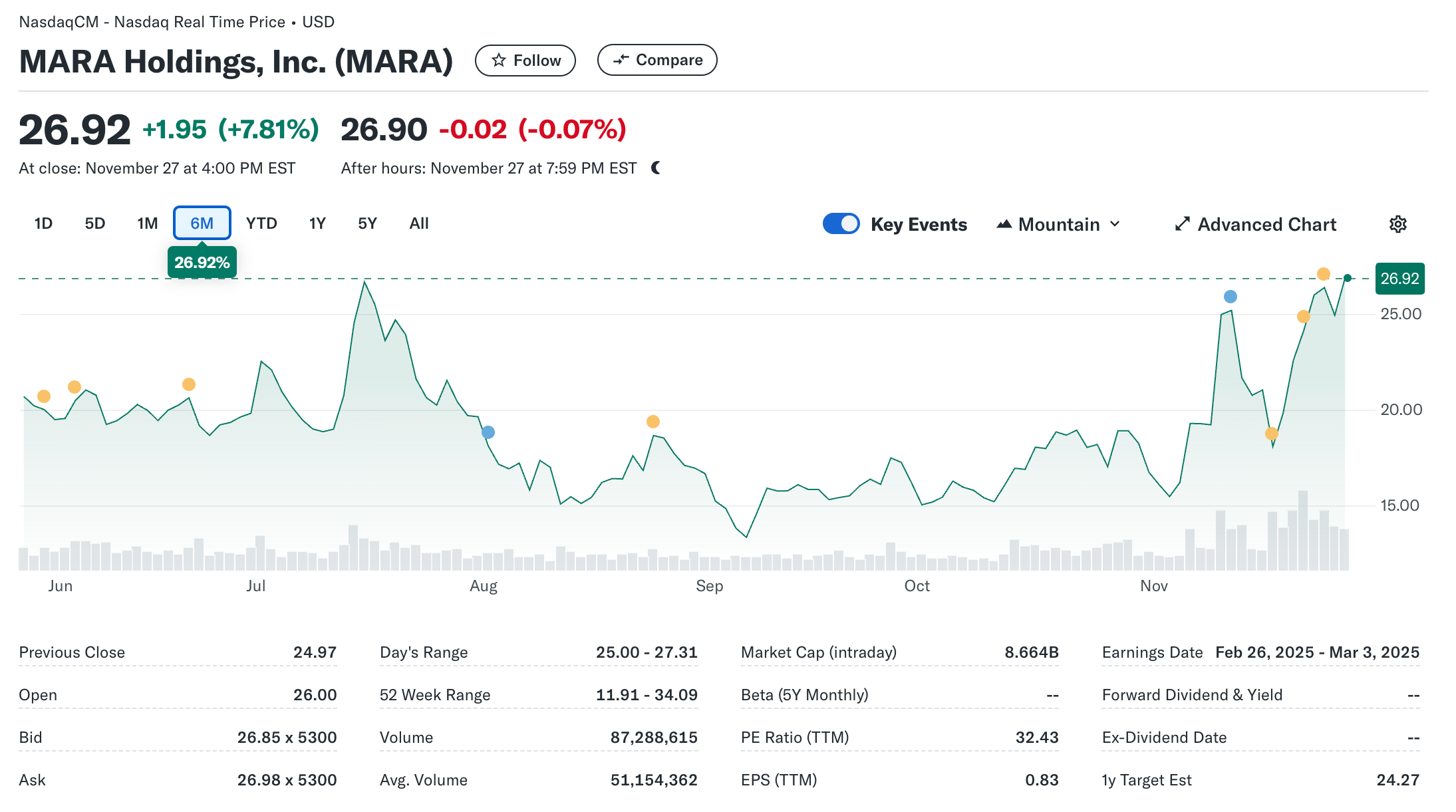

- The OI in Bitcoin futures has increased from $39B on November 5 to the current level of $60.9B.

- Institutional and individual traders alike often use leverage build-up strategies as per analysts.

An increase in trading activity and market speculation has been indicated by the substantial jump in bitcoin futures open interest after Donald Trump’s U.S. presidential election win on Nov. 5. Experts insist that leveraged trades are safe from an impending market correction, despite the spike.

Coinglass data shows that the open interest in Bitcoin futures has increased from $39 billion on November 5 to the current level of $60.9 billion. The value of positions linked to bitcoin derivatives contracts, some of which use leverage, has risen significantly as a result of this.

Increased Market Leverage

According to analysts, the increase in open interest seems to be natural and motivated by hopes for future price gains. Institutional and individual traders alike often use leverage build-up strategies to position themselves for future market fluctuations, they said.

Also, as of November 22nd, they saw a little drop in open interest. Especially around the $94,000 mark, where a lot of sitting orders were completed. Recent increases in leverage do not strike the analysts as unusual. The experts also noted that the Bitcoin price’s retesting of the $93,000 zone was just a typical pullback.

According to another analyst, the increased market leverage was precipitated by Trump’s election triumph. Analysts are optimistic that bitcoin will prosper under Trump’s administration. And the market’s high leverage is evidence that investors are starting to value the market based on regulatory and technological advancements.

Price corrections, maybe in the form of long squeezes, are conceivable owing to bitcoin’s intrinsic volatility, the expert said, and they might help calm the market when leverage becomes too high.

Highlighted Crypto News Today:

Matchain Reaches 100 Million Transactions in Record Time