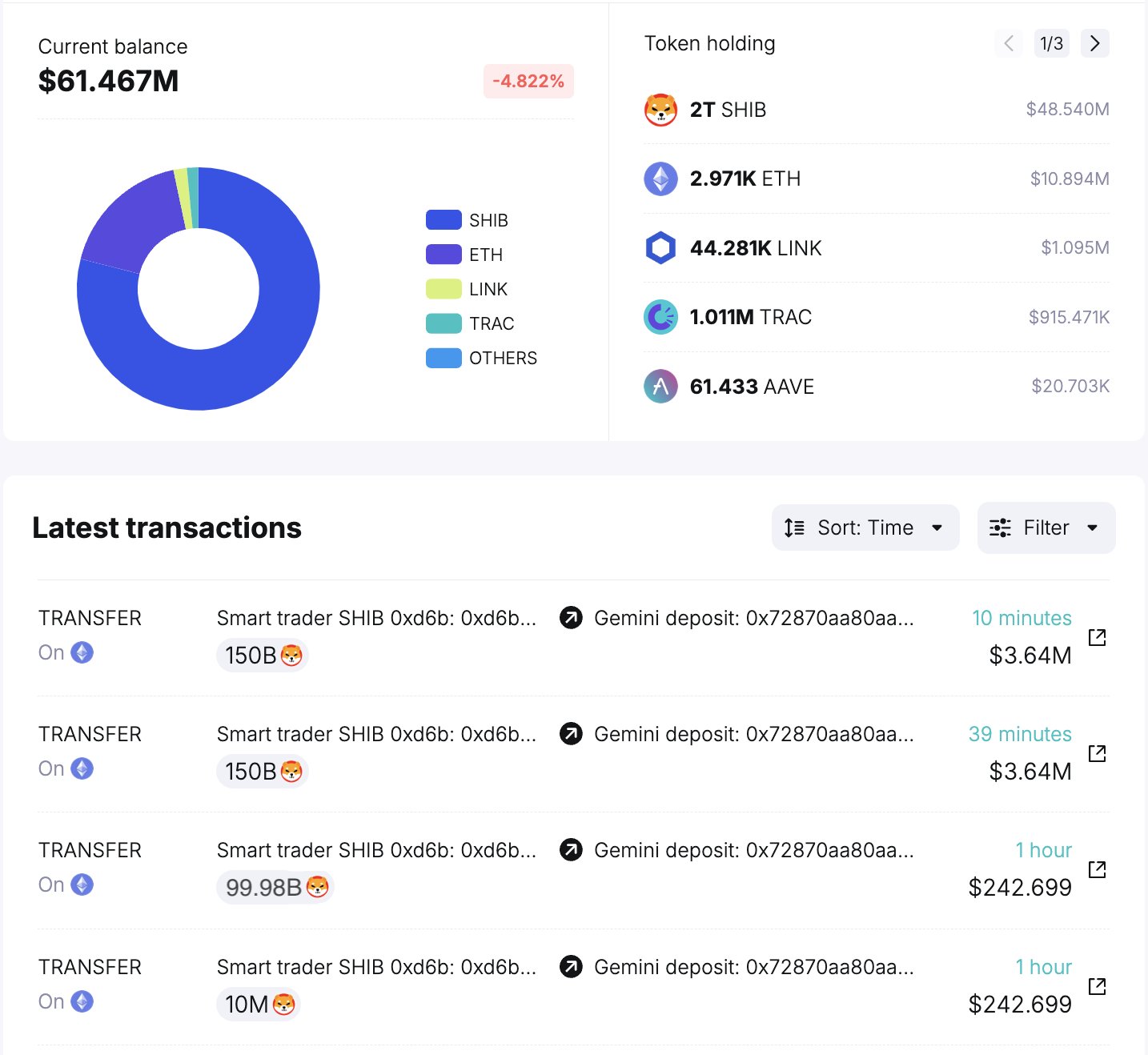

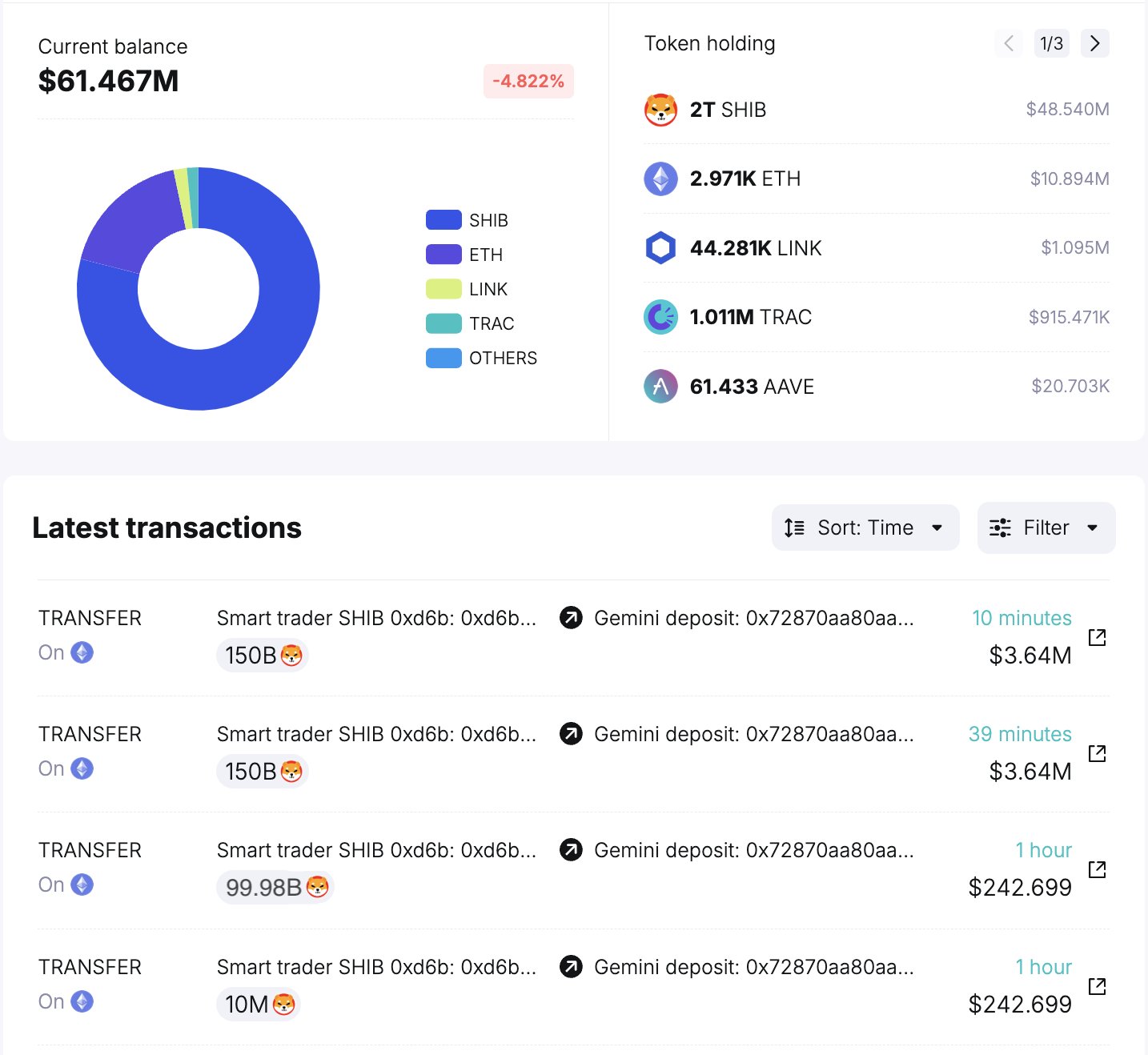

A significant Shiba Inu (SHIB) transfer has caught the attention of traders today, December 19, as an early and highly profitable SHIB whale moved nearly 400 billion tokens. On-chain analysis service Spot On Chain (@spotonchain) highlighted that this well-known early buyer deposited 399.99B SHIB (worth $9.69 million) to Gemini, building on a history of substantial gains after initially acquiring 15.2 trillion SHIB in August 2020 for a mere 10 ETH.

