A recent report by IntoTheBlock offers new insights into the profitability of meme coin holders, including Dogecoin, highlighting variations in the percentage of holders in profit and whale concentration. Dogecoin, the forerunner in this category, continues to hold its own, with new data underscoring its dominance in terms of profitability for its holders.

According to the report by blockchain data analytics platform IntoTheBlock, Dogecoin outpaces its counterparts, with 42% of its holders being in profit.

It is worth noting that this appears to solidify its position as a frontrunner in the meme coin domain and emphasizes its growing importance in the broader crypto space.

The analysis, which took into account the top six meme coins including Dogecoin (DOGE), Pepe (PEPE), Doge Killer (LEASH), Dogelon Mars (ELON), Shiba Inu (SHIB), and Floki (FLOKI), positioned PEPE and LEASH in second and third places, with 21% and 19% of their holders respectively turning a profit.

In addition to highlighting profitability, the study delved into the concentration of whales within these meme coins. Interestingly, 44% of Dogecoin tokens are held by whale accounts, while nearly half of the PEPE tokens (49%) are whale-owned.

The report also shows that whale concentration for LEASH rests at 42%. Dogelon Mars and Shiba Inu, although popular names in the meme coin sphere, are fourth and fifth in terms of holder profitability, with 14% and 11%, respectively.

Floki, on the other hand, sees 10% of its holders in profit with a 59% whale concentration, indicating the large players’ influence in the meme coin market. Notably, whale concentrations can significantly impact the price movements of cryptocurrencies, making large holders create substantial market swings just with their trading decisions.

Furthermore, while Dogecoin has put roughly 44% of its holders in profit, the meme coin has not been exempt from the market’s volatile swings. In the past month alone, DOGE has seen a more than 16% decline. It took a dip from its previous high of $0.77 to a low of $0.62, at the time of writing.

