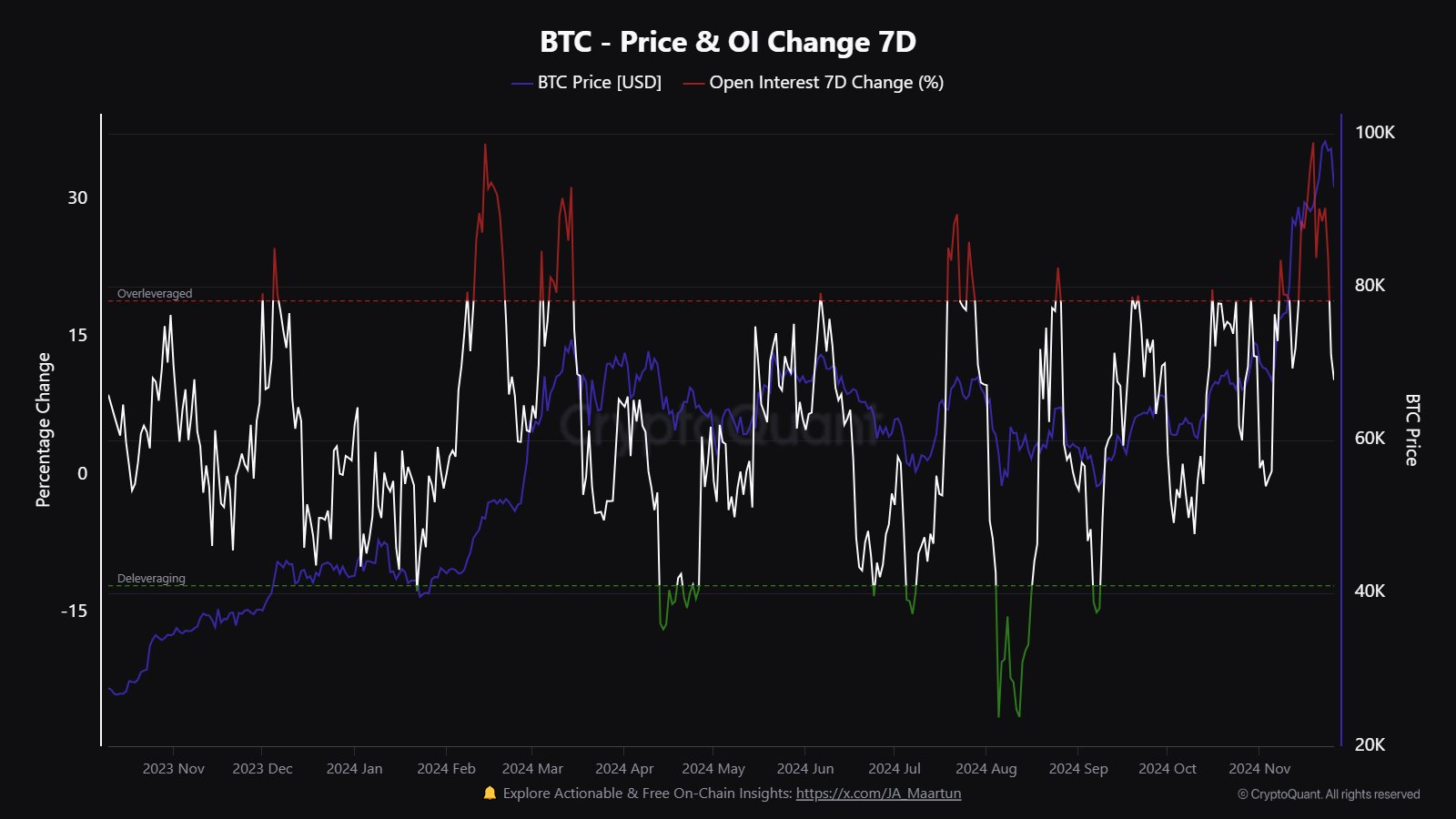

- Bitcoin experienced a 7% dip over the past seven days.

- The SEC delays Bitcoin ETF decisions, creating market uncertainty.

