- XRP 20% dip hints at potential bullish reversal signals.

- Market trends suggest whales accumulate amidst price correction dynamics.

XRP has experienced significant volatility over the past week, dropping 21% from its seven-year high of $2.90 recorded on December 3. The token’s price plummeted to $2.16 earlier today before stabilizing at $2.06, reflecting a 12% decline from its intra-day high of $2.49. Despite the bearish trend, trading volume surged by 99%, indicating heightened market activity.

Whale transactions have added intrigue to the unfolding narrative. In the last 24 hours, a major transfer of 34.9 million XRP worth $84 million between unknown wallets caught the attention of analysts and traders. Whale activities like these often signal upcoming market shifts, fuelling speculation about XRP’s potential trajectory. Notably, recent whale accumulations of approximately 120 million XRP tokens, valued at $288 million, suggest confidence in a price recovery.

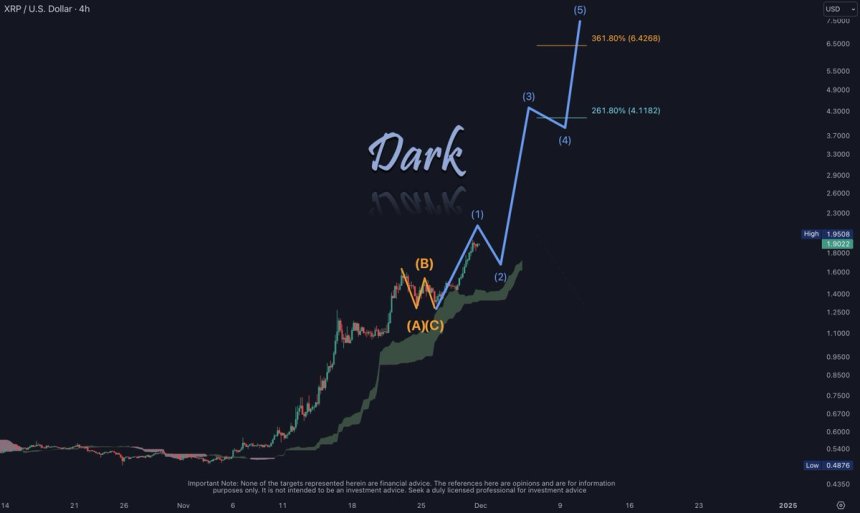

Meanwhile, technical analysis highlights XRP’s consolidation between $2.17 and $2.70, with projections of a potential breakout. Analysts foresee a possible retest of the $2.25 resistance level, with bullish scenarios targeting $4.40 in the coming weeks. Some optimists predict an even more dramatic rally, projecting prices between $4.30 and $6.40 or a surge to $13 by 2025.

The token’s performance mirrors past cycles, with some comparing its current trends to the 2017 bull market. On-chain activity supports this optimism, as XRP Ledger (XRPL) adoption surged, with active addresses climbing to a 33-month high of 108,771. And transactions have increased by 190% over the past month.

Legal and Policy Impacts

XRP’s price outlook remains intertwined with Ripple Labs’ ongoing legal battle with the U.S. SEC Speculation about an extension request for the January 2025 appeal deadline adds uncertainty. Meanwhile, the appointment of David Sacks as the “White House AI & Crypto Czar” has sparked hope that favorable policy changes could bolster Ripple’s position.

Moreover, XRP’s near-term movements are uncertain, its combination of whale activity, rising adoption, and technical momentum has led to cautious optimism. Analysts and investors will closely monitor developments as they anticipate a possible return to all-time highs.