- Ethereum Whales poured in around $425 million to purchase 260,000 ETH.

- ETH’s market cap has fallen below $200B as a result of price declines over the last week.

Ethereum price has declined over the last week as the market struggles with persistent macroeconomic uncertainties and prolonged delays in the approval of spot ETFs.

According to on-chain data, whales are quite active during this severe market downturn. Ali Martinez, a prominent crypto researcher, recently shared that in only 24 hours, Ethereum Whales poured in $425 million to purchase 260,000 ETH. This occurs after significant ETH whale movement was reported a day earlier. On Monday, 300,000 ether were transferred between two “whale” addresses on Coinbase.

Further Decline Likely?

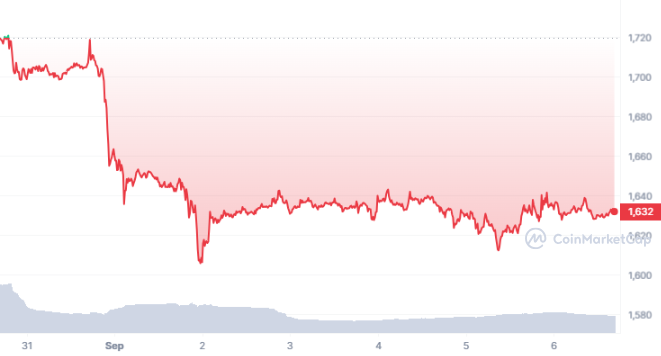

Despite Ethereum’s fall over the last week, the cryptocurrency has now been trading at around the $1630 mark. According to CMC statistics, ETH’s market cap has fallen below $200 billion as a result of price declines over the last week.

The price of ETH declined all the way till $1612 yesterday. However, bulls were able to quickly outnumber bears offering a ray of optimism. There has been heavy selling pressure on ETH as of late, but $1600 is acting as a significant support level. Ethereum’s price has repeatedly bounced off of its support trendline over the last several weeks, rejecting efforts by sellers to bring about a deep fall.

Source: CoinMarketCap

ETH price has been consolidating in a tight range, fluctuating between $1600 and $1645. Many market watchers assessing Ethereum’s present scenario believe losses might escalate if the price falls below the $1600 levels.

If the price manages to break the support level of $1600 then it will likely test the $1100 mark. On the other hand if it manages to clearly break above the $1643 mark then it will likely test the next resistance level at $1700.