In a rollercoaster ride of hope and despair, Bitcoin, the largest market capitalization Cryptocurrency, sent ripples throughout the community when its price soared from $25,912 to $28,089, following Grayscale Bitcoin Trust’s (GBTC) triumph over the Securities and Exchange Commission (SEC) on August 29. However, this bullish momentum proved to be fleeting as bears swiftly regained control. It pushes it back into the seemingly confining range of $25,628 to $25,858. Adding to it, BTC experienced a 6.25% decline in the past seven days.

Recently, discussions of a potential Bitcoin exchange-traded fund (ETF) approval heated up the bullish mood. But the initial buzz subsided when the SEC, later in the week, delayed decisions on several spot Bitcoin ETF applications, including BlackRock’s, until 2024. Meanwhile, Bitwise officially withdrew its Bitcoin and Ether ETF applications, adding to the negative sentiment.

Rumors have also swirled that BlackRock may be manipulating Bitcoin prices in anticipation of its ETF launch. However, analysts suggest this theory appears speculative at best. The investment giant has more to lose than gain from a dramatic Bitcoin price crash.

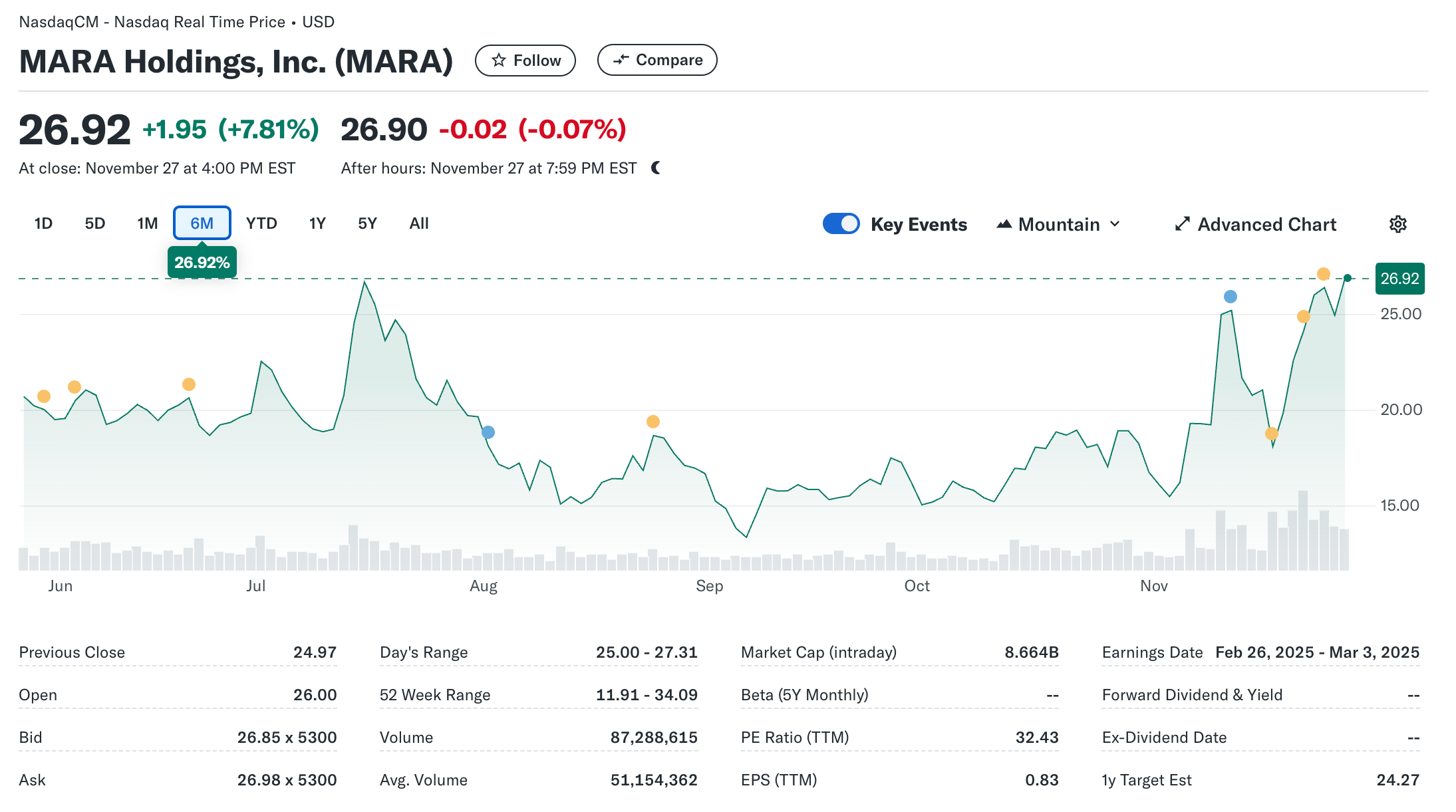

Nonetheless, despite the short-term uncertainty stemming from a complex U.S. regulatory landscape, institutional investors remain resolute in their long-term outlook for cryptocurrencies. Nine top-tier investment firms such as WisdomTree, and VanEuk currently have ETF applications awaiting the SEC’s verdict.