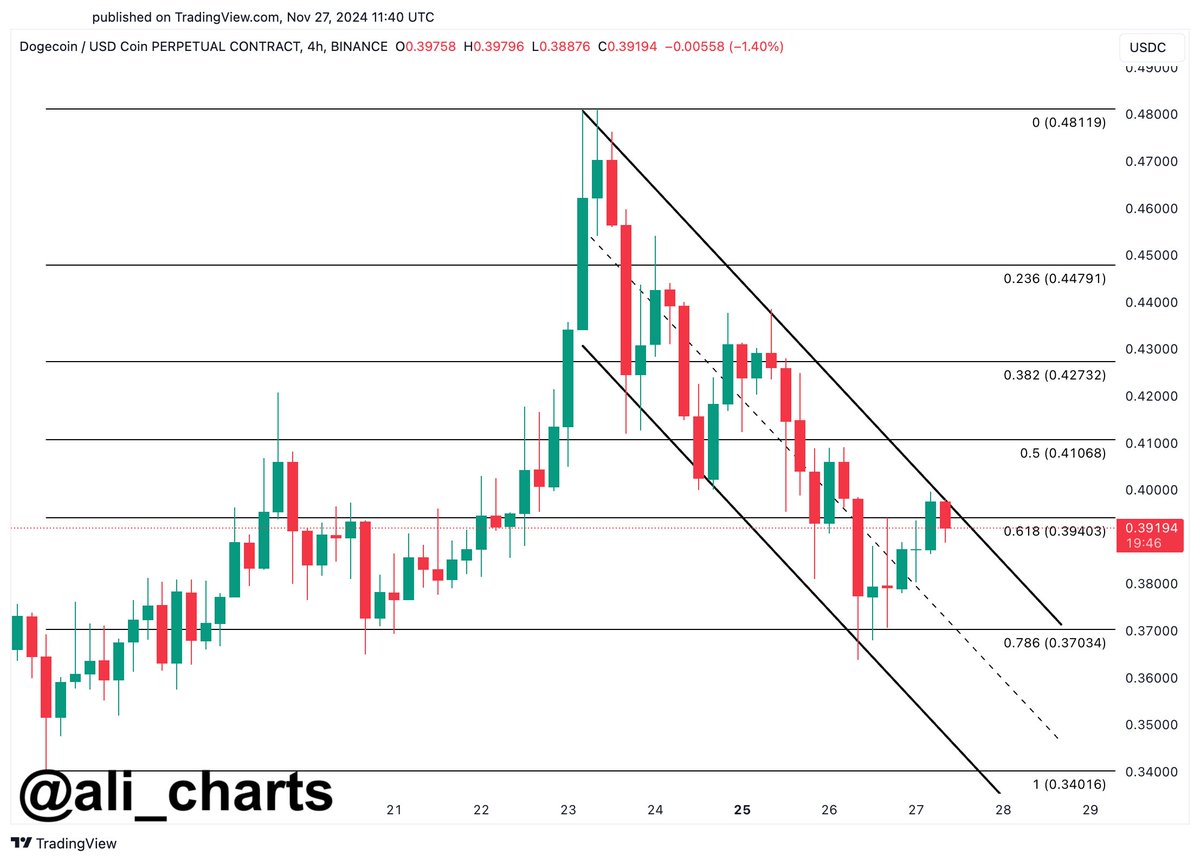

Dogecoin (DOGE) price is moving sideways on the 4-hour chart. Source: DOGE/USDT on TradingView.com

In addition, despite the market downtrend, DOGE’s trading activity has surged. The daily trading volume for the meme coin currently stands at $201 million, a considerable increase from the $128 million recorded late last month.

Featured image from Unsplash, Chart from TradingView

Dogecoin Holds The Lead

According to the report by blockchain data analytics platform IntoTheBlock, Dogecoin outpaces its counterparts, with 42% of its holders being in profit.

It is worth noting that this appears to solidify its position as a frontrunner in the meme coin domain and emphasizes its growing importance in the broader crypto space.

Ever wondered how meme coins compete on important metrics?Dive into our latest infographic where we break down the performance of 6 popular meme coins, analyzing holder profits and whale concentration.#Dogecoin #Pepe #LEASH #SHIB #FLOKI #ELON pic.twitter.com/Di5vbyo3PZ

— IntoTheBlock (@intotheblock) September 8, 2023

The analysis, which took into account the top six meme coins including Dogecoin (DOGE), Pepe (PEPE), Doge Killer (LEASH), Dogelon Mars (ELON), Shiba Inu (SHIB), and Floki (FLOKI), positioned PEPE and LEASH in second and third places, with 21% and 19% of their holders respectively turning a profit.

Whale Concentrations And Other Tokens

In addition to highlighting profitability, the study delved into the concentration of whales within these meme coins. Interestingly, 44% of Dogecoin tokens are held by whale accounts, while nearly half of the PEPE tokens (49%) are whale-owned.

The report also shows that whale concentration for LEASH rests at 42%. Dogelon Mars and Shiba Inu, although popular names in the meme coin sphere, are fourth and fifth in terms of holder profitability, with 14% and 11%, respectively.

Floki, on the other hand, sees 10% of its holders in profit with a 59% whale concentration, indicating the large players’ influence in the meme coin market. Notably, whale concentrations can significantly impact the price movements of cryptocurrencies, making large holders create substantial market swings just with their trading decisions.

Furthermore, while Dogecoin has put roughly 44% of its holders in profit, the meme coin has not been exempt from the market’s volatile swings. In the past month alone, DOGE has seen a more than 16% decline. It took a dip from its previous high of $0.77 to a low of $0.62, at the time of writing.

Dogecoin (DOGE) price is moving sideways on the 4-hour chart. Source: DOGE/USDT on TradingView.com

In addition, despite the market downtrend, DOGE’s trading activity has surged. The daily trading volume for the meme coin currently stands at $201 million, a considerable increase from the $128 million recorded late last month.

Featured image from Unsplash, Chart from TradingView