The Bitcoin Coinbase Premium Gap has been positive during the past few days, implying the surge above $27,000 may be driven by the platform’s users.

In a new post on X, the CryptoQuant Netherlands community manager, Maartunn, has pointed out how there appears to have been buying going on at Coinbase recently.

The relevant indicator here is the “Coinbase Premium Gap,” which keeps track of the difference between the Bitcoin prices listed on the cryptocurrency exchanges Coinbase and Binance.

The former platform is more popular among US-based investors (including large institutional holders), while the latter receives more global traffic. As such, the Premium Gap’s value may provide insight into how the behaviors of these two audiences differ.

When the value of this metric is positive, it means that the price on Coinbase is greater than that on Binance right now. This would imply that the American investors have either been applying a higher buying pressure or a lower selling pressure as compared to the global users.

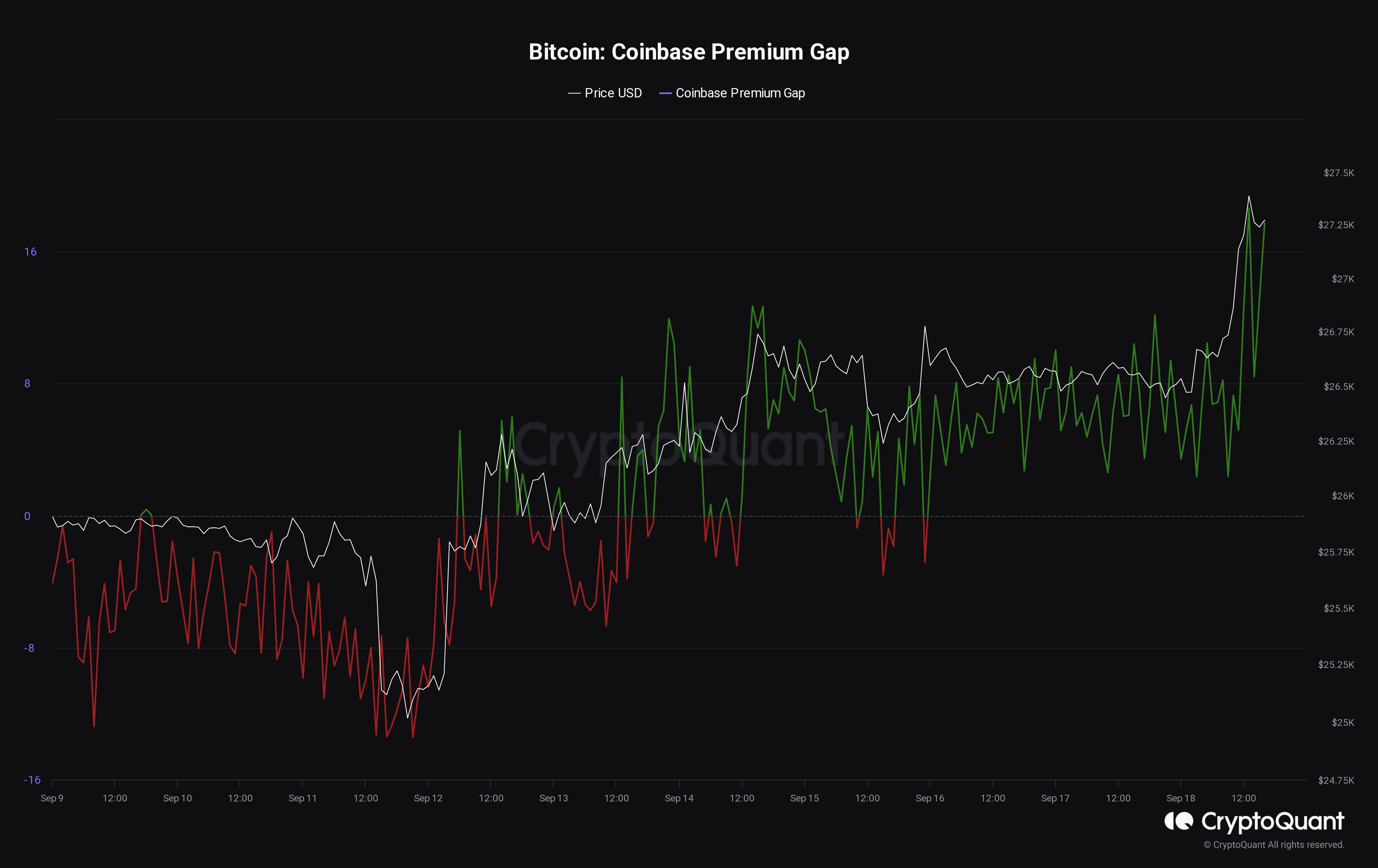

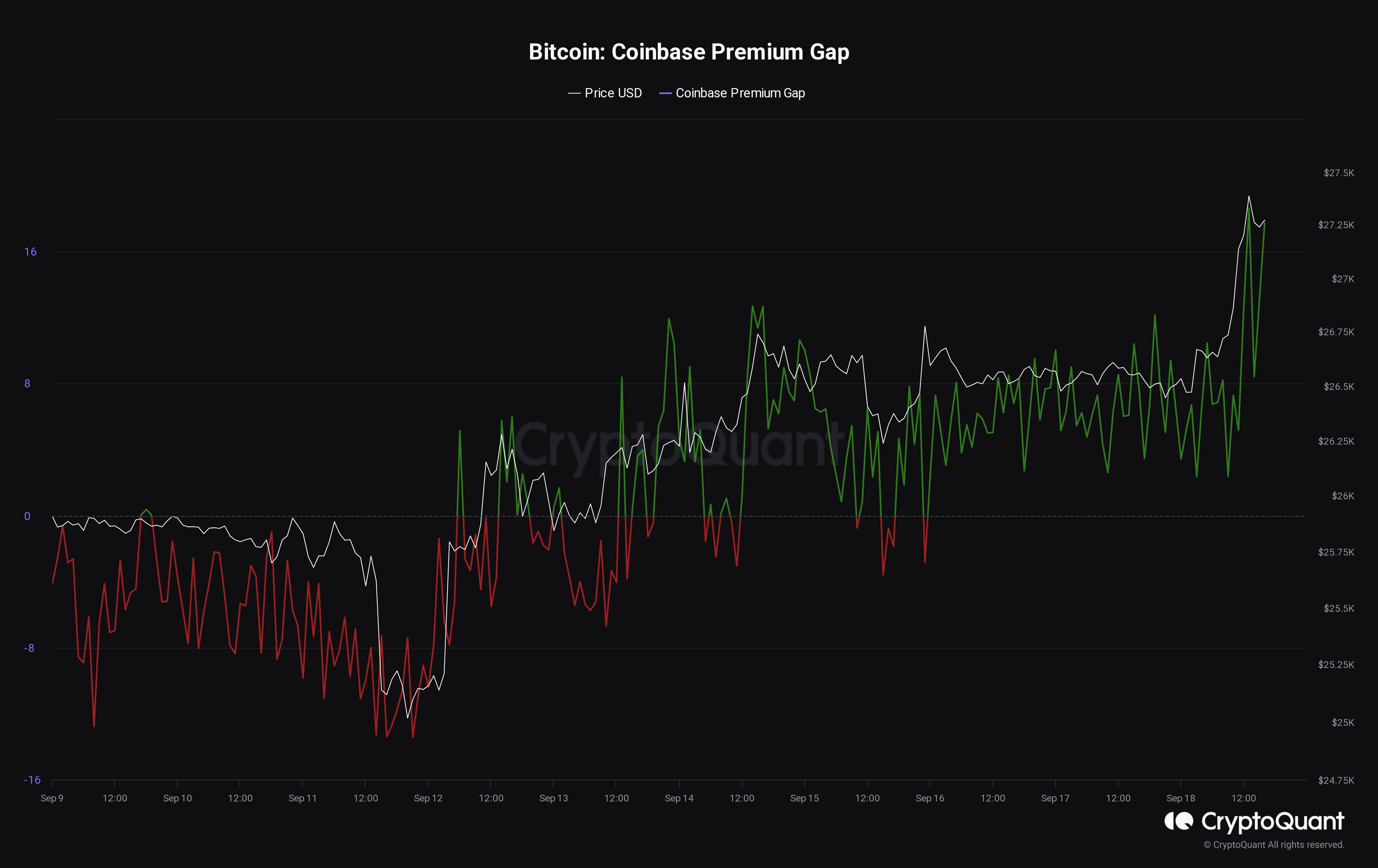

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap over the last few days:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap had been negative earlier in the month, implying that Coinbase users had been selling more than Binance users.

The metric had turned especially deep in the leadup to and during the plunge towards the $25,000 level, suggesting the selloff was driven by the American holders.

During the recovery that had followed, the Premium Gap had turned positive, but only after a delay, implying that the US-based investors didn’t initially contribute towards the surge.