Bitcoin ETF Approval is in Control of BTC Price?

In a recent market report dated September 5, K33 senior analyst Vetle Lunde and Anders Helseth, Vice President, indicated that the last three months have significantly enhanced the chances of a spot Bitcoin ETF approval. Strikingly, this positive sentiment hasn’t translated into substantial price gains for Bitcoin or other major cryptocurrencies.

According to them, an ETF approval would be a game-changer, attracting massive capital inflows and substantially increasing Bitcoin’s buying pressure. In contrast, they suggest that a potential spot ETF rejection would have negligible consequences, with Bitcoin prices largely maintaining their current status quo.

What’s Next For BTC?

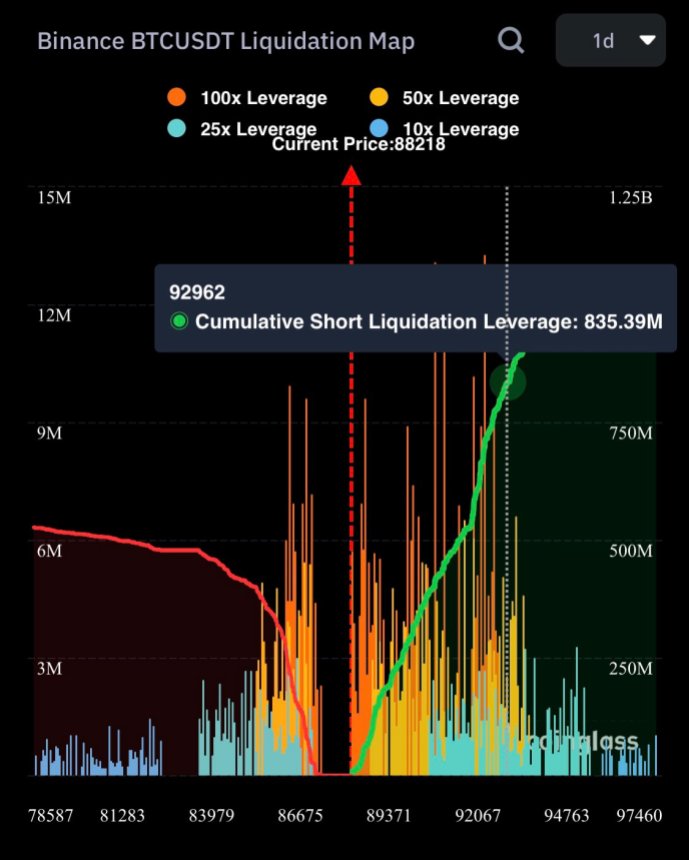

A closer examination of Bitcoin’s recent price movements paints a vivid picture of the ongoing struggle between bullish and bearish forces. The short-term 9-day exponential moving average (EMA) currently hovers at $26,026, underscoring the prevailing bearish sentiment. The Relative Strength Index (RSI) sits at 39, indicating that oversold conditions may be imminent.

At the time of writing, Bitcoin is trading at $25,752, accompanied by a 1% dip in trading volume in the last 24H. The digital asset finds itself perched near the support zone within the wide-ranging corridor of $24,800 to $31,000.

Notably, the $24,800 level is expected to be a battleground where bulls and bears will fiercely contest. Should this level give way, a sharp decline could follow, potentially driving the BTC/USDT pair toward the critical support at $20,000, with only a minor cushion at $24,000.

Conversely, there remains a glimmer of hope for the bulls. If they manage to break through the $26,833 barrier, the pair could ascend toward the 50-day Simple Moving Average (SMA) at $28,221.

Will BTC Break its Bearish Momentum? Share your thoughts by tweeting us at @The_NewsCrypto