Spot On Chain wrote via X: “This early $SHIB whale with a $108M profit just further deposited 399.99B $SHIB ($9.69M) to Gemini in the past hour. Notably, on Aug 7, 2020, this whale bought 15.2T SHIB for just 10 ETH. Now, the whale still holds 2T SHIB ($48.54M) with an estimated total profit of $107.7M (3.7x return) from SHIB.”

This is not the first time such profit-taking has occurred by the anonymous whale. In mid-November, Spot On Chain noted that the same early buyer (address “0xd6b”) was “back to offload tokens after 8 months of inactivity,” depositing 100 billion SHIB (worth $2.81 million at the time) to Gemini. Prior to that, the whale was last active in March, transferring 200 billion SHIB to both Gemini and Crypto.com.

Within the last 24 hours, SHIB’s price has declined roughly 6.2%, extending a short-term downward move that saw a 10% drop on December 18.

Notably, much of this weakness aligns with the broader crypto market downturn following the recent Federal Open Market Committee (FOMC) press conference. Although the expected 25 bps rate hike was delivered, Fed Chair Jerome Powell’s emphasis on a more restrained approach to interest rate cuts in 2024 resulted in a bearish market response across digital assets.

Despite these macro headwinds and the high-profile whale sell-off, Shiba Inu’s higher time-frame technical structure remains relatively stable. In the daily chart, SHIB held key support which is the 100-day EMA which has proven to be a formidable support level for SHIB since the price first ascended above it in late September.

Marked by the yellow circles on the chart, this EMA has repeatedly served as a crucial pivot point for price action, sustaining support for the fifth time during the observed period. Currently, the 100-day EMA sits at approximately $0.00002264

Additionally, SHIB remains above the 0.382 Fibonacci retracement level at $0.00002409, another critical threshold currently being watched by analysts. The 0.5 Fibonacci level at $0.00002821 marks a pivotal midpoint from the recent high-to-low range, serving as a psychological test for traders should SHIB attempt a recovery.

Beyond that, further upside resistance levels await at the 0.618 Fib ($0.00003234) and 0.786 Fib ($0.00003821), potential barriers if bullish momentum returns.

Spot On Chain wrote via X: “This early $SHIB whale with a $108M profit just further deposited 399.99B $SHIB ($9.69M) to Gemini in the past hour. Notably, on Aug 7, 2020, this whale bought 15.2T SHIB for just 10 ETH. Now, the whale still holds 2T SHIB ($48.54M) with an estimated total profit of $107.7M (3.7x return) from SHIB.”

This is not the first time such profit-taking has occurred by the anonymous whale. In mid-November, Spot On Chain noted that the same early buyer (address “0xd6b”) was “back to offload tokens after 8 months of inactivity,” depositing 100 billion SHIB (worth $2.81 million at the time) to Gemini. Prior to that, the whale was last active in March, transferring 200 billion SHIB to both Gemini and Crypto.com.

Shiba Inu Price Drops

Within the last 24 hours, SHIB’s price has declined roughly 6.2%, extending a short-term downward move that saw a 10% drop on December 18.

Notably, much of this weakness aligns with the broader crypto market downturn following the recent Federal Open Market Committee (FOMC) press conference. Although the expected 25 bps rate hike was delivered, Fed Chair Jerome Powell’s emphasis on a more restrained approach to interest rate cuts in 2024 resulted in a bearish market response across digital assets.

Despite these macro headwinds and the high-profile whale sell-off, Shiba Inu’s higher time-frame technical structure remains relatively stable. In the daily chart, SHIB held key support which is the 100-day EMA which has proven to be a formidable support level for SHIB since the price first ascended above it in late September.

Marked by the yellow circles on the chart, this EMA has repeatedly served as a crucial pivot point for price action, sustaining support for the fifth time during the observed period. Currently, the 100-day EMA sits at approximately $0.00002264

Additionally, SHIB remains above the 0.382 Fibonacci retracement level at $0.00002409, another critical threshold currently being watched by analysts. The 0.5 Fibonacci level at $0.00002821 marks a pivotal midpoint from the recent high-to-low range, serving as a psychological test for traders should SHIB attempt a recovery.

Beyond that, further upside resistance levels await at the 0.618 Fib ($0.00003234) and 0.786 Fib ($0.00003821), potential barriers if bullish momentum returns.