- The LTC price dropped shortly after the halving event completed.

- The recent drop in Litecoin prices may indicate a lack of interest among investors.

The Litecoin halving event in August was perhaps the most anticipated event of the year. Halving of Litecoin occurred on August 2, 2023, as planned after the last halving event on August 5, 2019. However, the price of LTC did not surge after the halving. Contrarily, the token’s value dropped shortly after the event completed.

The LTC price has been favoring the bears ever since. The recent drop in Litecoin prices may indicate a lack of interest among investors. In addition, the token, which is frequently compared to silver, has continued to be bearish since its peak in July.

Traders Await Catalyst

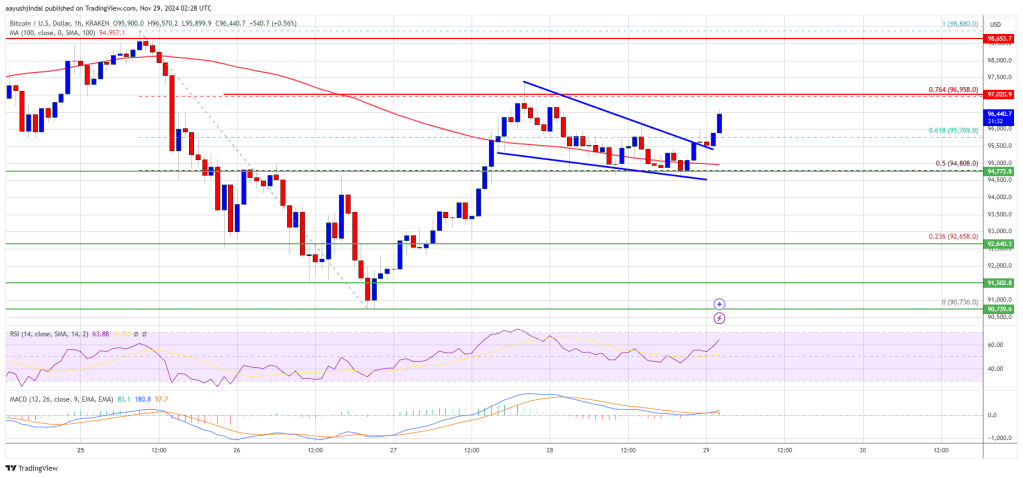

However, post prolonged decline, Litecoin bears seem to be taking a break. In addition to being at a support level that it tested in March, the price is in the oversold zone. The Relative Strength Index (RSI) is negative as it remains below the 50 level. Given the presence of support and the oversold circumstances, accumulation is to be expected in this area.

Source: CoinMarketCap

An intriguing pattern emerged when LTC supply was measured. The rise of addresses with 10–1,000 LTC indicates that retail traders have been purchasing the drop. As per the daily chart, LTC trade volumes have been growing, which might signal a bottom for the cryptocurrency, which has been under pressure in recent trading sessions.

The price recently failed to break through the $65 resistance level. The market uncertainty shown by the discrepancy between these indicators suggests that investors are looking for a trigger to direct the price of LTC.