- The community as a whole agreed to implement Proposal 286.

- Last week, $61 million worth of funds were stolen from Curve Finance pools.

The proposal to prohibit further CRV borrowing was supported by 100% of the Aave community. The community has been advised by risk management company Gauntlet to avoid the liquidation risk of Curve Finance founder Michael Egorov’s debt, which might cause a ripple effect and perhaps a DeFi meltdown, by prohibiting the borrowing of Curve DAO Tokens (CRVs).

The community as a whole agreed to implement Proposal 286. No one voted against the plan to prevent further borrowing against CRV. Gauntlet has been investigating Michael Egorov, founder of Curve Finance, and his risk profile.

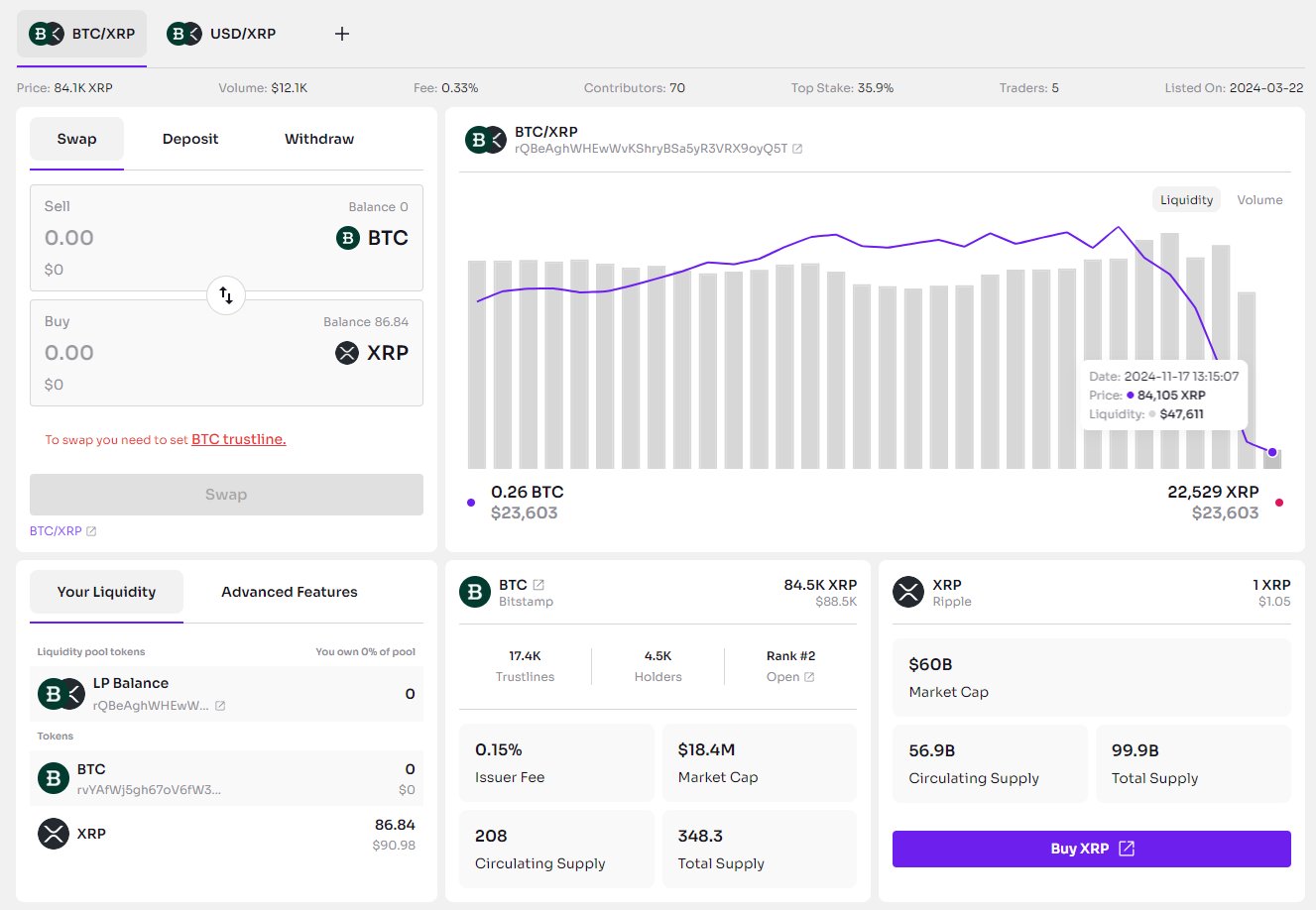

There are around $54 million in USDT borrowed against $158 million in CRV in this account. But because of OTC sales of CRV tokens, Egorov is swiftly erasing his $80 million debt. According to DeBank records, a loan application for about $29 million USDT against $116 million of CRV has been submitted on Aave.

Significant Impact

Last week, $61 million worth of funds were stolen from Curve Finance pools. After the time for the hacker’s voluntary return of money passed, the DeFi platform decided to take legal action against the exploiter.

Meanwhile, Michael Egorov has paid off over $40 million of his $80 million debt via over-the-counter (OTC) sales of CRV tokens. The consequence was a 10% increase in the price of CRV tokens on Saturday. The price recovered, although the upswing is weakening. The 70% drop in volume over the last day is more evidence that investors are losing interest. According to CMC, at the time of writing the price of CRV is $0.6157, up 0.07% in the last 24 hours.

Highlighted Crypto News Today:

Elon Musk Sets Off a Frenzy: Crypto Boom Upcoming, or Are Tokens Just Twitter Chatter?