Bitcoin price has been a topic of great interest and speculation in the financial world, with investors eagerly watching its price movements for potential opportunities. Recently, an interesting development has caught the attention of both seasoned traders and crypto enthusiasts alike.

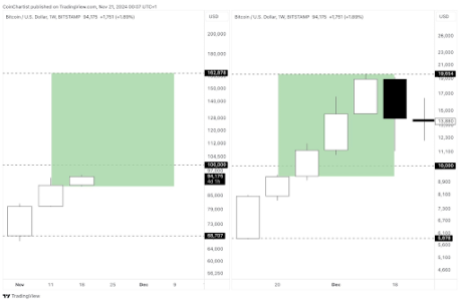

According to Mikybull Crypto, there is a long-term chart feature that, if it continues to hold, could potentially lead to a significant upside for Bitcoin (BTC). In his latest analysis, the popular trader highlighted encouraging signs on the BTC/USD weekly chart, suggesting the possibility of a remarkable 60% surge in value. This potential surge would catapult bitcoin price to an impressive point of approximately $40,000.

The question on everyone’s mind is: Will Bitcoin indeed experience this substantial upside, and what factors might contribute to such a surge?

With Bitcoin still confined within a narrow trading range it entered nearly three months ago, traders and investors find themselves in a quandary when it comes to predicting short-term price targets. The day-to-day performance of the cryptocurrency has failed to establish a clear trend, leaving $30,000 as a formidable resistance level hanging overhead.

Nonetheless, renowned trader Mikybull Crypto remains optimistic, as he identifies an intriguing price action on the higher time frames that could signal a significant move in the near future. According to his analysis, the weekly chart reveals the completion and subsequent retesting of an inverse head-and-shoulders pattern for BTC/USD.

In contrast to the standard head-and-shoulders pattern, which typically indicates a solidified resistance followed by a downward trend, the inverse head-and-shoulders pattern is a bullish counterpart. This suggests that Bitcoin may be on the verge of a positive breakout.

“Bitcoin is flashing a text book inverse head and shoulders on the weekly TF. Price is currently retesting the Neckline after the breakout,” Mikybull Crypto wrote.

“As taught, if the range between the head and neckline is usually the sprint, we are anticipating another 60% rally on BTC,” he said

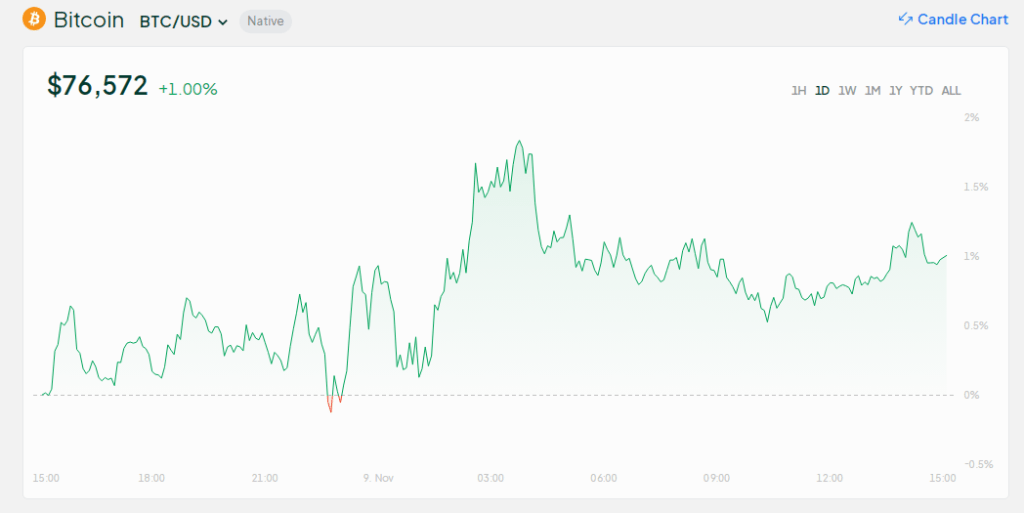

As Bitcoin’s price drops to the $25K level on CoinGecko, market participants continue to keep a close eye on the highly anticipated $40,000 mark. This significant price level has become a popular target for many traders and investors, as it symbolizes a potential breakthrough for the leading cryptocurrency.

