- Binance Coin (BNB) reached a six-month low.

- SEC lawsuit against Binance exerted bearish pressure on other major cryptocurrencies.

The largest crypto exchange, Binance, native cryptocurrency BNB, witnessing a massive decline due to the ongoing legal battle between the US Securities and Exchange Commission (SEC) and Binance.

The lawsuit brought by the SEC against Binance has had a significant impact on the token BNB. And the crypto token price reached a six-month low of below $225. Also, the allegations made against the crypto exchange indicate its alleged engagement in unlawful activities—multiple violations of securities laws. In addition, Binance experiences significant whale activity and outflows from the exchange.

SEC Lawsuit Weighs Heavy on Binance

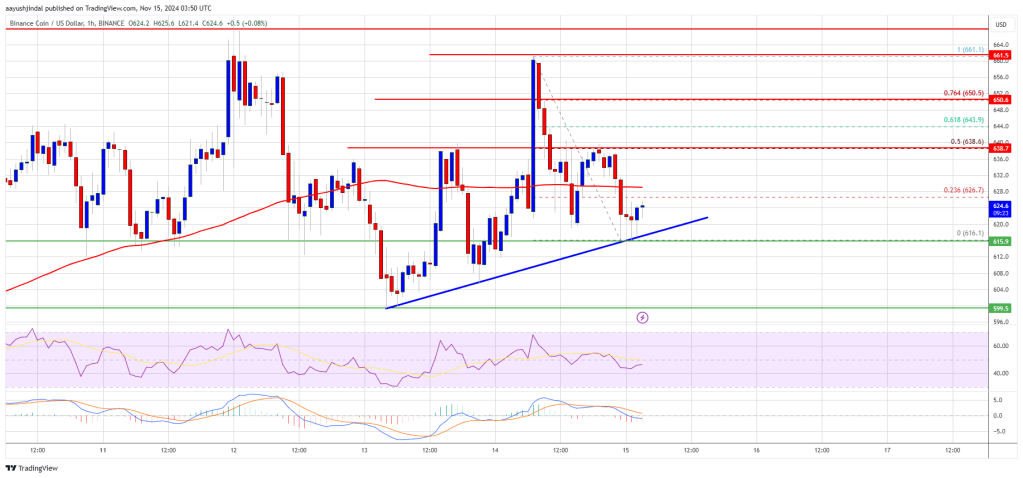

The SEC lawsuit against Binance has posed a major hurdle for Binance and had negative effects on BNB. Recently, the price of BNB has experienced a significant drop from its previous value of over $280 against the US dollar, indicating a bearish trend in the market.

In mid-April, the price of BNB formed a notable high of around $350 before experiencing a sharp decline. It breached crucial support levels at $280 and $250, eventually reaching the vital support zone at $220. Currently, BNB is trading below the $250 mark and the 100-day simple moving average.

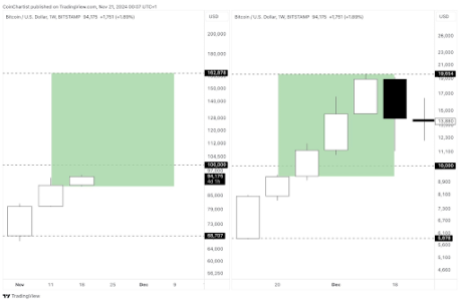

Binance Coin (BNB) Price Chart (Source: Tradingview)

At the time of writing, Binance coin traded at $225.50 with a 24-hour trading volume of $571 million and a market cap of $35 billion. The price of BNB declined by over 5% in a day and by 24% in just a week. The above chart shows that the BNB price is in the “strong sell” zone.

Further, the situation has also exerted bearish pressure on other major cryptocurrencies like Bitcoin and Ethereum.

Recommended for you

Binance Coin (BNB) Price Prediction 2023