- Robinhood’s single-wallet holdings of over $3 billion make it to the third-largest bitcoin holder.

- The daily price chart indicates that Bitcoin remains within the bearish zone.

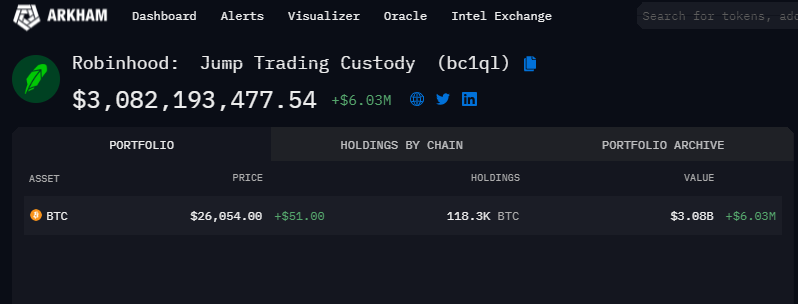

In a recent report published by Arkham Intelligence revealed that the popular investing and trading platform Robinhood (HOOD) has amassed a significant bitcoin (BTC) holding amounting to over $3 billion. This substantial sum of Bitcoin, stored in a single wallet, has been accumulated over the course of several months.

Robinhood’s bitcoin holdings encompass a staggering 118,300 BTC, which currently have a valuation of approximately $3.08 billion. This vaults Robinhood to the position of the third-largest holder of bitcoin, trailing behind cryptocurrency exchanges Binance and Bitfinex. Binance and Bitfinex currently hold $6.4 billion and $4.3 billion worth of tokens, respectively, in single wallets.

Robinhood’s Bitcoin Holding (Source: Arkham)

In addition, the recent data discloses that the fifth largest Bitcoin wallet is connected to Russian billionaire Yevgeny Prigozhin, while the fourth largest wallet remains undisclosed.

Further, Robinhood’s significant bitcoin holdings have sparked market speculation, from linking them to BlackRock’s Bitcoin ETF interest to considering possible moves by Gemini involving user holdings. Despite its notable holdings, Robinhood’s Q2 crypto trading revenue fell to $31 million, marking an 18% drop from the previous quarter’s $38 million, as per the latest earnings report.

Analyzing Bitcoin’s (BTC) Recent Price Trends

According to CoinMarketCap, Bitcoin exhibited a price of $26,040, marking a slight increase of 0.27% over the past 24 hours. The largest cryptocurrency’s daily trading volume stood at $10.8 billion, witnessing a 38% surge within the span of a day. Notably, Bitcoin’s price track had undergone a decline on August 17, plummeting to the $27K range. After this drop, Bitcoin has fluctuated within the range of $27,000 to $25,600.

The daily price chart highlights Bitcoin’s continued confinement within bearish territory. The current price is situated below the 50-day exponential moving average (EMA), indicating a challenging phase for Bitcoin. Further, the daily relative strength index (RSI) stands at 26.54, signaling that the cryptocurrency is positioned near the edge of the oversold zone.

Bitcoin (BTC) Price Chart (Source: TradingView)

Over the past week, Bitcoin’s trading range has swung between $26K and $25.5K. However, if the current trend reverses, BTC will experience a bullish rally toward resistance levels of $27,453 and $28,718. Conversely, there remains the possibility of Bitcoin undergoing further downward movement. If such a scenario unfolds, the BTC price could breach the support level of $25,174. Even the bears could exert enough pressure to drive the price below $24,947.

What are your thoughts on the impact of Robinhood’s significant $3 billion bitcoin holdings on the cryptocurrency market in the coming months? Tweet to us at @The_NewsCrypto and let us know your thoughts.