just uploaded an important $SOL update, including:

• My price prediction • My top ecosystem picks

If you hold Solana, you need to watch this videohttps://t.co/fsa8qabYHE pic.twitter.com/KX7xeG3gkn

— Miles Deutscher (@milesdeutscher) October 24, 2024

Technical signs indicate an even brighter future for the fifth-largest altcoin. According to experts, Solana’s present trajectory, which is supported by a bullish pennant pattern, indicates that SOL might reach as high as $260 if it breaks past resistance.

Solana is outperforming most altcoins as prices are looking to rebound after a big fall Wednesday. The #5 market cap asset continues to be a prime example of how the crowd usually gets it WRONG. View the current bearish sentiment as a sign SOL can continue to pump. pic.twitter.com/pRkCnyxRxh

— Santiment (@santimentfeed) October 23, 2024

Increasing Interest And Technical Indicators

As Solana’s price rose, observers saw a dramatic surge in positive sentiment about the asset. According to data, the number of discussions surrounding Solana has contributed to the upsurge observed in the slant.

Mindshare (a measure of the percentage of crypto discussions a coin commands) has remained high. For Deutscher, the increasing attentiveness on Solana is a sign that there is even more room for growth, contrary to the prevailing tendency in the market.

Although some investors are wary, experts say the technical terrain is still favorable. If the item breaks over its barrier, the optimistic pennant formation in SOL’s price action usually denotes more gains. Depending on if Solana can break out from its present level, its token’s price might be positioned for a notable climb toward $260.

Surprisingly, Solana’s comeback happens at the same time that Ethereum co-founder Anatoly Yakovenko shows his accolade on Ethereum. Solana and Ethereum are competitors, but Yakovenko recently praised Ethereum’s core technology and said he liked its design and goal.

I like @BanklessHQ and ethereum. I even like the ethereum design and vision. If you told me to go build an alternative to bitcoin, ethereum settlement layer focused design is what I would steer the engineering towards.

If that’s the vision, ethereum can just embrace all the…

— toly(@aeyakovenko) October 24, 2024

This is of interest to people as they are generally two competing networks that try to outdo each other in offering superior decentralized apps and smart contracts functionality.

Ethereum has long been the preferred protocol among developers, but Solana, dubbed a “Ethereum-killer,” has quickly gained favor because to its speed and lower transaction fees. Yakovenko’s recognition demonstrates a developing sector in which competitors can acknowledge each other’s contributions to blockchain innovation.

Future Perspectives And Market Sentiment

Meanwhile, Deutscher feels Solana’s price might double or possibly quadruple, particularly if Bitcoin rises to new highs, say $100,000. SOL’s continued performance despite recent falls suggests that it may have strong community and long-term holders. For the time being, SOL is a coin to keep an eye on, and with increased sentiment and a technical boost, it appears to be on track to continue challenging expectations.

Featured image from Pintu, chart from TradingView