- Solana drops 10% from ATH, triggering $64M in long liquidations

- Open interest hits weekly low of $3.34B, signaling reduced market confidence

- Technical analysis suggests crucial battle at $231.54 support level

Solana’s recent price action has created a challenging environment for bullish traders, with the cryptocurrency experiencing a notable correction from its all-time high of $264.63 reached on November 22.

The 10% decline over the past week has triggered a cascade of market effects that warrant careful analysis to understand the potential path forward.

Understanding Solana’s Liquidation Cascade

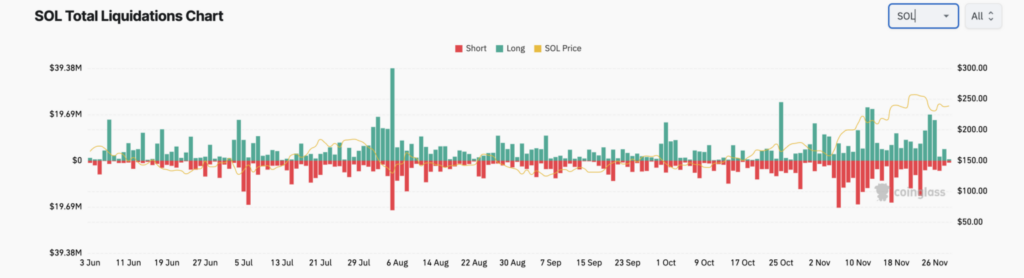

The Solana market retreat has had a particularly severe impact on leveraged traders, resulting in $64 million worth of long position liquidations. To understand the significance of this figure, imagine a domino effect where each forced sale puts additional downward pressure on the price, potentially triggering more liquidations.

Source: Coinglass

This self-reinforcing cycle can accelerate price declines as traders scramble to exit positions before incurring further losses.

Perhaps even more telling than the liquidation data is the substantial decline in open interest, which has fallen to a weekly low of $3.34 billion. This SOL metric serves as a barometer for market confidence – when it drops during a price decline, it suggests traders are not just closing losing positions but actively choosing to stay on the sidelines rather than opening new ones.

The Awesome Oscillator has begun generating red histogram bars, providing technical confirmation of the market’s bearish shift. This indicator compares short-term and long-term momentum, and its current reading suggests the immediate price pressure has turned decisively negative. This technical signal aligns with the broader market narrative of waning bullish momentum.

The immediate focus for traders now turns to the crucial support level at $231.54. A breach below this threshold could accelerate the decline toward $205.56.

However, the market remains dynamic, and a revival in buying interest could still drive prices back toward the recent all-time high of $264.63, though current indicators suggest such a move would face significant resistance.