Since then, however, the indicator has remained at notable positive values, meaning that the platform’s user base has been constantly accumulating the cryptocurrency.

From the graph, it’s visible that the buying on Coinbase appears to have only ramped up during the past couple of days, as the Premium Gap has observed a sharp spike.

The timing of this surge could indicate that the US-based investors are the ones helping the asset’s recent growth beyond the $27,000 level. This is a good sign, naturally, as strong buying pressure from the US institutional holders could provide the appropriate fuel for the cryptocurrency to retest higher levels.

It now remains to be seen whether the Bitcoin Coinbase Premium Gap would continue to remain at positive values in the coming days, or if buying would cool down on the platform.

Bitcoin had observed a sharp drop from the $27,200 level to $26,600 yesterday but has since made a swift recovery back to the mark, as the below chart displays.

Coinbase Users Have Been Participating In Aggressive Bitcoin Buying Recently

In a new post on X, the CryptoQuant Netherlands community manager, Maartunn, has pointed out how there appears to have been buying going on at Coinbase recently.

The relevant indicator here is the “Coinbase Premium Gap,” which keeps track of the difference between the Bitcoin prices listed on the cryptocurrency exchanges Coinbase and Binance.

The former platform is more popular among US-based investors (including large institutional holders), while the latter receives more global traffic. As such, the Premium Gap’s value may provide insight into how the behaviors of these two audiences differ.