Adding to the discourse, renowned trader and analyst Credible Crypto recently made a prediction suggesting that Bitcoin may enter a sideways phase, ranging between $20,000 and $40,000, for approximately 12 months following the upcoming halving event in April 2024.

Bitcoin halving, which occurs approximately every four years, is a significant event in the cryptocurrency’s ecosystem. It is marked by a reduction in the block rewards earned by miners, resulting in a decreased rate at which new Bitcoins are generated.

This event has historically been associated with bullish trends, as the reduced supply of new coins often drives up demand and subsequently impacts the price.

Featured image from TechSpot

According to Mikybull Crypto, there is a long-term chart feature that, if it continues to hold, could potentially lead to a significant upside for Bitcoin (BTC). In his latest analysis, the popular trader highlighted encouraging signs on the BTC/USD weekly chart, suggesting the possibility of a remarkable 60% surge in value. This potential surge would catapult bitcoin price to an impressive point of approximately $40,000.

The question on everyone’s mind is: Will Bitcoin indeed experience this substantial upside, and what factors might contribute to such a surge?

Long-Term Chart Signals Potential Upside For Bitcoin Price

With Bitcoin still confined within a narrow trading range it entered nearly three months ago, traders and investors find themselves in a quandary when it comes to predicting short-term price targets. The day-to-day performance of the cryptocurrency has failed to establish a clear trend, leaving $30,000 as a formidable resistance level hanging overhead.

Nonetheless, renowned trader Mikybull Crypto remains optimistic, as he identifies an intriguing price action on the higher time frames that could signal a significant move in the near future. According to his analysis, the weekly chart reveals the completion and subsequent retesting of an inverse head-and-shoulders pattern for BTC/USD.

#Bitcoin is flashing a text book inverse head and shoulders on the weekly TF. Price is currently retesting the Neckline after the breakout.

As taught, if the range between the head and neckline is usually the sprint, we are anticipating another 60% rally on #BTC pic.twitter.com/67KU37Tfbq

— MikybullCrypto (@MikybullCrypto) June 8, 2023

In contrast to the standard head-and-shoulders pattern, which typically indicates a solidified resistance followed by a downward trend, the inverse head-and-shoulders pattern is a bullish counterpart. This suggests that Bitcoin may be on the verge of a positive breakout.

“Bitcoin is flashing a text book inverse head and shoulders on the weekly TF. Price is currently retesting the Neckline after the breakout,” Mikybull Crypto wrote.

“As taught, if the range between the head and neckline is usually the sprint, we are anticipating another 60% rally on BTC,” he said

Bitcoin Price Faces Speculation On $40K Target Amid Halving Predictions

As Bitcoin’s price drops to the $25K level on CoinGecko, market participants continue to keep a close eye on the highly anticipated $40,000 mark. This significant price level has become a popular target for many traders and investors, as it symbolizes a potential breakthrough for the leading cryptocurrency.

Adding to the discourse, renowned trader and analyst Credible Crypto recently made a prediction suggesting that Bitcoin may enter a sideways phase, ranging between $20,000 and $40,000, for approximately 12 months following the upcoming halving event in April 2024.

Expectations: “The Bitcoin halving is in April 2024. Expect $BTC to go sideways between 20-40k for about 12 months which is when we accumulate as much Bitcoin as we can. Once the halving hits, we start our next bull run to 100k+ into 2025. WAGMI.”

Reality: BTC makes a new ATH…

— CrediBULL Crypto (@CredibleCrypto) June 3, 2023

Bitcoin halving, which occurs approximately every four years, is a significant event in the cryptocurrency’s ecosystem. It is marked by a reduction in the block rewards earned by miners, resulting in a decreased rate at which new Bitcoins are generated.

This event has historically been associated with bullish trends, as the reduced supply of new coins often drives up demand and subsequently impacts the price.

Featured image from TechSpot