When the value of this metric is positive, it means that the price on Coinbase is greater than that on Binance right now. This would imply that the American investors have either been applying a higher buying pressure or a lower selling pressure as compared to the global users.

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap over the last few days:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap had been negative earlier in the month, implying that Coinbase users had been selling more than Binance users.

The metric had turned especially deep in the leadup to and during the plunge towards the $25,000 level, suggesting the selloff was driven by the American holders.

During the recovery that had followed, the Premium Gap had turned positive, but only after a delay, implying that the US-based investors didn’t initially contribute towards the surge.

Since then, however, the indicator has remained at notable positive values, meaning that the platform’s user base has been constantly accumulating the cryptocurrency.

From the graph, it’s visible that the buying on Coinbase appears to have only ramped up during the past couple of days, as the Premium Gap has observed a sharp spike.

The timing of this surge could indicate that the US-based investors are the ones helping the asset’s recent growth beyond the $27,000 level. This is a good sign, naturally, as strong buying pressure from the US institutional holders could provide the appropriate fuel for the cryptocurrency to retest higher levels.

It now remains to be seen whether the Bitcoin Coinbase Premium Gap would continue to remain at positive values in the coming days, or if buying would cool down on the platform.

BTC Price

Bitcoin had observed a sharp drop from the $27,200 level to $26,600 yesterday but has since made a swift recovery back to the mark, as the below chart displays.